Best Ethereum Bridges for Effortless Asset Transfers in 2025

Table of Contents

- Key Takeaways

- How Ethereum bridges work

- Best 8 Ethereum Bridges

- deBridge

- Stargate

- Across

- Synapse Protocol

- Wormhole

- Hop Protocol

- Allbridge

- Celer cBridge

- How to choose the best Ethereum bridge

- Why deBridge is the best option

- Frequently Asked Questions (FAQs)

If someone were asked about the “Best Ethereum Bridges” in 2020, the chances of them even knowing about what bridges are would be slim. Fast forward to today, bridging assets has become an everyday routine for most of us exploring the DeFi ecosystem.

While Ethereum remains the largest hub of liquidity, it is also infamous for high gas fees and high wait times during periods of congestion. As new blockchains like Arbitrum, Solana, Base, and BNB Chain offer faster speeds and lower costs, users are increasingly moving their assets out of Ethereum to explore various opportunities, including high-yield investments, efficient trading, access to better dApps, and more.

However, bridging isn’t without risks. Poorly designed bridges have already been targeted by hackers, resulting in billions of dollars in damage. Users also face common pain points, including wrapped token risks, transaction delays caused by low liquidity, and inconsistent transaction speeds.

This article explores the best Ethereum bridges in 2025 to help you ease your journey of transferring assets in a fast, cheap, and more secure way. Whether you’re bridging ETH, USDC, or memecoins, our comparison will help you choose the right bridge.

Key Takeaways

- Bridging from Ethereum gives users access to faster, cheaper DeFi and broader ecosystems.

- The best Ethereum bridges in 2025 include deBridge, Stargate, Across, Synapse, Wormhole, Hop Protocol, Allbridge, and Celer cBridge.

- All bridges listed support major wallets like MetaMask, TrustWallet, and Coinbase Wallet.

- deBridge stands out for real-time native transfers, no slippage, zero pooled liquidity risks, and enterprise-grade security.

- This guide explains how bridges work, compares pros and cons, and highlights which bridge is best for different user needs.

How Ethereum bridges work

Ethereum bridges enable users to transfer assets or data across blockchains. Since blockchains are siloed systems, bridges act as the connective tissue that unlocks interoperability.

Most bridges operate using a "lock and mint" mechanism, where tokens are locked on the source chain (e.g., Ethereum) and then wrapped tokens are minted on the destination chain. However, some bridges release native assets directly on the destination chain.

There are two main types of bridges:

Trusted (custodial) bridges

Trusted bridges are run by centralized entities or small validator sets that custody assets before releasing them on the destination chain.

Pros

- Simple design and easy for beginners

- Lower transfer fees

- Broad chain coverage through custodians

Cons

- Custodial risk (Funds may be lost if the operator is hacked)

- Lower transparency compared to onchain verification

- Limited decentralization

Trustless (non-custodial) bridges

Trustless bridges rely on smart contracts, validators, and cryptographic proofs to secure funds.

Pros

- Greater transparency and decentralization

- Assets are secured onchain rather than by a custodian

- More composable with DeFi protocols

Cons

- Higher gas costs in some cases

- Technically complex, which can introduce new vulnerabilities

Although both models offer their advantages, trustless bridges are emerging as the standard for DeFi users.

Best 8 Ethereum Bridges

With so many bridging protocols available today, selecting the right bridge can be overwhelming, especially when transferring high-value assets between Ethereum and other networks. In this section, we’ll analyze the 8 best Ethereum bridges one by one, highlighting how each works, which chains they support, and why they stand out for speed, safety, or ease of use, helping you choose the right one.

- deBridge

- Stargate

- Across

- Synapse Protocol

- Wormhole (Portal)

- Hop Protocol

- Allbridge

- Celer cBridge

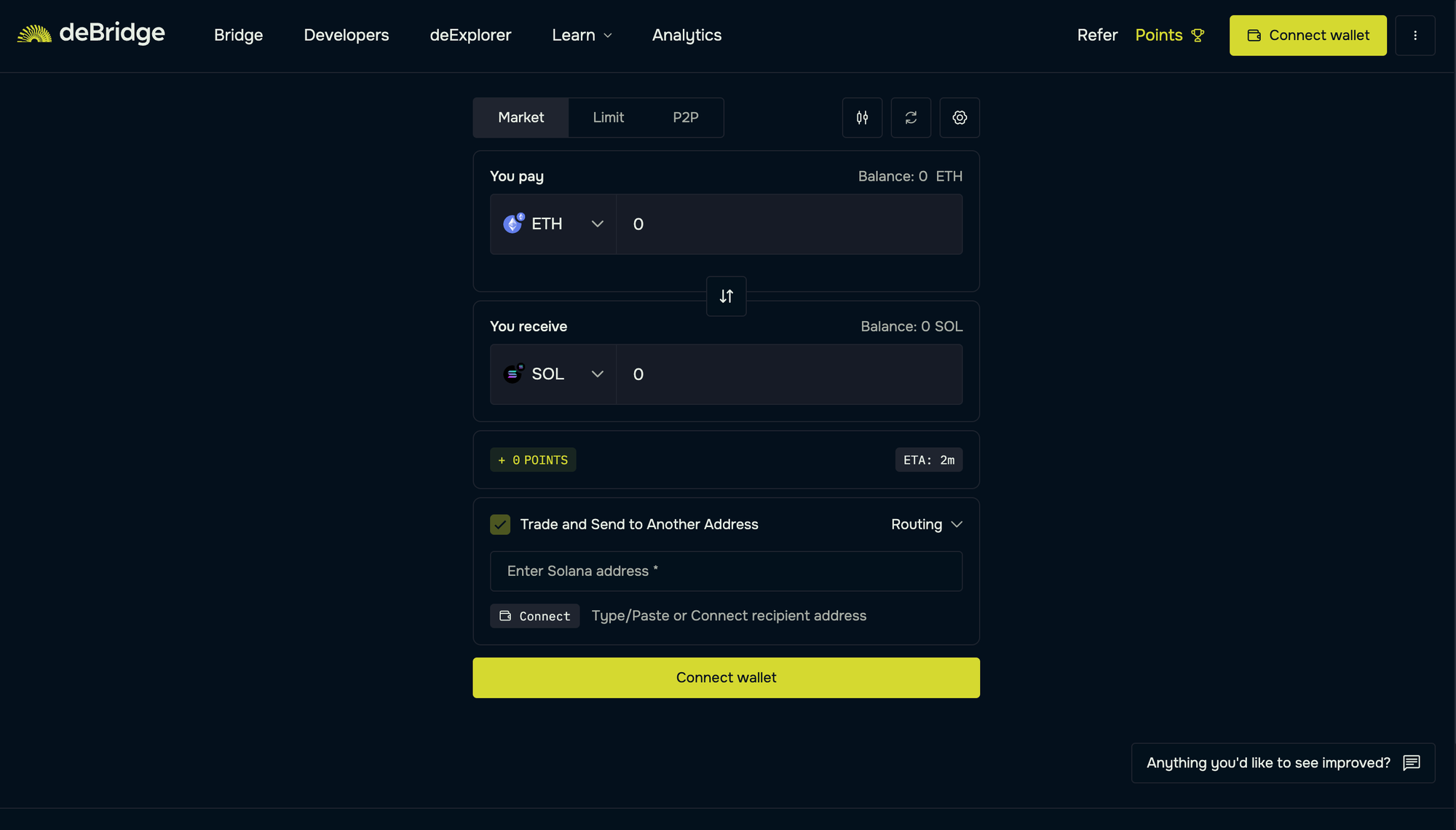

deBridge

deBridge is a trustless, security-first bridge that enables real-time cross-chain transfers of native assets. Instead of relying on wrapped tokens or liquidity pools, deBridge uses a 0-TVL architecture for enabling direct asset settlement, eliminating slippage and custody risks.

Supported tokens: Millions (ETH, USDC, USDT, SOL, ARB, DOGE, BNB, HYPE, etc.)

Supported wallets: MetaMask, TrustWallet, Phantom, Coinbase Wallet, Ledger, Solflare, and many more

Supported chains: Ethereum, Solana, Base, HyperEVM, and 19 more.

Developer tools: SDK, APIs, cross-chain widgets, deBridge Hooks for automation

Why choose deBridge?

With over $12 billion in transaction volume, deBridge is trusted by major wallets and dApps such as Phantom, Jupiter Exchange, and more. It has faced zero downtime even during network spikes and helped users move crypto assets across blockchains.

- Native asset transfers (no wrapped token risks)

- Real-time execution with instant finality

- Zero slippage (always receive the exact amount)

- Deep security track record with audits

- $200k bug bounty program

- Developer-friendly APIs for building cross-chain apps

Stargate

Stargate, built on LayerZero, is a trustless stablecoin bridge that focuses on liquidity pools for USDC, USDT, and other assets. It’s used for liquidity transfers between Ethereum, Arbitrum, Optimism, Avalanche, and BNB.

Supported tokens: Wide range (mostly stablecoins: USDC, USDT, DAI, FRAX)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: LayerZero SDK, liquidity APIs

Why choose Stargate?

- Deep liquidity pools make it easy to move stablecoins.

- Popular among DeFi protocols for stablecoin farming.

- Composable with LayerZero apps.

Drawback: Stargate relies on liquidity pools, which means price impact and slippage risks exist, and security depends on LayerZero validator assumptions.

Across

Across is a trustless bridge specialized in Ethereum Layer 2 transfers. It uses relayers and UMA’s optimistic oracle to ensure secure, low-fee transfers.

Supported tokens: Limited support (ETH, USDC, WBTC, DAI)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: APIs, relayer integration kits

Why choose Across?

- Ultra-low fees for small transfers.

- Optimized for Ethereum rollups like Arbitrum, Optimism, and Base.

- Fast transfers using relayers.

Drawback: Across is limited to L1 ↔ L2 flows and does not provide support for popular chains like Solana or Avalanche.

Synapse Protocol

Synapse is a trustless cross-chain AMM and bridge supporting both stablecoins and altcoins. It combines liquidity pools with bridging to allow swaps across Ethereum, Avalanche, Polygon, BNB, and more.

Supported tokens: Limited support (ETH, USDC, USDT, DAI, altcoins depending on chain)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: Synapse SDK, API endpoints

Why choose Synapse?

- Supports many chains and assets beyond just stablecoins.

- AMM + bridge design for liquidity efficiency.

Drawbacks: Synapse often uses wrapped tokens instead of native assets on the destination chain. It doesn’t support the Solana blockchain and often results in higher slippage for users.

Wormhole (Portal)

Wormhole is a popular bridge, especially for Ethereum to Solana transfers. It works as a trustless message-passing protocol but issues wrapped tokens on destination chains.

Supported tokens: 100+ (ETH, SOL, USDC, USDT, WBTC, etc.)

Supported wallets: MetaMask, Phantom, Solflare, Coinbase Wallet, and more

Developer tools: Wormhole SDK, message relayer infrastructure

Why choose Wormhole?

- Often, people use Wormhole for bridging from Ethereum to Solana.

- Supports NFTs and tokens alike.

- Used by many dApps as infrastructure.

Drawbacks: Wormhole always uses wrapped tokens for transfers between the blockchains. Past security incidents also highlight risks of using the platform for bridging.

Hop Protocol

Hop Protocol is a trustless Ethereum bridge designed for fast L1 ↔ L2 transfers. It uses AMM pools to enable near-instant exits from rollups like Optimism and Arbitrum.

Supported tokens: ETH, USDC, USDT, DAI, and six more assets.

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, and more

Developer tools: Hop SDK, AMM pool APIs

Why choose Hop Protocol?

- Simple interface for Ethereum ↔ rollup transfers.

- Optimized for ETH and stablecoins.

Drawbacks: The Hop protocol supports a limited number of tokens and enables transfers only between nine blockchains. Users are always prone to slippage risk due to AMM liquidity.

Allbridge

Allbridge is a trusted bridge that enables token transfers across EVM and non-EVM chains like Solana and Polygon. It often relies on custodians or wrapped tokens.

Supported tokens: Limited support of stablecoins

Supported wallets: MetaMask, Phantom, TrustWallet, and more

Developer tools: API endpoints for swaps and bridges

Why choose Allbridge?

- Broad chain support, including Solana and Polygon.

- Convenient for simple swaps.

Drawbacks: Allbridge is based on a trusted model, meaning higher custodial risks for anyone interacting with the protocol. It also uses wrapped tokens that introduce dependency risks.

Celer cBridge

cBridge by Celer Network is a trustless bridge that supports 40+ chains with liquidity pool-based transfers. It is one of the widest-reaching bridges.

Supported tokens: Limited support (ETH, USDC, USDT, WBTC, MATIC, AVAX)

Supported wallets: MetaMask, TrustWallet, Coinbase Wallet, OKX Wallet, and more

Developer tools: cBridge SDK, Celer Inter-chain Messaging

Why choose cBridge?

- Huge multichain coverage (40+ chains).

- Backed by Celer’s interchain messaging framework.

Drawbacks: Celer relies on wrapped tokens for many assets available on the protocol. Also, liquidity fragmentation sometimes leads to delays.

Comparison Table

How to choose the best Ethereum bridge

Some users turn to bridge aggregators like Rango or Bungee to compare bridging routes. While these platforms can seem convenient, it’s worth noting that they ultimately depend on the bridges themselves (deBridge, Stargate, and others) to process the actual transfer.

For greater control, speed, and transparency, it’s often better to go directly through a trustless bridge rather than rely on an aggregator solution. Here are the factors to consider when choosing:

- Asset type: If you’re bridging stablecoin or memecoin, deBridge shall suit you. On the contrary, Wormhole is a suitable solution for bridging NFTs.

- Destination chain: Some bridges specialize in L2s (Across, Hop), others in Solana (Wormhole), while deBridge covers all major chains.

- Security model: Trustless bridges (deBridge, Across, Synapse) are safer than custodial ones (Allbridge).

- Speed: deBridge offers real-time execution at lightning-fast speed without any delays.

- Slippage: If slippage is a concern, avoid bridges that are dependent on liquidity pools.

Why deBridge is the best option

deBridge prioritizes speed without compromising on security. Unlike traditional bridges relying on wrapped assets or pooled liquidity, deBridge uses a 0-TVL architecture that avoids liquidity pools and eliminates attack surfaces.

The protocol has undergone 30+ security audits by top firms, including Halborn and Zokyo, and has kept a clean record with no exploits so far. deBridge has also been hosting a $200,000 bug bounty for years, which remains unclaimed.

Today, many well-known crypto projects like Phantom, Jupiter Exchange, Solflare, Infinex, Trust Wallet, and more trust deBridge.

- Native ETH transfers: Skip the concept of wrapping and bridge real ETH.

- 0-TVL architecture: User funds are never pooled or exposed to contract risk.

- Real-time asset delivery: ETH is received before transaction finality.

- Universal wallet support: Works with MetaMask, Phantom, WalletConnect, Coinbase Wallet, and many more.