Best Solana Bridges for Fast and Secure Transfers in 2025

Table of Contents

- Key Takeaways

- How Solana Bridges work

- 5 Best Solana Bridges in 2025

- deBridge

- Wormhole

- Allbridge

- Symbiosis

- Mayan Finance

- How to Choose the Best Solana Bridge

- Why deBridge is the best option

- Frequently Asked Questions (FAQs)

Before Solana existed, Ethereum led all the complex onchain activity with the help of smart contracts. Now, Solana has made its mark in DeFi as the chain of choice for traders and builders who need ultra-fast execution and minimal fees.

But Solana isn’t EVM compatible. It runs on its unique architecture (based on Proof of History), which makes it different from Ethereum, L2s, or most other chains. Because of this, the Solana blockchain cannot communicate with other chains for asset/data transfers.

That’s where bridges come in. A Solana bridge allows assets and data to flow in and out of the Solana ecosystem easily. Without bridges, Solana’s fast, low-cost environment would stay out of reach for users on Ethereum, BNB Chain, or other ecosystems.

But bridging is not without challenges. Common pain points include wrapped assets, slippage when moving between liquidity pools, delays due to congestion, and security risks. In this guide, we’ll explore how Solana bridges work, compare the three main architectural models, and review the top five Solana bridges in 2025.

Key Takeaways

- Bridging is critical for Solana since it isn’t EVM compatible and cannot directly connect with other blockchains.

- Three main models exist: Lock-and-Mint (Wormhole, Mayan), Liquidity Pool (Allbridge, Symbiosis), and Zero-TVL (deBridge).

- deBridge stands out with its Zero-TVL design, native asset transfers, instant execution, and no slippage or wrapped token risks.

- Choosing the right bridge depends on priorities — for security and reliability, deBridge is best; for asset variety or NFTs, Wormhole and others may be suitable.

How Solana Bridges work

Unlike Ethereum and other EVM-based blockchains, Solana speaks its own language. It runs on a completely different architecture and requires a cross-chain bridge to talk with other blockchains. At their core, Solana bridges handle one simple but powerful task: taking value from one chain and making it usable on another.

When we perform a bridge transfer, the bridge ensures that tokens on the source chain (eg, Ethereum) are either locked or swapped. At the same time, a corresponding asset becomes available on Solana (or vice versa).

Not all bridges are the same. They differ in their design type: some rely on smart contracts, others on validator networks, and some use hybrid mechanisms. Let’s explore the three main architectural models along with their pros and cons.

Bridge from Ethereum to Solana

Lock-and-Mint Model

This model involves locking tokens in a smart contract on the source chain (eg, Base), and a wrapped version of the token is minted on the destination chain (Solana). Wormhole is the most notable Solana bridge using this approach.

Pros: Widespread adoption, supports many assets.

Cons: Involves wrapped tokens, which can depeg or face risks if the validator set is compromised.

Liquidity Pool Model

This model involves users or liquidity providers to deposit tokens on both sides of the bridge. A bridge user can swap one token for another via these liquidity pools. Allbridge and Symbiosis both use this method.

Pros: Fast execution, no need for wrapped tokens in some cases.

Cons: Subject to liquidity depth; large trades can face slippage.

Zero-TVL Model

deBridge pioneered this design. Instead of locking tokens or relying on pooled liquidity, assets are transferred natively in real-time without leaving assets idle in a contract.

Pros: No pooled liquidity risks, no wrapped assets, instant execution.

Cons: Requires advanced infrastructure and security audits, but deBridge has been proven with billions in settlements.

5 Best Solana Bridges in 2025

In this section, we’ll review the 5 best Solana bridges, pointing out how each functions, which chains they support, and why they excel in speed, safety, or ease of use, helping you decide which one is right for you.

- deBridge

- Wormhole

- Allbridge

- Symbiosis

- Mayan Finance

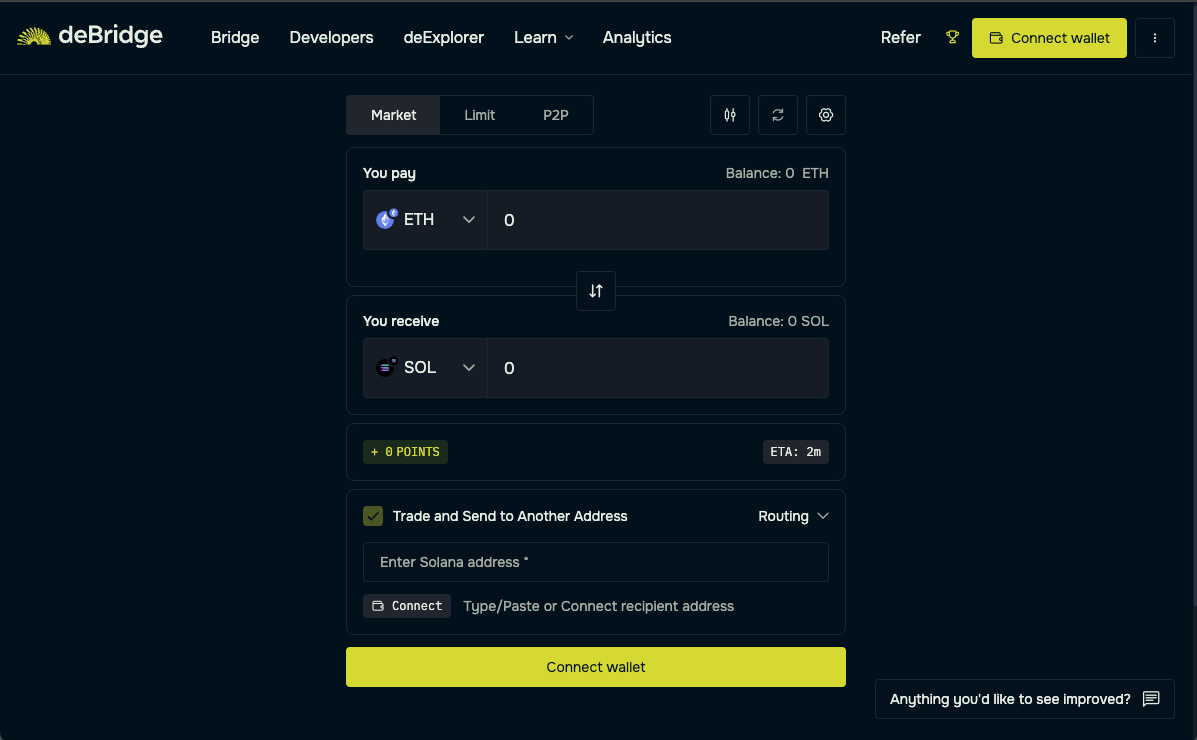

deBridge

deBridge is a cross-chain infrastructure that supports transfers to Solana through its 0-TVL model, meaning no pooled liquidity and no wrapped tokens. It routes transactions in real time across chains such as Ethereum, BNB Chain, Solana, Base, and 18 more.

Supported tokens: Millions (ETH, USDC, USDT, SOL, ARB, DOGE, BNB, HYPE, etc.)

Supported wallets: Solana (Phantom, Solflare, MetaMask, Backpack, Jupiter, and many more)

Supported chains: Ethereum, Solana, Base, HyperEVM, and 19 more.

Developer tools: SDK, APIs, cross-chain widgets, deBridge Hooks for automation

Why choose deBridge?

deBridge has processed over $12 billion in transactions and is trusted by well-known wallets and dApps like Phantom, Trust Wallet, Jupiter Exchange, and many others. It has faced zero downtime even during network spikes and helped users move crypto assets across blockchains.

- Native asset transfers (no wrapped token risks)

- Real-time execution with instant finality

- Zero slippage (always receive the exact amount)

- Deep security track record with audits

- $200k bug bounty program

- Developer-friendly APIs and development tools

Wormhole

Wormhole is one of the oldest integrated Solana bridges. Its Portal interface allows users to move tokens from other chains to Solana. Wormhole relies on the ‘Lock-and-Mint’ model, issuing wrapped tokens on Solana.

Supported tokens: 100+ (ETH, SOL, USDC, USDT, etc.)

Supported wallets: Phantom, MetaMask, Solflare, and more

Developer tools: SDKs and integration APIs.

Why choose Wormhole?

Wormhole benefits from broad adoption and integration across wallets and dApps. It is also commonly used to bridge NFTs from one blockchain to another.

Drawbacks: Wormhole always uses wrapped tokens for transfers between the blockchains. Past security incidents also highlight risks of using the platform for bridging.

Allbridge

Allbridge connects Solana with Ethereum, BNB Chain, and more using a Liquidity Pool model. Users swap between assets deposited by liquidity providers.

Supported tokens: Limited support of stablecoins

Supported wallets: MetaMask, Phantom, TrustWallet, and more

Developer tools: API endpoints for swaps and bridges

Why choose Allbridge?

Allbridge stands out for simplicity and ease of access. That said, liquidity pool depth can cause slippage on large transfers, and security risks are tied to the pool contracts.

Drawbacks: Allbridge is based on a trusted bridge model, exposing it to higher custodial risks for anyone interacting with the protocol. It also uses wrapped tokens that introduce dependency risks.

Symbiosis

Symbiosis acts both as a bridge and an aggregator, using the Liquidity Pool model to connect Solana with chains like Ethereum, Polygon, and BNB Chain.

Supported tokens: Limited support of assets

Supported wallets: Phantom, MetaMask, and more

Developer tools: APIs and liquidity aggregator tools.

Why choose Symbiosis?

Symbiosis makes cross-chain swaps convenient, often routing through the best liquidity path.

Drawbacks: Symbiosis is based on a liquidity pool method where execution depends on external liquidity, which can introduce slippage and security risks.

Mayan Finance

Mayan Finance focuses on cross-chain swaps with Solana via the Lock-and-Mint model, wrapping assets as they move in and out.

Supported tokens: 100+ (ETH, SOL, USDC, USDT, etc.)

Supported wallets: Phantom, MetaMask, Solflare, and more

Developer tools: APIs and dApp integration guides

Why choose Mayan Finance?

Mayan offers a simple bridging process, though, like other lock-and-mint bridges, it relies on wrapped tokens that may carry risks.

Drawbacks: Mayan Finance is based on a “lock-and-mint” method that relies on wrapped tokens. This can carry risks for the users during the order lifecycle.

Comparison Table

How to Choose the Best Solana Bridge

While bridge aggregators like Rango or Bungee are common among users to compare bridging routes, it’s worth noting that they ultimately depend on the bridges themselves (deBridge, Wormhole, and others) to process the actual transfer.

For more transparency, control, and speed, it makes sense to go straight to a trustless-based bridge rather than rely on a third-party router. Here are the factors to consider when choosing:

- Security & trust: Choose deBridge, with its zero-TVL model and audits.

- Asset type: If you’re bridging stablecoin or memecoin, deBridge shall suit you. On the contrary, Wormhole is a suitable solution for bridging NFTs.

- Speed: deBridge offers real-time execution at lightning-fast speed without any delays.

- Slippage: If slippage is a concern, avoid bridges that are dependent on liquidity pools.

For a deeper dive into how bridging is reshaping UX, check our article on real-time bridging with a UX-first approach.

Why deBridge is the best option

Security is the #1 priority for deBridge

Unlike traditional bridges that depend on wrapped assets or pooled liquidity, deBridge uses a 0-TVL architecture that avoids liquidity pools and reduces potential attack surfaces. This helps boost security for users during the order lifecycle of the trade.

The protocol has undergone over 30 security audits by leading firms and has maintained a clean record. deBridge has been hosting a $200,000 bug bounty program for many years, which has yet to be claimed.

- Native ETH transfers: Skip the concept of wrapping and bridge native ETH.

- 0-TVL architecture: User funds are never pooled or exposed to contract risk.

- Real-time asset delivery: ETH is received before transaction finality.

- Universal wallet support: Works with MetaMask, Phantom, Solflare, WalletConnect, Coinbase Wallet, and many more.