Decentralizing access to institutional liquidity w/ FORDEFI

Last week we introduced deBridge P2P, a global OTC desk for DeFi, enabling fully non-custodial cross-chain OTC deals, allowing anyone to choose a counterparty for their cross-chain transfer. But in fact, P2P is just one step towards our broader vision for DeFi.

We believe that the future of DeFi lies in composable, intent-based liquidity, a market where the smallest and biggest participants can have instant access to value, where liquidity can flow exactly where and when it is needed with granular control. By enabling this on the cross-chain scale, we will enable DeFi to exist and thrive as one unified market. So why hasn’t this vision already been realized?

Crucially, there exists a huge gap between sophisticated DeFi participants — those who can build market efficiency through tech — and those who hold the amounts of liquidity needed to realize efficiency, needed to make assets on all chains freely tradable for every type of market participant.

At deBridge, one of our roles is to bridge this gap.

The need for liquidity networking

First, we must understand why deBridge needs to solve this problem, and why classic pooled liquidity approaches cannot realize our vision of the single interconnected DeFi market. While there are many faces to this problem, this post will focus on how decentralizing access to institutional liquidity will lead to all sorts of breakthroughs for DeFi at large.

Quite simply, classic cross-chain protocols will never be able to give DeFi efficient access to institutional liquidity. With the classic pooled liquidity design, a finite amount of liquidity locked across chains creates a bottleneck on larger amounts, subjecting cross-chain transfers to prohibitive amounts of slippage, price impact, and MEV.

Beyond bottlenecks, you also have use cases that are simply impossible with the old approach. Take OTC, for example — where institutions need to know their counterparty. By nature, traditional bridge protocols can’t offer compliance as it is impossible to identify the counterparty fulfilling the trade.

This lack of ability to facilitate compliant DeFi, which hands over power to centralized venues like OTC desks, makes it difficult for institutions to enter DeFi.

Connecting solvers to institutional liquidity

Instead, deBridge uses a unique 0-TVL architecture where trades are settled by market makers that provide just-in-time liquidity. This asynchronous model allows for near-instant cross-chain trades without the need for liquidity pools. These market makers fulfill intents on the destination chain and send a cross-chain message to unlock the liquidity of the trade on the source chain, earning a spread.

But this setup presents a new challenge. We have talented solvers who can develop scripts that are fast and efficient but lack institutional-grade liquidity to operate. Similarly, there are institutional liquidity owners who want to generate yield on their liquidity, but have no experience in MEV or the development of automated on-chain scripts used for solving.

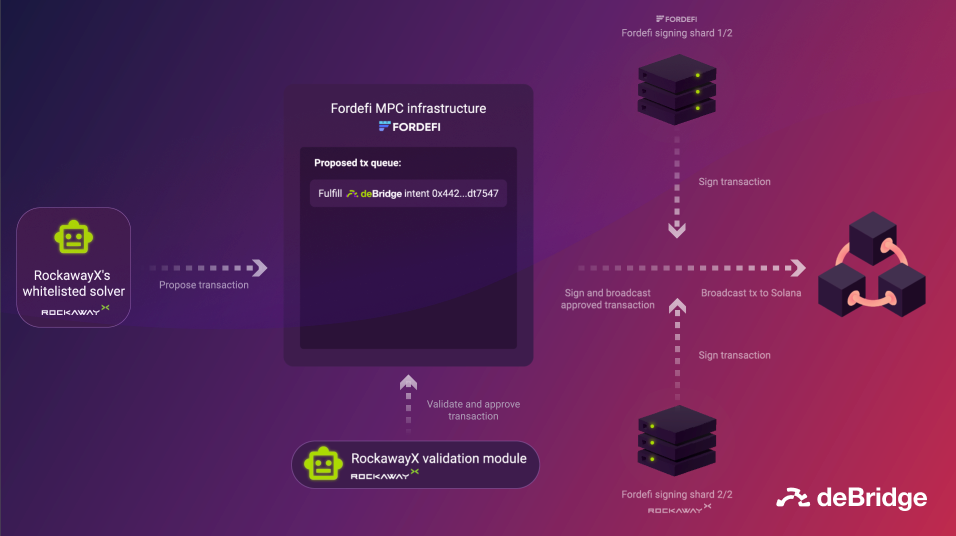

Thanks to innovations in the MPC wallet technology, we built a first-of-a-kind architecture in DeFi, enabling liquidity delegation to protocols by liquidity providers without leaving the custodial control of their funds.

As a result, solvers can now partner up with Rockaway and get access to institutional liquidity to fulfill multi-million dollar intents on deBridge, and the liquidity owners (such as RockawayX) can always keep custody over that liquidity.

We innovated a unique setup for this purpose by working with FORDEFI, an MPC infrastructure, that bridges the gap between DeFi and institutional onchain capital, allowing the creation of isolated financial contours where capital owners preserve custody over their assets.

Institutional liquidity owners like RockawayX, a participant in the network, always maintain custody of assets, holding a shard of the private key and a backup key that allows the unilateral recovery of funds in case of any emergency. The policy engine can help minimize risk by limiting trading permissions (for both human and API traders) to a particular smart contract and up to a specific amount.

For example, an asset owner can add a third-party trader to their workspace and grant access to execute trades on their own up to a certain volume. While this helps third-party traders execute transactions on behalf of the asset owner, the full custody of assets at all times remains with the asset owner.

By enabling this setup, we open doors for institutions, asset managers, and anyone else to implement bilateral/multilateral setups and explore new avenues in DeFi. If you’re an institution and would like to be listed as a possible counterparty on P2P, shoot us a message on X.

About FORDEFI

FORDEFI is a one-of-a-kind MPC wallet platform and web3 gateway that enables you to securely self-custody your private keys, seamlessly connect to thousands of dApps across any blockchain, protect your workflows with granular policies, and manage your digital asset operations all-in-one place.

About deBridge

deBridge is the bridge that moves at lightspeed. By removing the bottlenecks and risks of liquidity pools, deBridge enables value and information to flow across the DeFiverse virtually instantly with deep liquidity and guaranteed rates.