Best BNB Bridges for Secure Cross-Chain Transfers 2025

Table of Contents

- Key Takeaways

- How BNB Bridges Work

- Best 7 BNB Bridges

- deBridge

- Stargate

- Celer cBridge

- Symbiosis

- Synapse Protocol

- Wormhole

- BNB Chain Bridge

- How to choose the best BNB bridge

- Why deBridge is the best option

- Frequently Asked Questions (FAQs)

DeFi, or short for Decentralized Finance, has been growing in leaps and bounds, continuing to expand the blockchain ecosystem. As more chains emerge, the necessity to transfer assets between these blockchains becomes essential for everyone.

The BNB Chain (formerly Binance Smart Chain) remains one of the most popular networks due to its low transaction fees, fast confirmation times, and broad ecosystem of dApps. Whether you're a trader, liquidity provider, yield farmer, or DeFi explorer, bridging assets to and from BNB Chain unlocks many possibilities.

BNB Chain, though EVM-compatible with Ethereum chains, depends on bridges for safe transfers. A BNB bridge enables you to quickly bridge assets across chains, including Ethereum, Solana, Arbitrum, Base, and more. However, bridging involves risks like slippage, wrapped tokens, congestion, and security issues.

In this guide, we’ll help you find the best BNB bridge in 2025. We’ll explain how bridges work, compare different models, and highlight the Top 7 BNB bridges to help you safely move assets across blockchains.

Key Takeaways

- BNB Chain remains a top DeFi ecosystem thanks to its low fees, fast transactions, and large network of dApps.

- There are three main bridge models: Lock-and-Mint, Liquidity Pool, and Zero-TVL.

- deBridge is the most secure o-TVL bridge, offering real-time, native asset transfers to BNB Chain.

- For high-value transfers, users should go directly to bridges like deBridge rather than relying on aggregators, which depend on underlying bridges to process transactions.

How BNB Bridges Work

BNB bridges enable the transfer of tokens across blockchains by locking, minting, or directly swapping assets between chains. They play a critical role in unifying fragmented liquidity and making DeFi truly multi-chain. There are three main bridge architecture models:

- Lock-and-Mint Model

- Liquidity Pool Model

- Zero-TVL Model

Lock-and-Mint Model

In this bridge model, assets are locked on the source chain, and wrapped tokens are minted on the destination chain. When you bridge back, the wrapped tokens are burned, and the original assets are released.

Pros: Widely supported, easy to integrate for developers, and works for chains that don’t share the same virtual machine

Cons: High custodial risk, wrapped tokens may lose value, and slower compared to other models

Liquidity Pool Model

This bridge model uses liquidity pools on both chains to facilitate instant swaps. When you bridge assets, you’re effectively trading them through pooled liquidity provided by users or protocols.

Pros: Fast execution, scalable, and supports a wide variety of tokens

Cons: Slippage risk and security risks tied to smart contracts and liquidity pools

Zero-TVL Model

In this bridge model, transfers happen directly between chains in real-time, without pooled liquidity or wrapped tokens. Assets are moved natively, eliminating many traditional risks.

Pros

1. Native asset transfers only, no wrapped tokens.

2. No slippage or liquidity fragmentation.

3. Strong security since there’s no locked capital to hack.

Cons: More complex to implement and requires advanced infrastructure and routing logic.

Best 7 BNB Bridges

With so many bridge options, selecting the right one can significantly impact speed, cost, and safety. Below are seven top BNB bridges to consider in 2025:

- deBridge

- Stargate

- Celer cBridge

- Symbiosis

- Synapse Protocol

- Wormhole

- BNB Chain Bridge

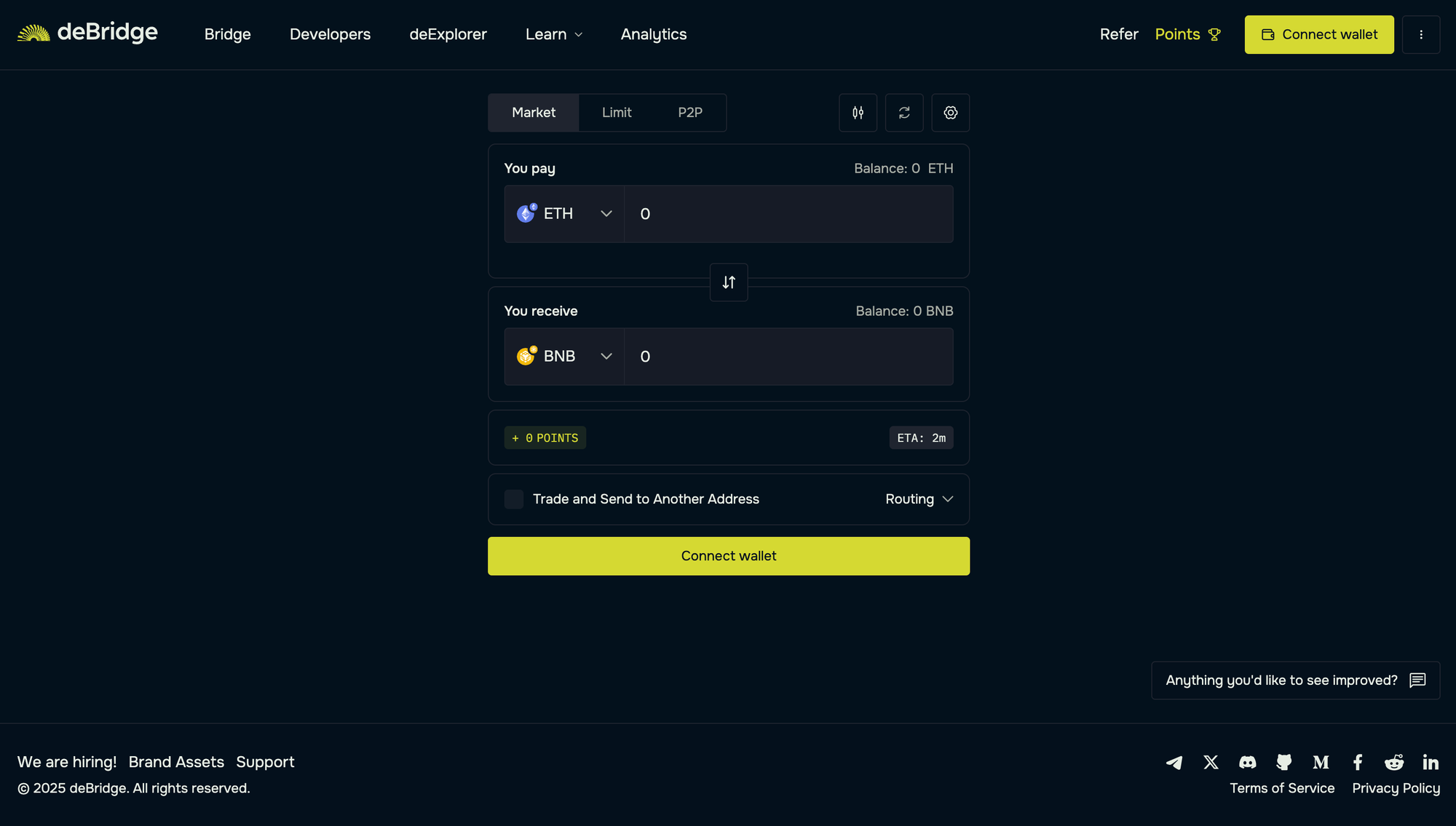

deBridge

deBridge is a cross-chain infrastructure that supports transfers to Solana through its 0-TVL model, meaning no pooled liquidity and no wrapped tokens. It routes transactions in real time across chains such as Ethereum, BNB Chain, Solana, Base, and 18 more.

Supported tokens: Millions (ETH, USDC, USDT, SOL, ARB, DOGE, BNB, HYPE, etc.)

Supported wallets: MetaMask, Trust Wallet, Rabby, OKX Wallet, Coinbase, Phantom, Solflare, and many more

Supported chains: Ethereum, Solana, Base, HyperEVM, and 19 more

Developer tools: SDK, APIs, cross-chain widgets, deBridge Hooks for automation

Why choose deBridge?

deBridge has processed over $14 billion in transactions and is trusted by well-known wallets and dApps like Phantom, Trust Wallet, Jupiter Exchange, and many others. It has faced zero downtime even during network spikes and helped users move crypto assets across blockchains.

- Native asset transfers (no wrapped token risks)

- Real-time execution with instant finality

- Zero slippage (always receive the exact amount)

- Deep security track record with audits

- $200k bug bounty program

- Developer-friendly APIs and development tools

Stargate

Stargate is a cross-chain bridge built on the LayerZero protocol. It uses liquidity pools to enable instant, decentralized transfers between major chains like BNB, Ethereum, and Avalanche.

Supported tokens: Wide range (mostly stablecoins: USDC, USDT, DAI, FRAX)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: LayerZero SDK, liquidity APIs

Why choose Stargate?

- Deep liquidity pools make it easy to move stablecoins.

- Stargate is popular among DeFi protocols for stablecoin farming.

Drawback: Stargate relies on liquidity pools, which means price impact and slippage risks exist, and security depends on LayerZero validator assumptions.

Celer cBridge

Celer cBridge is part of the Celer Network and supports 40+ chains with liquidity pool-based transfers. transfers. It supports a wide variety of chains and assets with competitive fees.

Supported tokens: Limited support (ETH, USDC, USDT, WBTC, MATIC, AVAX)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, OKX Wallet, and more

Developer tools: cBridge SDK, Celer Inter-chain Messaging

Why choose cBridge?

- cBridge is versatile with multichain coverage (40+ chains)

- Backed by Celer’s interchain messaging framework.

Drawbacks: Celer relies on wrapped tokens for many assets available on the protocol. Also, liquidity fragmentation sometimes leads to delays.

Symbiosis

Symbiosis focuses on multi-chain token swaps, making it simple for users to move between ecosystems in a single click. It supports a broad range of assets and chains, including BNB.

Supported tokens: Limited support (BNB, ETH, USDT, USDC, etc)

Supported wallets: MetaMask, Trust Wallet, Coinbase Wallet, and more

Developer tools: APIs and integration options for DeFi apps

Why choose Symbiosis?

- Wide range of chains.

- Ideal for everyday DeFi users.

Drawbacks: Symbiosis is dependent on liquidity pools, which introduces slippage and potential security risks for the users.

Synapse Protocol

Synapse is a cross-chain liquidity network known for supporting a variety of L2s, sidechains, and alt-L1s alongside BNB Chain. It combines liquidity pools with bridging to allow swaps across Ethereum, Avalanche, Polygon, BNB Smart Chain, and more.

Supported tokens: Limited support (ETH, USDC, USDT, DAI, altcoins depending on chain)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: Synapse SDK, API endpoints

Why choose Synapse?

- Supports many chains and assets beyond just stablecoins.

- AMM + bridge design for liquidity efficiency.

Drawbacks: Synapse often uses wrapped tokens instead of native assets on the destination chain. No support for the Solana blockchain is a major hindrance for users looking to move assets to Solana.

Wormhole (Portal)

Wormhole is based on a lock-and-mint bridge model. It is branded through the Portal interface, connecting BNB Chain to networks like Ethereum, Solana, and Avalanche using wrapped assets.

Supported tokens: 100+ (ETH, SOL, USDC, USDT, WBTC, etc.)

Supported wallets: MetaMask, Phantom, Solflare, Coinbase Wallet, and more

Developer tools: Wormhole SDK, message relayer infrastructure

Why choose Wormhole?

- Wormhole is popular for bridging from Ethereum to Solana.

- Supports NFTs and tokens alike.

Drawbacks: Wormhole always uses wrapped tokens for transfers between the blockchains. Past security incidents also highlight risks of using the platform for bridging.

BNB Chain Bridge

The official BNB Chain Bridge is based on a lock-and-mint model, connecting BNB Chain with Ethereum and other supported networks. It’s straightforward but limited compared to third-party options.

Supported tokens: BNB, ETH, USDC, and a few others

Supported wallets: MetaMask, Trust Wallet, and more

Developer tools: None

Why choose BNB Chain Bridge?

- Easy to use and great for basic transfers

- Aggregates multiple bridges for quotes

Drawbacks: BNB Chain bridge doesn’t use the best available bridge model in the market, and it also lacks advanced features, supports fewer tokens, and has higher wrapped token risk.

How to Choose the Best BNB Bridge

While some users go to bridge aggregators for comparing bridge routes, it’s worth noting that the aggregators are dependent on the bridges themselves (deBridge, Stargate, and others) to process the actual transfer.

For greater control, speed, and transparency, it’s better to go directly to the bridge of your choice rather than rely on an aggregator solution. When selecting a BNB bridge, consider the following factors:

- Speed: deBridge offers real-time execution at lightning-fast speed without any delays.

- Security: Zero-TVL and audited bridges are safer than those with pooled liquidity.

- Asset Support: Check for the specific tokens you want to bridge.

- Security model: Trustless bridges such as deBridge, Across, and Synapse are safer than custodial ones.

Why deBridge is the Best Option

Among all BNB bridges, deBridge stands out as the most secure and advanced choice for 2025. Its 0-TVL model, real-time execution, and native asset transfers eliminate the most common bridging risks.

The protocol has undergone 30+ security audits by top firms, including Halborn and Zokyo, and has kept a clean record with no exploits so far. deBridge has also been hosting a $200,000 bug bounty for years, which remains unclaimed.

Today, many well-known crypto projects like Phantom, Jupiter Exchange, Solflare, Infinex, Trust Wallet, and more trust deBridge.

- Native ETH transfers: Skip the concept of wrapping and bridge real ETH.

- 0-TVL architecture: User funds are never pooled or exposed to contract risk.

- Real-time asset delivery: ETH is received before transaction finality.

- Universal wallet support: Works with MetaMask, Phantom, WalletConnect, Coinbase Wallet, and many more.