How to Bridge from Ethereum to Solana Quickly and Securely

Key Takeaways

- Bridge native ETH to native SOL, not wrapped tokens

- Transfers complete in 1–2 seconds with instant finality

- deBridge is secure — 27+ audits, 0-TVL architecture

- Developers can easily integrate with SDKs and earn fees

Table of Contents

- Why Bridge ETH to Solana?

- What’s Wrong with Most ETH to SOL Bridges?

- Step-by-Step Guide: How to Bridge ETH to Solana Using deBridge

- What Makes deBridge Unique for ETH to Solana Flows

- Reduce Gas Costs When Bridging ETH to Solana

- For Developers: Add ETH–Solana Bridging to Your App

- deBridge Security Summary

- Explore More Bridging Use Cases

- FAQs (Frequently Asked Questions)

Bridging isn’t just a technical step, it’s your access key to Solana’s speed and low fees. While Ethereum continues to be a leader in DeFi and liquidity, its high gas fees and long transaction times often frustrate users seeking better efficiency. That’s where Solana comes in.

Whether you're exploring Solana-native DeFi platforms, leveraging trading bots, or chasing yields, bridging your ETH over to Solana unlocks a whole new world of opportunities. But not all crypto bridges are built the same, as many rely on wrapped assets or liquidity pools, exposing users to significant delays and security risks.

deBridge changes the game with native asset transfers, instant finality, and a truly user-first experience. No wrapped tokens. No liquidity pool risks. Just fast, secure, and seamless bridging from Ethereum to Solana.

Looking to bridge from ETH to Solana? Start here

Why Bridge ETH to Solana?

Ethereum is the go-to network for OGs due to deep liquidity, established DeFi protocols, and trusted infrastructure. But its strengths also come with trade-offs, such as high gas fees and slower finality, especially during periods of heavy network traffic.

Value Framing

Solana flips that equation. With instant finality and low fees (typically less than $0.01 per transaction), it’s built for performance and those who don't like to wait. Solana is home to consumer-focused dApps, NFT platforms, and yield strategies that require speed and efficiency.

Leveraging Solana’s fast transactions and low fees, developers can create innovative dApps, while users enjoy an improved experience with newer applications.

Common Use Cases

- NFT Minting: Participate in Solana-based NFT launches on platforms like Magic Eden and Tensor.

- Yield Aggregators: Put your assets to work in protocols like Kamino or Jito.

- Arbitrage & Trading Bots: Execute strategies that require sub-second execution.

- DAO Participation: Vote and engage with Solana-native governance protocols.

Whether you're a yield farmer, NFT collector, builder, or DeFi power user, bridging ETH to Solana offers a gateway to faster, cheaper, and more popular blockchain use cases.

Learn more about our cross-chain liquidity protocol.

What’s Wrong with Most ETH to SOL Bridges?

Most ETH to SOL bridges still rely on age-old mechanisms, like liquidity pools, posing a risk to the user experience. Wrapped tokens is another common issue, where ETH is locked, and a synthetic version is minted on the Solana side. The process creates trust assumptions, adds complexity, and opens the door to liquidity problems.

Common Pain Points

- Long Settlement Times: Many crypto bridges require multiple confirmations and oracle checks, leading to delays of over an hour.

- Centralized Bridges or Custodians: Some bridges rely on third-party custody, which creates a single point of failure and contradicts DeFi’s decentralization ethos.

- Failed or Stuck Transactions: Poorly maintained interfaces, buggy smart contracts, and overloaded validators can lead to transactions that are stuck or fail to complete.

- Slippage on large volumes: Liquidity pool-based bridges suffer from high slippage, particularly during periods of high volatility or large transfers.

These challenges can really shake user trust and hold back cross-chain movement, highlighting how traditional bridges just aren’t designed for scale or a great user experience.

How deBridge Solves It

deBridge removes the bottlenecks and risks of liquidity pools by enabling value and information to flow instantly across the DeFiverse with deep liquidity and guaranteed rates.

- Native asset bridging means no wrapped tokens.

- 0-TVL architecture helps eliminate pooled liquidity risk.

- Funds arrive in your wallet even before finality.

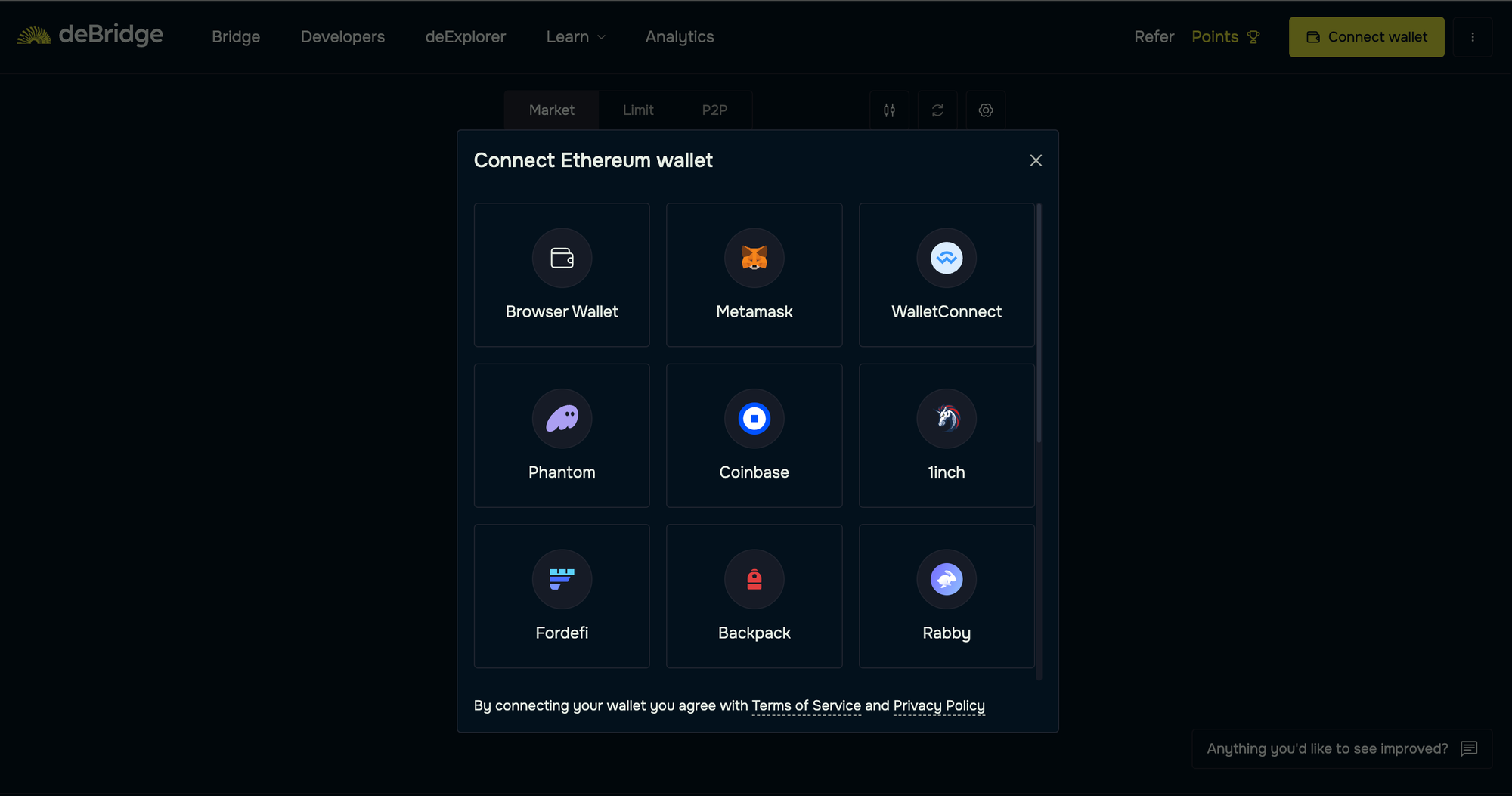

- Support for multiple wallets such as MetaMask, Phantom, Coinbase Wallet, and more.

Learn more about how deBridge improves DeFi UX through real-time bridging

Step-by-Step Guide: How to Bridge ETH to Solana Using deBridge

deBridge provides an instant bridging solution to help you bridge assets between Ethereum and any asset on the Solana network and vice versa. Let's explore how to perform cross-chain bridging for your crypto assets in a few simple steps.

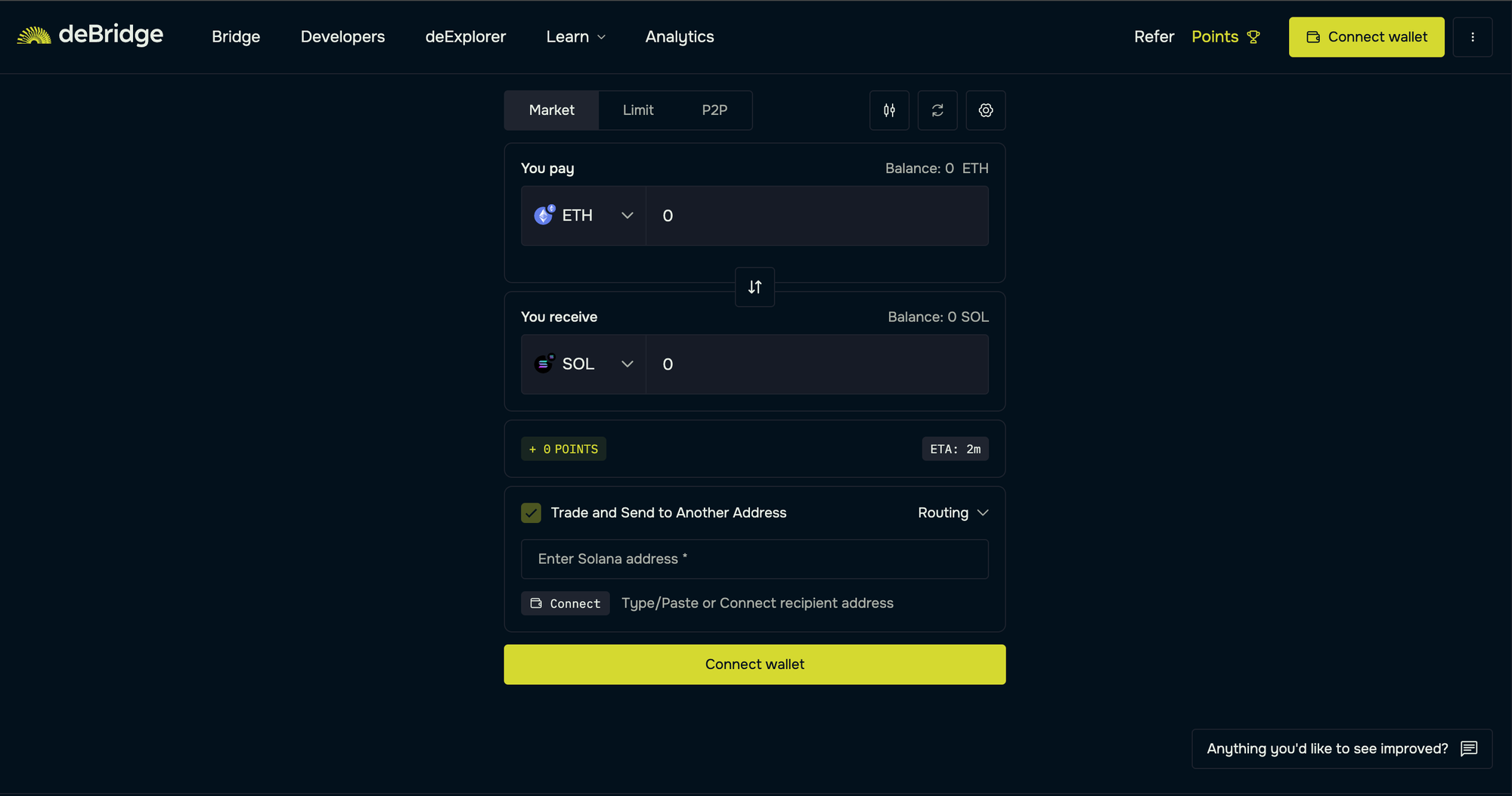

Bridging Instructions

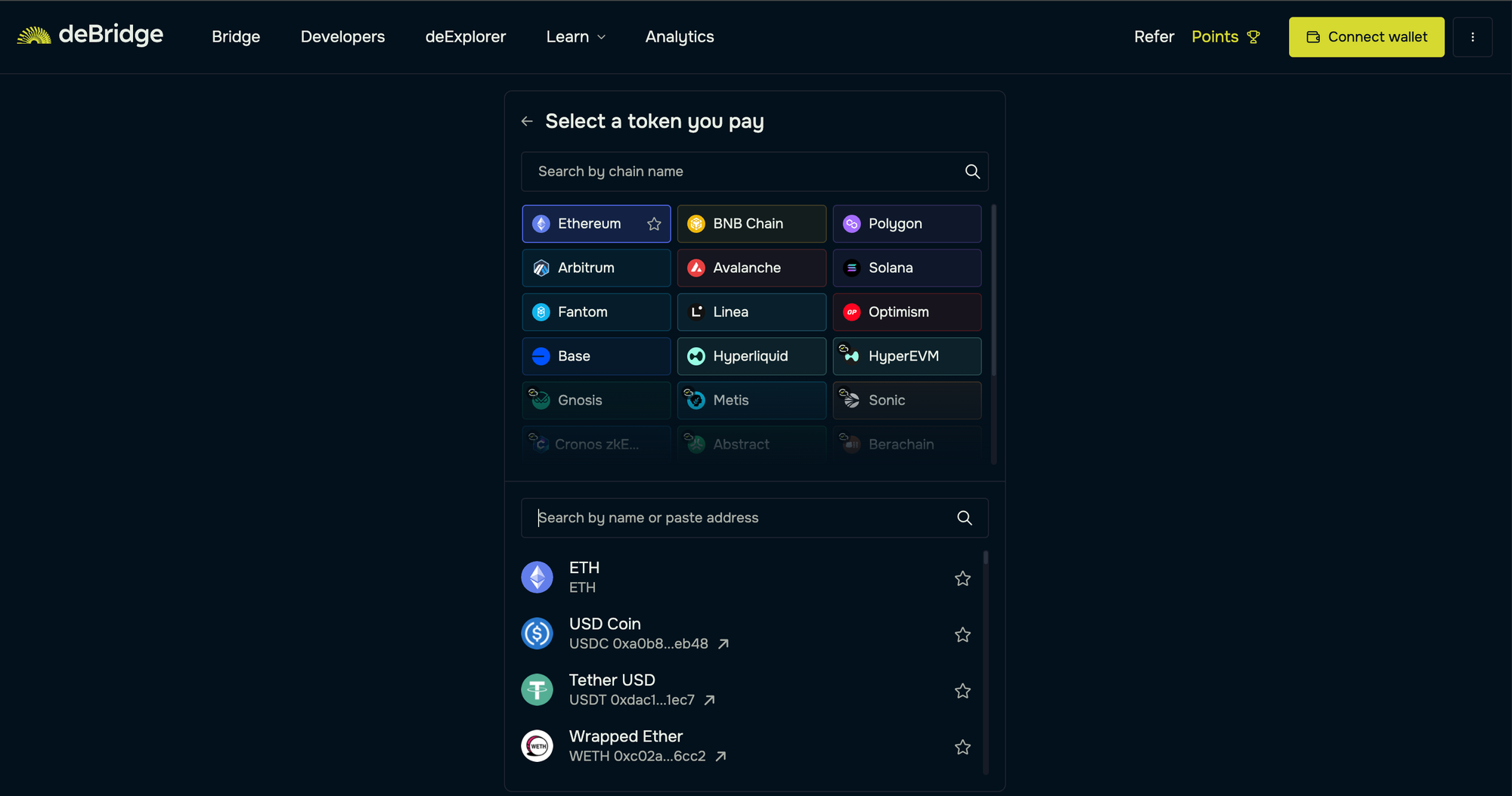

- Connect your Ethereum wallet address as the source and your Solana wallet address as the destination.

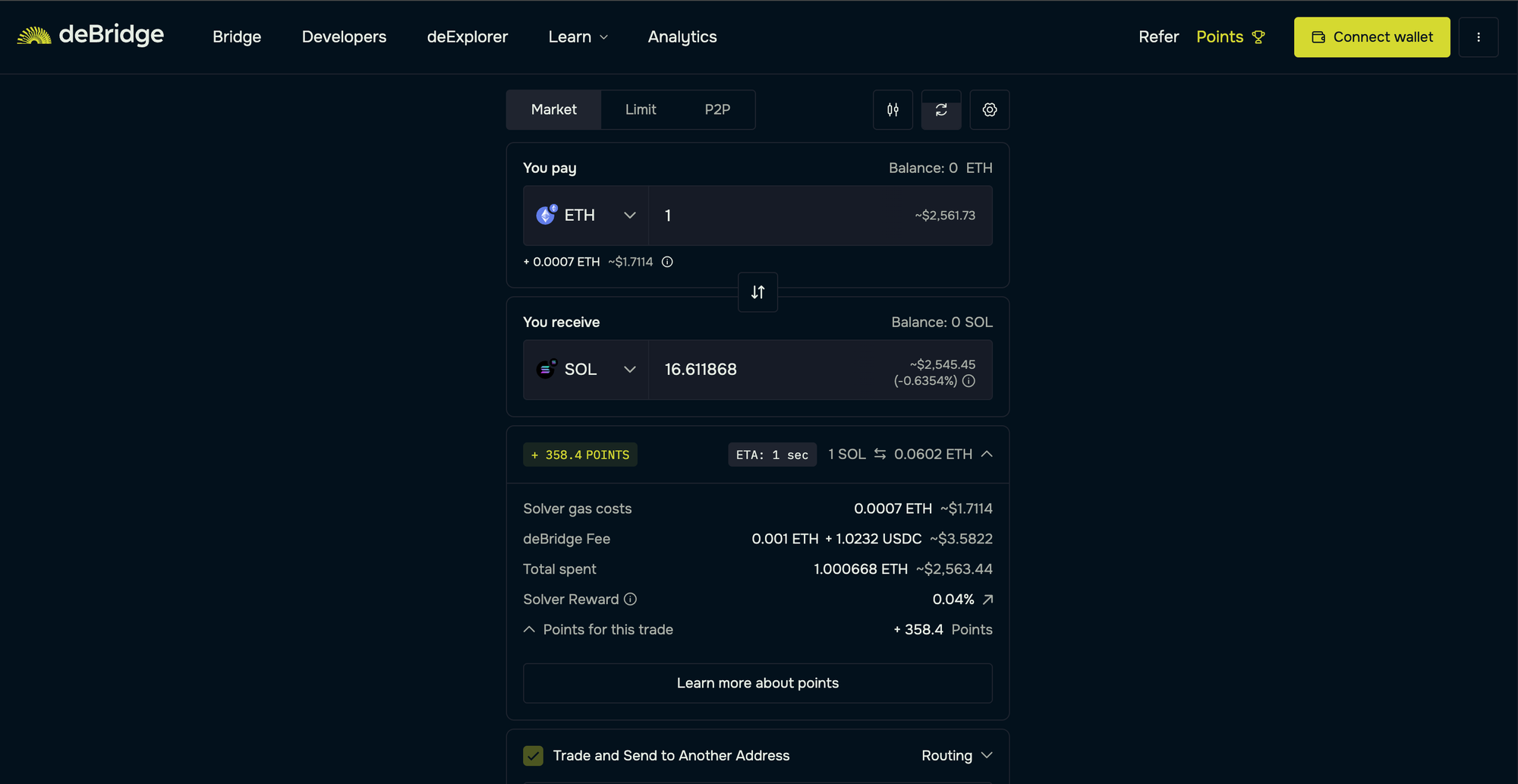

- Select the source chain (Ethereum) and asset you want to bridge. Here, we will bridge ETH to SOL.

- Next, select Solana as the destination chain and the token you want to receive. Here, we will select SOL as the asset on the target chain.

- Enter the quantity in ETH and review the transaction details.

- As the final step, confirm the trade, pay gas fees in ETH, and sign the ensuing transactions to receive crypto in your Solana wallet.

Pro Tips

- Make sure your destination wallet is already set up to receive SOL

- For best results, avoid bridging during high Ethereum gas congestion

The bridging process takes 1-2 seconds, and you'll see the "Order Fulfilled" pop-up, which indicates that the bridged assets (SOL) have been received in your Solana wallet. Technical users can also inspect the transaction(s) on the Solana mainnet explorer.

What Makes deBridge Unique for ETH to Solana Flows

What sets deBridge apart from other ETH-Solana bridges is its combination of speed, security, and decentralization. While most crypto bridges rely on pooled liquidity and wrapped assets, which introduce risk, delays, and complexity, deBridge takes a fundamentally different approach by adopting a 0-TVL architecture for enhanced security and zero-risk in cross-chain swaps.

Key Differentiators

- 0-TVL architecture: Unlike traditional bridges that lock assets in vulnerable smart contracts, deBridge operates without pooled liquidity, eliminating one of the most common exploit vectors.

- Native assets bridging: You get SOL and not wrapped tokens on the destination chain. This provides instant usability across Solana dApps.

- Real-time execution: Transactions settle in 1-2 seconds, with assets arriving in your blockchain wallet even before block finality.

- High volatility resilience: Zero downtime even during network spikes, thanks to its smart routing and on-chain validation systems.

- Universal wallet support: MetaMask, Phantom, Coinbase Wallet, Solflare, and WalletConnect are fully supported.

- Developer-ready: Easy SDK integration and API support for building custom cross-chain experiences.

With over $12 billion in transaction volume and more than 900,000 users, deBridge has earned the trust of the top people in the crypto space. It has been the first choice for anyone seeking a secure and scalable method to move crypto assets from Ethereum to the Solana blockchain.

Reduce Gas Costs When Bridging ETH to Solana

Gas fees on Ethereum are a major issue, particularly during periods of high network congestion. While deBridge is optimized for fast and cost-effective bridging, users can take additional steps to save even more on gas costs. Let’s read about them:

Optimization Tips

- Monitor Ethereum gas prices: Use Etherscan Gas Tracker to see current network conditions and track gas prices.

- Avoid high congestion times: Typically, gas fees are higher during weekday afternoons (UTC). Consider initiating your bridge during off-peak hours, such as late at night UTC or on weekends.

- Use "average" or "custom" settings: Most wallets allow you to select between "slow," "average," and "fast" gas speeds. Opting for "average" offers a good balance between speed and cost.

While gas efficiency not only saves you money, it also reduces network load and supports a more sustainable ecosystem. By staying on top of the gas prices, users can make ETH→SOL bridging even more affordable.

For Developers: Add ETH–Solana Bridging to Your App

deBridge is DeFi’s internet of liquidity, enabling real-time movement of assets and information across the DeFi landscape. Developers building in the crypto space are welcome to integrate deBridge for seamless cross-chain interactions within their dApp.

Why Integrate deBridge?

If you're building a dApp, wallet, or DeFi protocol that needs cross-chain connectivity, integrating deBridge offers an easy way to onboard Ethereum users into the Solana ecosystem. With deBridge’s developer tools, you can add ETH→SOL bridging in just a few lines of code.

- Multi-chain SDK: Supports EVM and Solana out of the box

- Plug-and-play APIs: Simplify integration and speed up time to market

- Real-time execution: Assets arrive in seconds

- Affiliate routing: Earn revenue from each transaction routed through your app

deBridge is designed with developers in mind, making it easy to add the deBridge widget or API within the decentralized application. Now, with an added functionality, you can explore how to fetch real-time DeFi data with deBridge Hooks.

Whether you’re building a cross-chain wallet, launching an NFT marketplace, or a DeFi protocol, deBridge provides the infrastructure to do it natively and securely.

Plus, with detailed docs, TypeScript SDKs, and support from the team, integrating deBridge is smooth, fast, and future-proof.

Explore deBridge’s API Integration

deBridge Security Summary

Security is a top priority when it comes to bridging, and deBridge is designed with that focus.

Unlike traditional crypto bridges that pool user funds into smart contracts or pools, deBridge uses a 0-TVL architecture that completely skips the liquidity pools. This ensures no attack surface for exploits like pool draining or front-running.

deBridge has undergone more than 27 audits by leading firms, including Zokyo, Halborn, and Ackee. It also ensures that funds arrive in the destination wallet before the transaction is finalized, maintaining user trust, along with zero downtime and no security risks since its inception.

Today, it’s trusted by major ecosystem players, including Phantom, Solflare, Jupiter Exchange, and more. deBridge gives you the confidence needed to move assets across 25+ chains in seconds.

Why Users Trust deBridge?

deBridge has been trusted by users of all generations for bridging to anywhere in DeFi. It also includes several features, such as:

- 0-TVL = no pooled liquidity risk

- Audited 27+ times, zero security incidents

- Funds delivered before finalization

- Trusted by Phantom, Jupiter, and Solflare

Explore More Bridging Use Cases

Bridging from Ethereum to Solana is just the beginning. With deBridge, you can move anywhere in DeFi and unlock a wide range of opportunities designed for traders, developers, and DeFi power users.

Looking to bridge tokens from Solana to Base? Want to seamlessly swap tokens between EVM chains and non-EVM chains? Or maybe you're building a product that needs to onboard users from any chain with just one click—deBridge has you covered.

Developers can integrate deBridge’s SDK and APIs to embed bridging flows directly into their dApps, while power users benefit from real-time transfers with no reliance on wrapped assets or centralized custody. Whether you're deploying on Polygon, Arbitrum, BNB Chain, Solana, or any other chain, deBridge powers native, secure, and lightning-fast transfers.

And if you're running a DAO, DeFi dApp, or wallet, integrating deBridge allows you to offer a smooth cross-chain UX for your users without needing to explore other options.