How to Bridge ETH to BNB Instantly and Securely (2025)

Table of Contents

- Why Users Bridge from Ethereum to BNB Chain

- Common Bridging Issues (and How deBridge Solves Them)

- Step-by-Step Guide: How to Bridge ETH to BNB Using deBridge

- What Makes deBridge Different from Other ETH to BNB Bridges

- How to Minimize Gas When Bridging ETH to BNB

- For Developers: Add ETH–BNB Bridging to Your dApp

- deBridge Security Overview

- FAQs (Frequently Asked Questions)

- Explore More Bridging Tools and Use Cases

Bridging isn’t just about moving assets, it’s about unlocking faster, cheaper DeFi.

As decentralized finance (DeFi) adoption grows, users and developers are increasingly looking for better ways to transfer assets across chains. Ethereum remains the go-to chain for liquidity and institutional-grade security. But when it comes to DeFi, BNB Chain is coming out as a powerful alternative. With lower gas fees, high throughput, and faster experience, Binance Smart Chain is where DeFi thrives.

Whether you’re accessing PancakeSwap, interacting with DeFi protocols, or deploying dApps, bridging ETH to BNB unlocks a new ecosystem for you to explore.

But the legacy bridging experience has been nothing short of a hassle, involving custodial risk, wrapped tokens, or long delays. That’s where deBridge changes the game.

deBridge is a fast, non-custodial bridge that lets you move ETH to BNB Chain instantly. No centralized exchanges. No wrapped assets. No long waits.

Looking to bridge from ETH to BNB? Start here

Why Users Bridge from Ethereum to BNB Chain

Ethereum has long been the gold standard for DeFi: unmatched in security, home to deep liquidity, and trusted by institutions and developers worldwide.

Value Framing

Like a coin has two sides, Ethereum’s strengths also come with trade-offs, mainly high network fees and limited scalability for retail users.

BNB Chain offers a solution to the above trade-offs with faster execution, lower fees, and a DeFi ecosystem tailored for mass adoption. It has become the chain of choice for traders, NFT projects, and everyday DeFi users who want performance.

Common Use Cases

- Access to BNB-native dApps like PancakeSwap, Venus, and Alpaca Finance.

- Low-cost trading and yield farming help users save on gas fees.

- Avoid centralized exchanges when transferring funds between ecosystems.

- Mobile-friendly UX for faster interaction on wallets like Trust Wallet.

For DeFi builders, bridging ETH to BNB offers a gateway to a faster, cheaper, and better ecosystem, allowing them to serve a broader base of users without any compromise.

Learn more about deBridge here.

Common Bridging Issues (and How deBridge Solves Them)

The idea of bridging is often misunderstood because of how legacy solutions have worked. They cause more problems than they solve, such as asset delays, wrap risks, wallet limitations, and many other issues. Let’s break down the most common issues and how deBridge eliminates them.

Key Bridging Pain Points

CEX Reliance: Most users still rely on centralized exchanges, such as Binance, to transfer ETH to BNB. This introduces KYC friction, custody risk, and additional delays due to withdrawal queues or limits.

Wrapped Tokens and Liquidity Pools: Instead of transferring native BNB, many bridges mint wrapped assets backed by liquidity pools, exposing users to risks associated with smart contracts.

Transaction Failures and Delays: Congested bridges, validator lag, and missing confirmations are common across traditional bridges.

Wallet Compatibility: Limited wallet support increases friction and risk of importing private keys to use the bridging protocol.

How deBridge Solves These

deBridge removes the bottlenecks and risks of liquidity pools by enabling value and information to flow instantly across the DeFiverse with deep liquidity and guaranteed rates.

- Real-time Bridging: Transfers settle in seconds with instant finality. No waiting, no stuck transactions.

- Native Assets Only: ETH in, native BNB out. No wrapped tokens.

- 0-TVL Architecture: No user funds are stored in smart contracts or liquidity pools, eliminating honeypot risk.

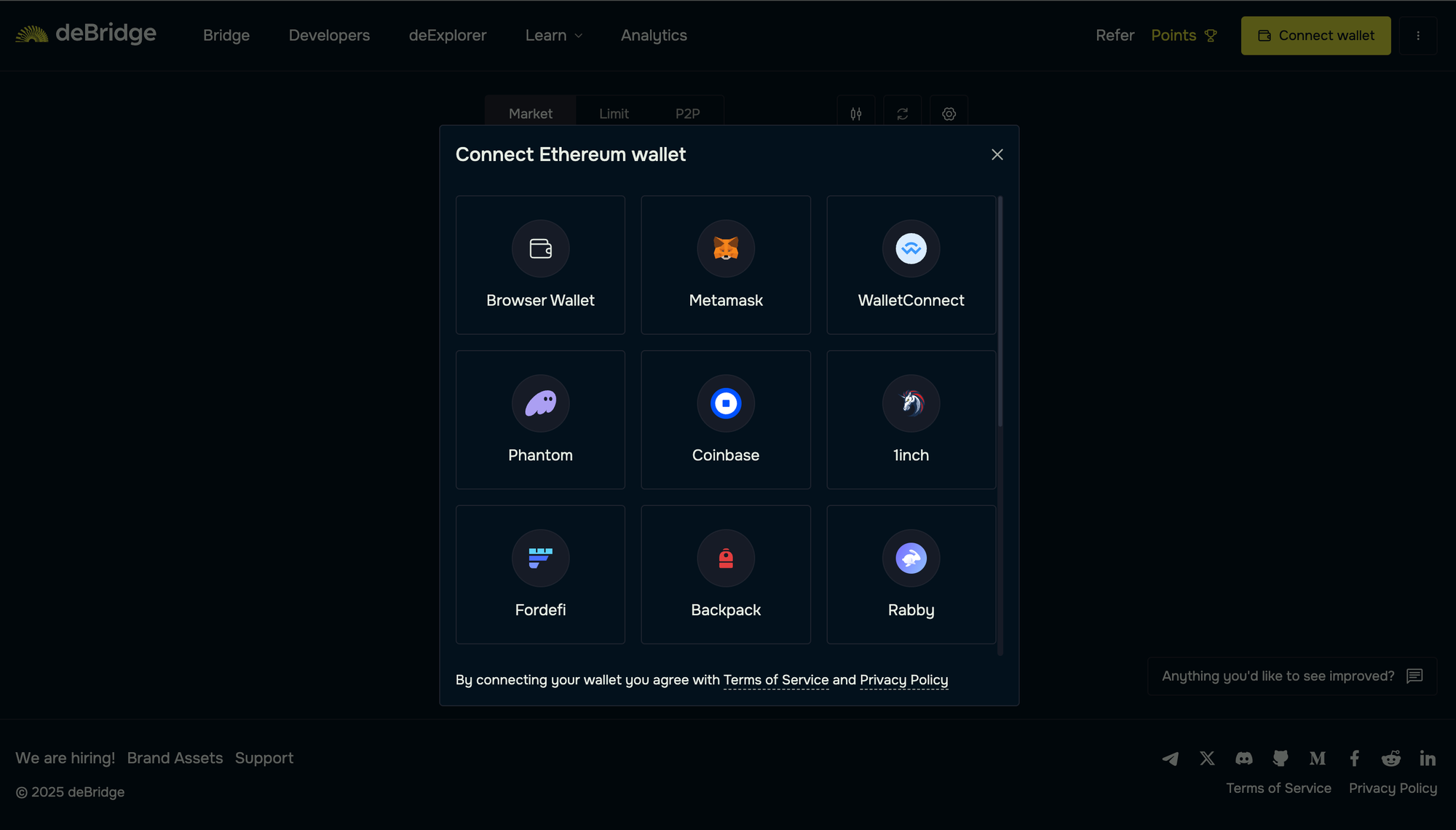

- Universal Wallet Support: Works with MetaMask, WalletConnect, Coinbase Wallet, Trust Wallet, and more.

Step-by-Step Guide: How to Bridge ETH to BNB Using deBridge

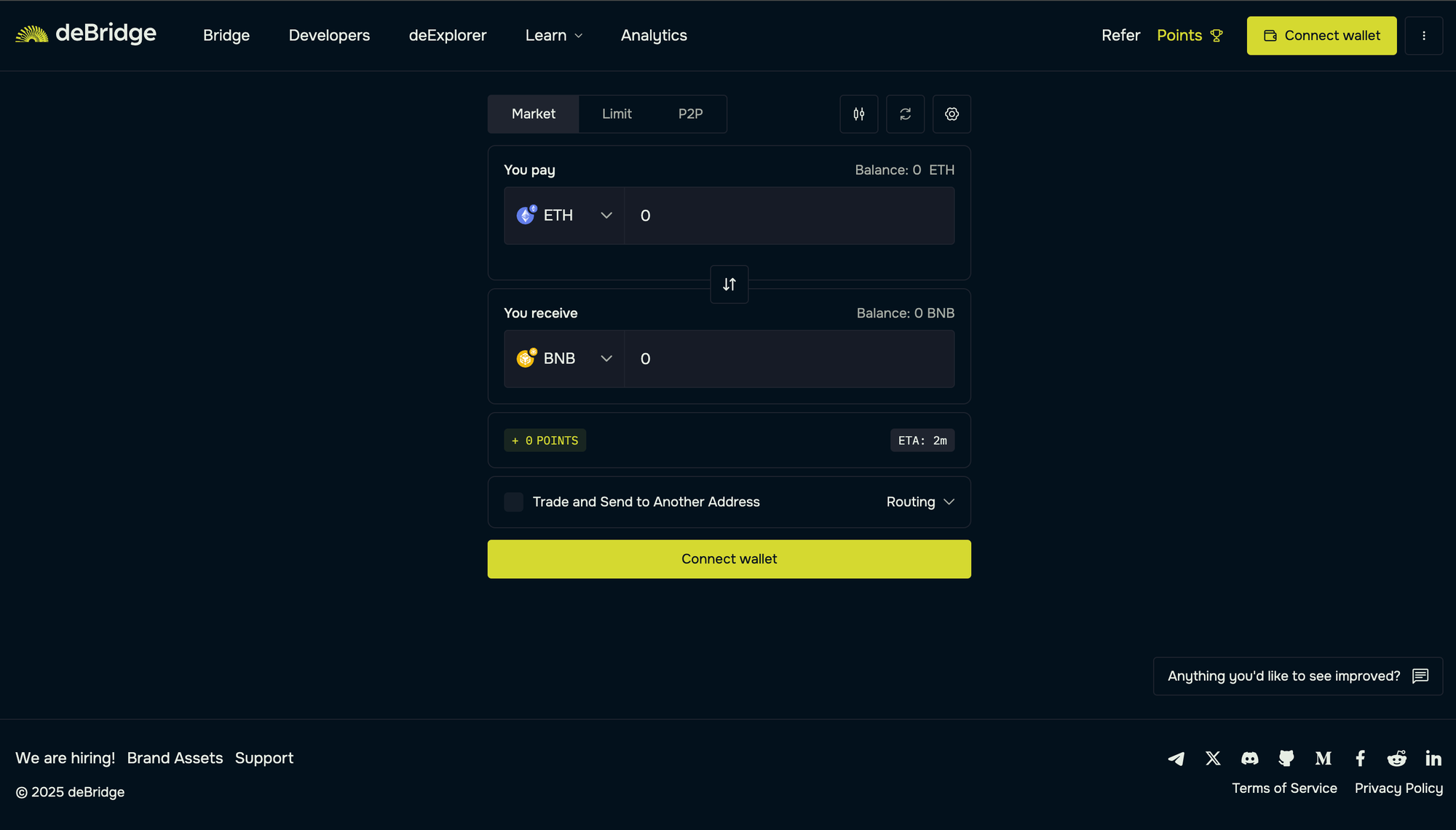

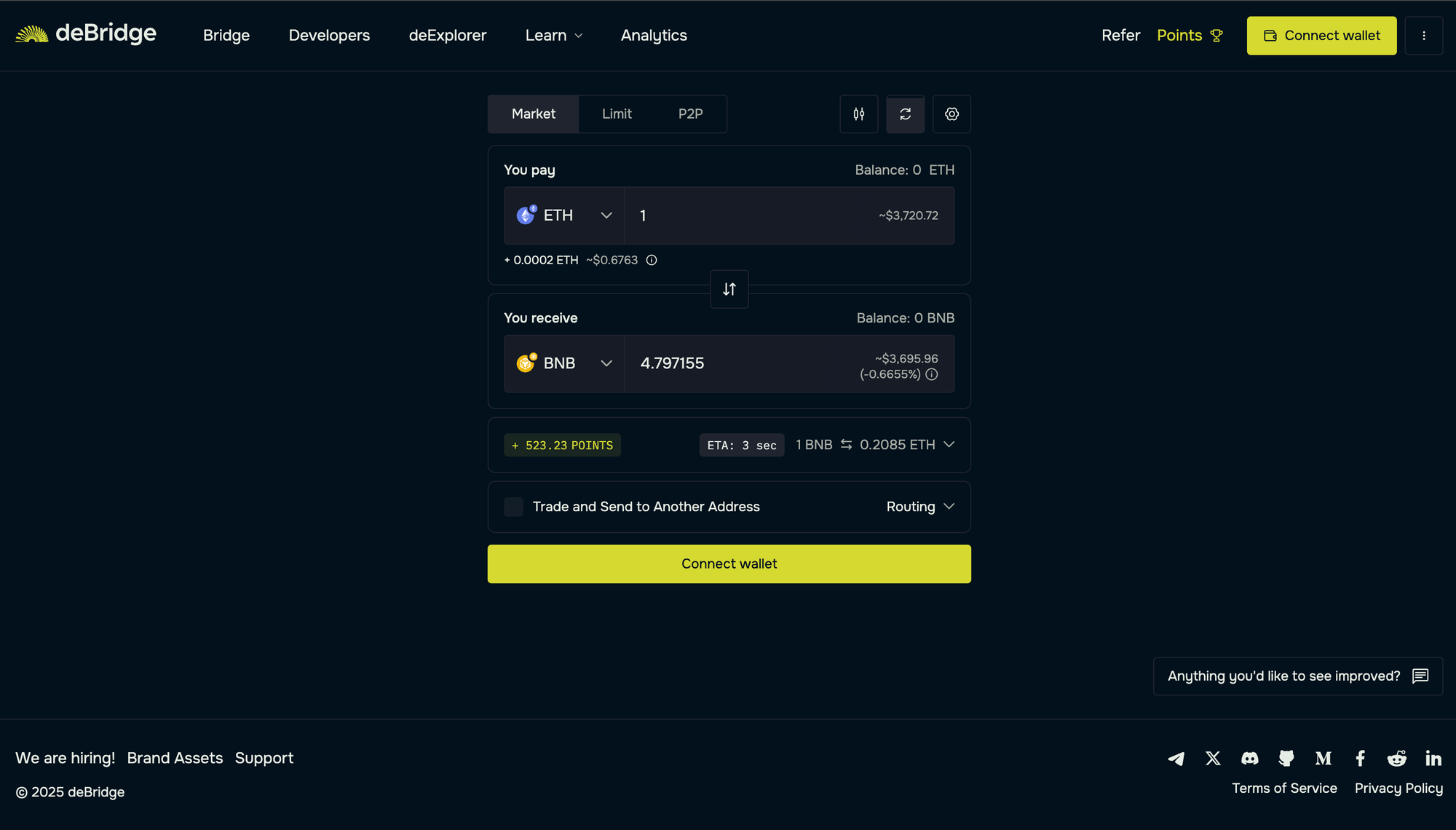

deBridge provides an instant bridging solution to help you bridge assets between Ethereum and any asset on the Binance Smart Chain and vice versa. Let's walk through the steps involved to perform BNB Chain bridging:

- Select the source network and asset you’d like to bridge. Here, we will select Ethereum and ETH, respectively.

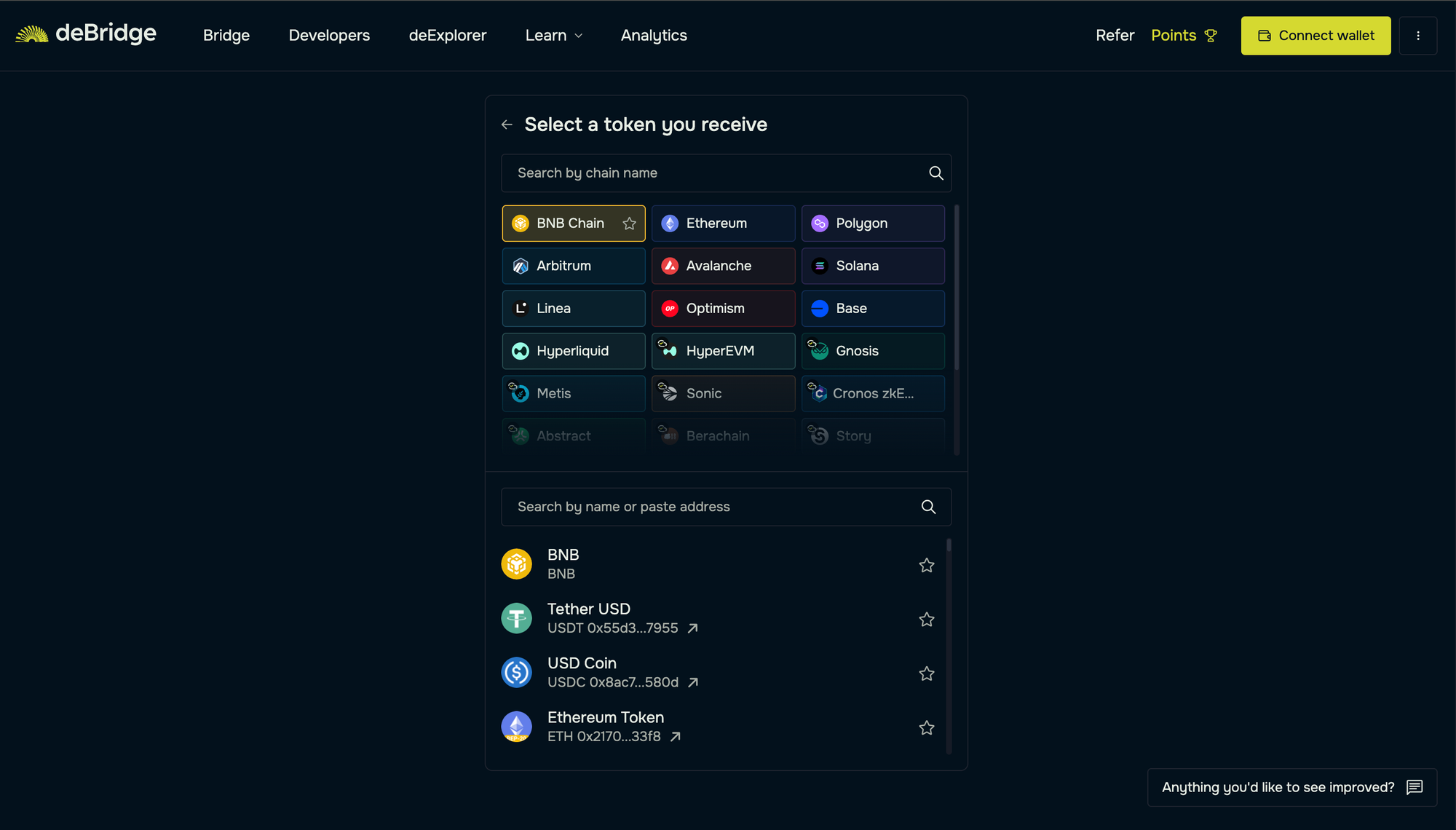

- Next, select the destination network and asset you’d like to receive. Here, we will choose BNB Chain and BNB as the asset on the target chain.

- Connect your EVM wallet as the source and destination.

- Enter the ETH quantity and review the transaction details.

- Click "Confirm trade" and sign the ensuing transactions to receive native BNB in your BNB Chain account.

Pro Tips

- Make sure you have sufficient BNB in your destination chain (BNB Chain) for future transactions. This will help you bridge assets from BNB Chain to other networks.

- Try to avoid bridging during peak hours to save on ETH gas costs. You can track gas prices on Etherscan.

The bridging process is simple and only takes a few seconds to complete. You will receive the bridged assets (BNB) in your BNB wallet instantly. Technical users can also inspect the transaction(s) on the BNB Chain explorer.

What Makes deBridge Different from Other ETH to BNB Bridges

Speed, security, and transparency make deBridge different from other ETH to BNB bridges. While most crypto bridges rely on liquidity pools and wrapped assets, deBridge takes a different approach by adopting a 0-TVL architecture for better security and zero-risk in cross-chain swaps.

Comparison Table

Feature | deBridge | Binance (CEX) | Celer | Stargate |

Custody | Non-custodial | Centralized | Mixed | Non-custodial |

Native Assets | Yes | Yes | Often Wrapped | Wrapped |

Wrap Risk | None | None | Medium | High |

Real-Time Execution | Yes | No | No | No |

Gas Optimization | Yes | Partial | Partial | Partial |

Wallet Support | Broad | Limited | Broad | Limited |

Key Differentiators

- 0-TVL architecture: Unlike traditional bridges that lock assets in smart contracts, deBridge works on a 0-TVL architecture that skips the use of liquidity pools.

- Native assets bridging: You receive native BNB and not wrapped tokens on the BNB chain. This provides instant usability across all the BNB chain dApps.

- Real-time execution: Transactions settle in the blink of an eye, with assets arriving in your blockchain wallet even before block finality.

- Wallet support: MetaMask wallet, Phantom, Coinbase Wallet, Solflare, and WalletConnect are fully supported.

- Developer-ready: Easy API support for building custom cross-chain experiences.

With over $12 billion in transaction volume, deBridge is trusted by major wallets and dApps such as Phantom, Jupiter Exchange, and more. It has faced zero downtime even during network spikes and helped users move crypto assets across blockchains.

How to Minimize Gas When Bridging ETH to BNB

While bridging ETH to BNB is much faster with deBridge, users often wonder how to minimize the associated gas costs on Ethereum, which is known for its high gas fees during periods of high activity.

deBridge is designed with gas efficiency in mind. But there are still a few tips that can help you save even more when bridging tokens across chains.

Optimization Tips

- Monitor gas prices: Use tools like Etherscan Gas Tracker and BSCScan Gas Tracker to keep track of current fees.

- Avoid peak congestion windows: Prevent bridging funds between 2 PM and 6 PM UTC. This is when DeFi activity, arbitrage bots, and activity are super high.

- Choose “Medium” gas settings: It helps balance confirmation speed with cost. You can also customize advanced gas settings if needed.

- Use wallets with gas optimizations: Rabby and OKX Wallet help select optimal fees and batching when possible.

Gas Cost Comparison

Bridge | ETH Gas (USD) | BNB Gas (USD) | Total Approx. Cost |

deBridge | ~$3.20 | ~$0.01 | ~$3.21 |

Binance Exchange | ~$5.00 | N/A | ~$5.00 |

Stargate | ~$4.80 | ~$0.12 | ~$4.92 |

*These numbers are referenced after taking into account the average for July. It will be fairly accurate for most users and serve as a reliable comparison between bridge types. While exact gas costs fluctuate block-to-block, it is important to DYOR for gas cost comparison.

With little planning and the right tools, you can reduce gas costs while still enjoying fast, secure bridging between Ethereum and Binance Smart Chain.

For Developers: Add ETH–BNB Bridging to Your dApp

Building cross-chain functionality into your dApp should be a no-brainer and doesn’t require months of development or complex infrastructure. With deBridge, developers can enable ETH ↔ BNB bridging in just a few lines of code using our developer APIs.

Whether you're building a DEX, NFT platform, onchain game, or wallet, integrating deBridge opens a seamless way to onboard users across Ethereum and BNB Chain. Now, with an added functionality, you can explore how to fetch real-time DeFi data with deBridge Hooks.

Integration Benefits

- Simple integrations: Enable cross-chain transfers in minutes with easy-to-use developer tools.

- Native asset delivery: Instead of wrapped tokens, users receive native ETH and BNB with real-time finality of all transactions.

- Revenue via affiliate model: Earn from every transaction routed through your app.

- Multi-chain support: Expand support across Ethereum, BNB Chain, Solana, Arbitrum, Base, and more.

deBridge is designed with performance in mind, making it ideal for both startups and bigger dApps. You can also perform all sorts of UI customizations in the deBridge widget to keep the colors consistent with your brand.

Integrate Cross-Chain Bridging via API

deBridge Security Overview

deBridge always puts security first, no matter what.

Unlike traditional crypto bridges that pool user funds into a single location, deBridge works on a 0-TVL architecture that skips the need for liquidity pools. This method prevents exploits like pool draining, leaving no room for an attack surface.

By mid-2025, deBridge had already completed 30+ audits by top firms, including Zokyo, Halborn, and Ackee. It also features a generous $200K bug bounty that has still not been claimed since its launch.

deBridge keeps user funds safe throughout the order lifecycle. The protocol ensures that funds arrive in the destination wallet before the transaction is finalized, providing you with the confidence to move assets across 25+ chains in seconds.

Trust Signals

deBridge is the top choice of users looking to bridge across 25+ chains from anywhere in DeFi. Some of the standout features include:

- 0-TVL = no pooled user funds

- Audited 27+ times, zero security incidents

- $200K bug bounty (never claimed)

- Trusted by Phantom, Jupiter, and Solflare

FAQs (Frequently Asked Questions)

What is the fastest way to bridge ETH to BNB?

Can I use MetaMask or Coinbase Wallet for ETH to Binance Smart Chain transfers?

Are gas fees included in the bridge?

Is deBridge safe for large ETH transfers?

Can I embed this bridge into my dApp?

Explore More Bridging Tools and Use Cases

While bridging ETH to BNB is a common use case, deBridge supports any-to-any swap and developer tooling to help you move seamlessly across ecosystems. You can bridge assets between Ethereum, BNB Chain, Solana, Arbitrum, Base, HyperEVM, and 20 other chains in real-time at lightning speed.

For builders, deBridge offers widget solutions and API access to power advanced DeFi products. From wallets to DEXs to complex DeFi platforms, the tooling is designed to be modular, lightweight, and production-ready.