Type-to-Snipe: The future of DeFi UX with deBridge & HeyAnon

Previously, people were confused about the capabilities of AI and what it can achieve; however, with the introduction of the AI + DeFi segment, the scenario has undergone a complete transformation. Eliza, ARC, and several AI agent frameworks are revolutionizing the entire AI landscape when they hit the scene in late 2024. While it is still early for these AI frameworks, it’s interesting to see their potential to transform how users engage with DeFi applications.

Imagine if moving assets between different blockchains could be as fast and easy as sending a text message? This case study explores how deBridge and HeyAnon – an AI-driven DeFi assistant – are together making the DeFi user experience 10x better with simple language prompts.

By plugging into deBridge on the backend, DeFi users can perform cross-chain transfers instantly by using commands typed in simple English. Now, you can easily say “Swap 100 USDC on Base for SOL on Solana,” and HeyAnon will execute it with a single click.

Making DeFi for humans

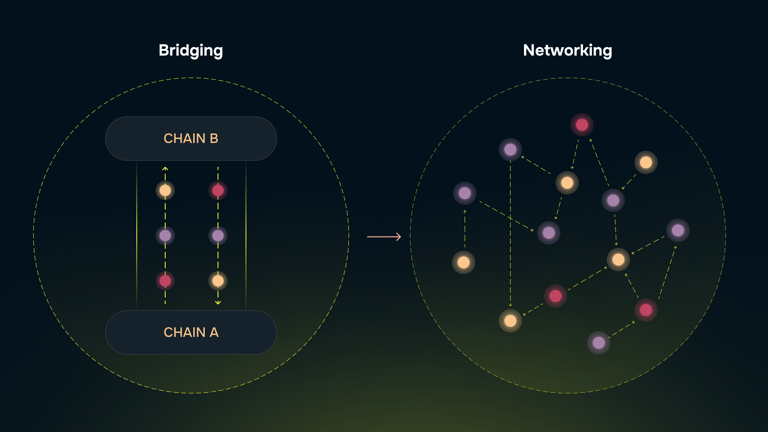

Today’s DeFi scenario is far from a perfect experience. Users need to run after multiple blockchains to chase yield, trade new assets, or use dApps. Meanwhile, the actual bridging process between the chains takes place separately from the dApps where users are trading, making the experience cumbersome.

Here comes deBridge, an innovative 0-TVL liquidity-on-demand model that eliminates the use of traditional liquidity pools. How? Instead of locking funds in pools, deBridge uses an off-chain network of validators and market makers to fulfill trades instantly, enabling you to experience cross-chain transactions in seconds or even milliseconds.

deBridge is one of the fastest-growing bridges, supporting over 21 blockchains across both the EVM and Solana ecosystems. Together with HeyAnon, deBridge is excited to push forward the DeFi + AI movement with an AI-driven DeFi assistant that can understand plain English to help users navigate complex interactions across a variety of protocols and dApps.

This makes it super easy for the end-user by taking away the hassle of multiple transactions; all they see is their funds moving to the target chain quickly after they make the request.

Human-friendly trading

Imagine the trading experience without cross-chain boundaries. deBridge and HeyAnon address the speed and usability problems of cross-chain DeFi. While deBridge (backend) is the fastest bridge on the planet, HeyAnon (frontend) offers a friendly, natural-language UI that is easy enough for even a 5-year-old to use.

Let’s break down the benefits:

Bridge at lightspeed

Anyone can trade any asset across multiple blockchains without dealing with anything. All you need to do is type in simple English in HeyAnon, and deBridge will do everything in the backend.

Simplicity Through Natural Language

Just type what you want, and HeyAnon will do all the magic. Swap? Bridge? Snipe? You are covered for everything you can imagine in one place.

Smart Execution with AI & Intent-Based Design

We’re in the “type-to-trade” era, which aligns with the intent-centric paradigm, i.e., you express what exactly you want, and not how it should be done. Sit back and relax, while the backend logic (powered by HeyAnon and deBridge) figures out everything for you.

Use Case Spotlight: Sniper Bot to GMGN – Cross-Chain in One Command

Let’s understand a use case in detail to understand the power of deBridge x HeyAnon.

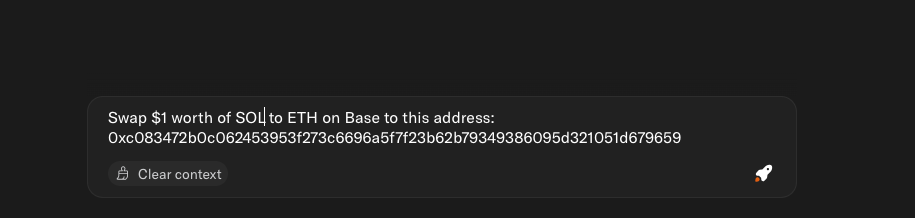

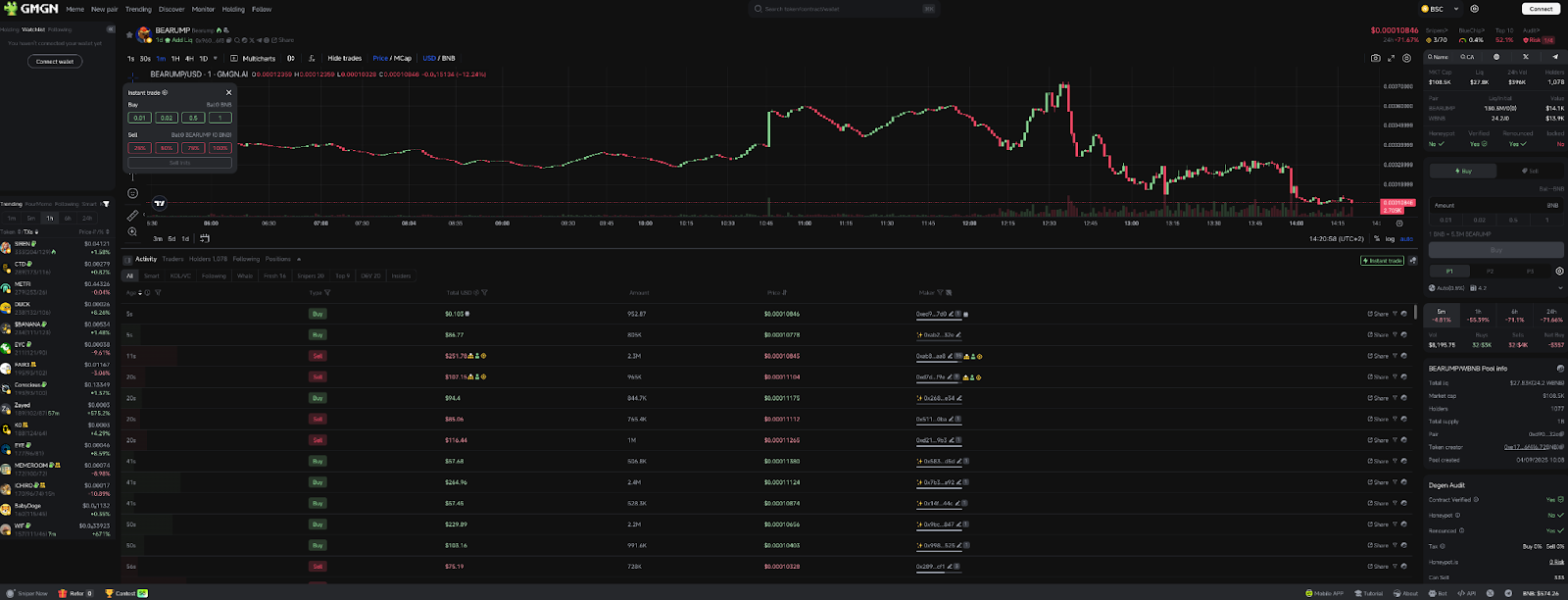

Scenario: A trader uses automated bots to snipe new token launches. They use a Sniper bot on Solana and GMGN bot on Base to trade memecoins. Now, they plan to send funds from Solana to Base, which involves multiple steps, including swapping SOL to a stablecoin, using a bridge, switching wallets, and depositing funds to the bot, all of which add time and complexity to the transfer.

With deBridge & HeyAnon: The trader opens the HeyAnon interface and simply inputs the below command: “Send X SOL from Sniper to GMGN on Base.” HeyAnon chooses deBridge as the optimal way to bridge Solana to Base. Everything happens under the hood, and within seconds, the GMGN bot on Base gets credited with USDC equivalent to 2 SOL.

This is no less than a magical experience for a trader. A single step ensures they can deploy funds instantly via the GMGN bot for new opportunities on Base. In fast-moving markets, it is essential to move quickly between chains to snipe memecoins or new token launches.

A New Standard for DeFi

By removing technical complexity and maximizing speed, HeyAnon and deBridge deliver an experience like no other. Let’s look at the key outcomes of this case study:

- Reduced Friction: All you need is a plain-text command that completes everything in the backend. No need to manually juggle wallets, bridge UIs, or different network tokens.

- Real-Time Agility in DeFi: DeFi moves at the speed of light. In the above case study, we’ve already witnessed the benefits of reallocating capital between blockchains for a seamless cross-chain experience. This real-time flexibility can lead to more efficient markets and better arbitrage equilibrium across chains.

- Broader Asset and Chain Access: deBridge supports 21+ chains and millions of long-tail assets. Any asset listed on CoinGecko is available for bridging on deBridge and all the integrators of deBridge’s API and SDK.

- Enhanced User Trust and Engagement: By providing a smooth UX, wallet and dApp developers can build greater trust with their users. With “type-to-trade,” even new users can easily experience DeFi and dive deep into the trenches. Overall, users are more likely to keep assets within an ecosystem that allows them to move and use those assets freely.

Future of DeFi UX

deBridge and HeyAnon together create a vision of what DeFi can look like if done right. A new world where everything can be achieved by sending a text, from complex cross-chain interactions to minimizing multiple steps. For developers and product teams, this serves as inspiration to think bigger about user experience within the ever-evolving DeFi ecosystem.

The end vision is a seamless financial space, where value flows freely at the speed of information and where interacting with DeFi is as easy as saying, “Hey Anon, send my funds where they need to go.”