Cross-Chain Transaction Bundling with deBridge

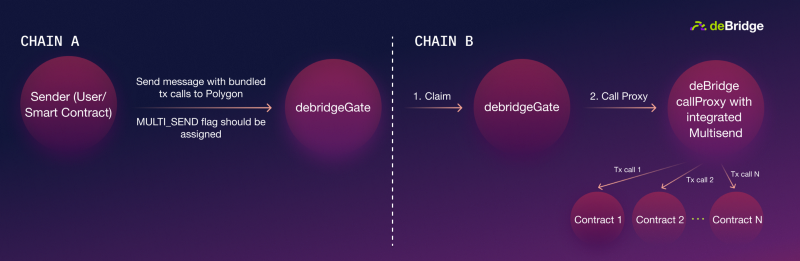

deBridge allows transaction bundling to easily perform a cross-chain swap and supply assets in a single transaction.

Looking back a few years, there was only one Layer 1 blockchain that was important: Ethereum. Today, there is a vast range of different blockchains like Ethereum, Polygon, Avalanche, Arbitrum, Solana, BNB Chain, and others.

Web3 today

One of the groundbreaking features of Web3 is composable finance (Money legos) where a few DeFi primitives are combined in order to enable new capital-efficient solutions like Convex + Curve, Yearn + AAVE, Rari + Fei, 1inch + DEXs, and many others.

These protocols are normally interacting with each other in one specific ecosystem (e.g. Ethereum) and projects have had to deploy on other chains, resulting in fragmenting their own liquidity to integrate with other protocols. Cross-chain integrations haven’t been feasible due to the lack of decentralized generic messaging protocols that could enable data transfers and arbitrary cross-chain interactions between smart contracts.

This was a challenge not only for protocols but also for users. They would have to think about what bridge to use, how to swap wrapped assets, and how to deposit the resulting liquidity into the protocol, which makes average cross-chain interactions and UX very complex.

Users also have to sequentially perform many transactions in different chains to achieve the desired action. This is something we want to change by enabling cross-chain transaction bundling for projects and developers.

Enabling more composability

deBridge became the first generic messaging protocol that allows passing arbitrary data and liquidity in one transaction between various chains. Composability has been one of the core principles that was added to the protocol design, and from the very beginning, we have been building the protocol to be fully compatible with the existing DeFi ecosystem.

In deSwap, a cross-chain swaps solution, we integrated with Curve to leverage its capital-efficient stableswap AMM, and partnered with 1inch to utilize their best-in-class routing algorithms. We adhere to the same principles when solving the transaction bundling challenge for cross-chain interactions.

If you have ever used Gnosis Safe multisig, it provides a great Transaction Builder feature that allows packing of multiple actions into one bundled transaction thanks to its unique Multisend library. This time we also decided not to reinvent the wheel and integrated deBridge protocol smart contracts with a battle-tested solution developed by the experienced Gnosis team to enable cross-chain transaction bundling.

We are excited to announce that with the release of transaction bundling, deBridge has become the very first generic messaging protocol that enables users and protocols to perform arbitrary complex cross-chain interactions in a single transaction.

What is transaction bundling and how does it work?

There are many scenarios where cross-chain conversion of assets is not the ultimate goal, but rather the first step to broader action on the destination chain. For instance, a user may want to provide liquidity or stake into a protocol, buy an NFT or perform some type of arbitrage, take a flash loan or call a third-party contract hook.

A classic example is where a user wants to execute a swap and deposit the asset in a lending and borrowing protocol like Aave to earn a yield on their asset. In the past, a user would need to approve->swap->claim (have native asset on the destination chain)->approve->deposit to Aave. A difficult process with a terrible user experience that no one really wants to do, but it’s a must due to the lack of options.

Our approach

This is changing now that deBridge allows transaction bundling where everyone will easily be able to do a cross-chain swap and supply the assets in a single transaction. Want to try this in practice right away? You can do that here: https://stake-aave.debridge.finance/stake-aave

In short, we want to make it as easy and smooth as possible for projects as possible to go cross-chain and to implement all types of cross-chain interactions in their protocols and applications. We have added support for the bundling into the deSwap API to make it seamless for protocols and applications to integrate swaps + interactions with their own protocol. It’s now possible with deBridge to unite different transaction calls together that have disparate messages and commands in one single transaction.

Protocols and applications can utilize Tx bundling in order to facilitate liquidity inflows and cross-chain interactions. Get started with our guidelines here: https://docs.debridge.finance/deswap/transaction-bundling

If you’re a project building cross-chain, reach out to us. We want to speak with you and get you started going cross-chain in the most efficient and best possible way with our infrastructure.

Website | deSwap | Docs | Discord | GitHub | Twitter | Telegram