Bridge USDT from Ethereum to Tron in Seconds with deBridge

Table of Contents

- Key Takeaways

- Why Bridge USDT from Ethereum to Tron

- Common Issues With Ethereum to Tron Bridges

- Step-by-Step Guide: Bridge USDT from Ethereum to Tron with deBridge

- What Makes deBridge Different from Other Ethereum to Tron Bridges

- For Developers: Add Ethereum to Tron Bridging to Your App

- deBridge Security Summary

- Frequently Asked Questions (FAQs)

- Explore More Bridging Use Cases

The world of cross-chain DeFi is moving faster than ever. One of the most common user needs is transferring USDT (Tether) between the Ethereum and Tron networks. As of September 2025, Tron holds over 50% of all the circulating supply of USDT, making it a lucrative platform for facilitating liquidity flows between Tron and other blockchains.

Ethereum is the hub of DeFi innovation, while Tron is known for its lightning-fast settlement and ultra-low fees. But moving assets between these two blockchains has historically been tricky. Users often face issues such as wrapped tokens, slippage, high fees, and delays when using traditional bridges or centralized exchanges (CEXs).

This is where deBridge changes the game. With real-time bridging, no pooled liquidity, and native asset transfers, deBridge enables fast, secure, and seamless asset movement between Ethereum and Tron.

Read this guide to find out more about Tron, including a step-by-step guide to bridging to Tron, how to enable Tron bridging in your dApp, and much more.

Key Takeaways

- Tron leads USDT adoption, holding over 50% of the total supply, making it the hub for stablecoin liquidity and low-cost transfers.

- Why bridge? Faster transactions, lower fees, and deep liquidity compared to Ethereum’s congestion and high gas costs.

- Common issues with bridges: High fees, wrapped tokens, slippage, and long settlement times.

- How deBridge solves it: 0-TVL architecture, native TRC20 USDT delivery, real-time execution, and wide wallet support.

Why Bridge USDT from Ethereum to Tron

Bridging opens new possibilities for users looking to explore new ecosystems. Bridging USDT from Ethereum to Tron unlocks a new world of speed, stablecoin dominance, and access to faster dApps.

Value Framing

Ethereum remains the leading smart contract ecosystem in DeFi, but it comes with a cost: network congestion, high gas fees, and slower transaction finality. For everyday users transferring stablecoins like USDT, these problems can be a dealbreaker.

However, Tron offers faster block times, significantly lower fees (thanks to recent fee reduction), and massive liquidity for USDT (TRC20). In fact, Tron is the fastest-growing chain for USDT transactions globally, particularly for cross-border settlements.

This makes bridging USDT from Ethereum to Tron an excellent choice for anyone looking to tap into the Tron ecosystem.

Common Use Cases

Here are some of the top reasons why users bridge USDT from Ethereum to Tron:

- Cross-border payments: Tron’s low transfer fees make it ideal for sending USDT globally, without paying hefty Ethereum gas costs.

- Trading opportunities: Many Tron-based dApps and exchanges offer unique trading pairs and liquidity pools not found on Ethereum.

- Avoiding Ethereum gas spikes: Ethereum fees can spike significantly during busy hours. Using Tron for bridging helps users save on these extra costs.

- Stablecoin dominance: Tron is home to over 50% of USDT in circulation, meaning deeper liquidity and faster execution for stablecoin transfers.

Common Issues With Ethereum to Tron Bridges

Users often face high fees, delays, slippage, and wrapped tokens when moving assets from Ethereum to Tron. Let’s break down these challenges and see how deBridge solves them with its state-of-the-art architecture.

Common Pain Points

Users bridging from Ethereum to Tron have often faced:

- Slippage: Unexpected losses when moving through liquidity pools.

- High fees: Paying both Ethereum gas and bridge service fees.

- Limited token support: Not all bridges support popular wallets or tokens.

- Long transaction times: Delays caused by liquidity shortages or congestion.

- Wrapped tokens: Receiving wrapped USDT instead of native TRC20.

- Dependence on CEXs: Using centralized exchanges to move assets.

How deBridge Solves Them

deBridge eliminates these problems with its 0-TVL bridging architecture:

- 0-TVL (Zero Total Value Locked): deBridge doesn’t rely on pooled liquidity, eliminating the risk of bridge hacks or drained pools.

- Native asset delivery: Instead of wrapped USDT, you always receive native TRC20 USDT directly in your Tron wallet.

- Real-time transfers: deBridge ensures near-instant settlement (seconds) with no delays.

- Zero slippage: With no liquidity pools, you receive exactly what you send.

- Wide wallet support: Compatible with major wallets including Tron Link, MetaMask, Trust Wallet, Phantom, Coinbase Wallet, and more.

This makes deBridge the most secure and reliable choice for cross-chain stablecoin transfers. You can also explore how this fits into the broader UX of DeFi in our guide to real-time bridging for a better DeFi experience.

Step-by-Step Guide: Bridge USDT from Ethereum to Tron with deBridge

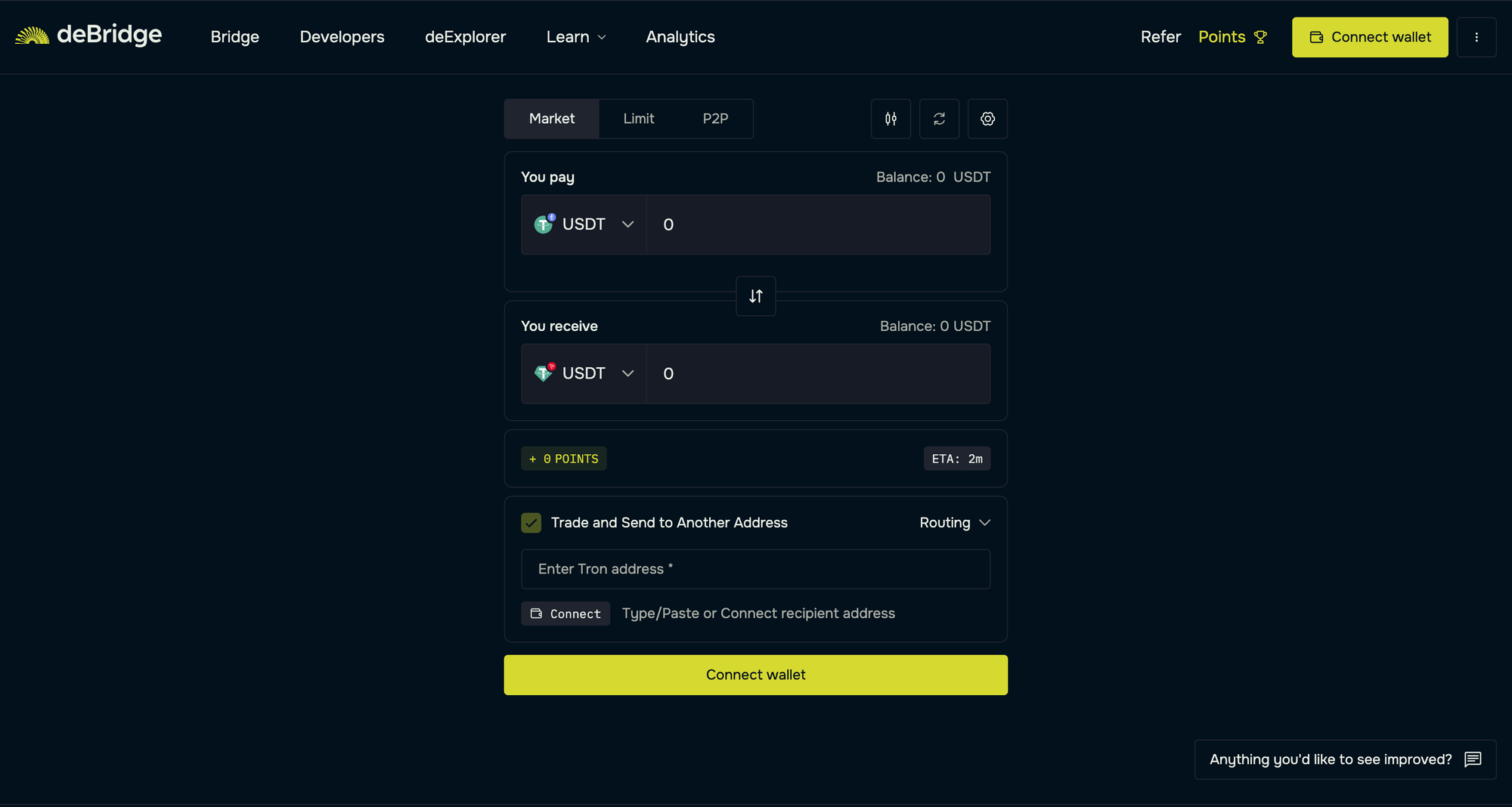

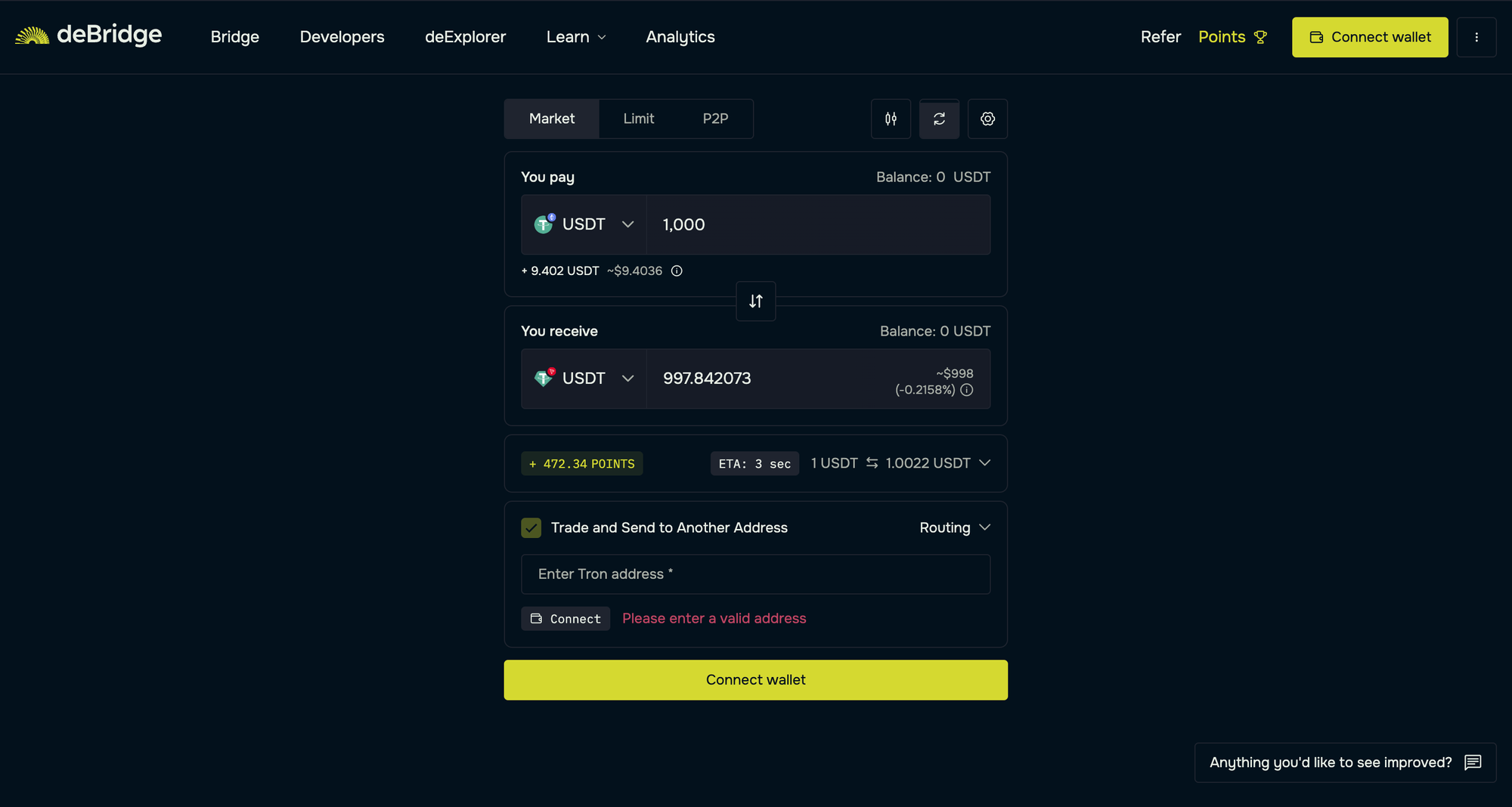

deBridge provides an instant bridging solution to help you bridge assets between Ethereum and any asset on the Tron blockchain and vice versa. Let's walk through the steps to bridge your crypto assets:

- Visit https://app.debridge.finance

- Select the source chain and asset you’d like to bridge. Here, we will select Ethereum as the source chain and USDT as the asset.

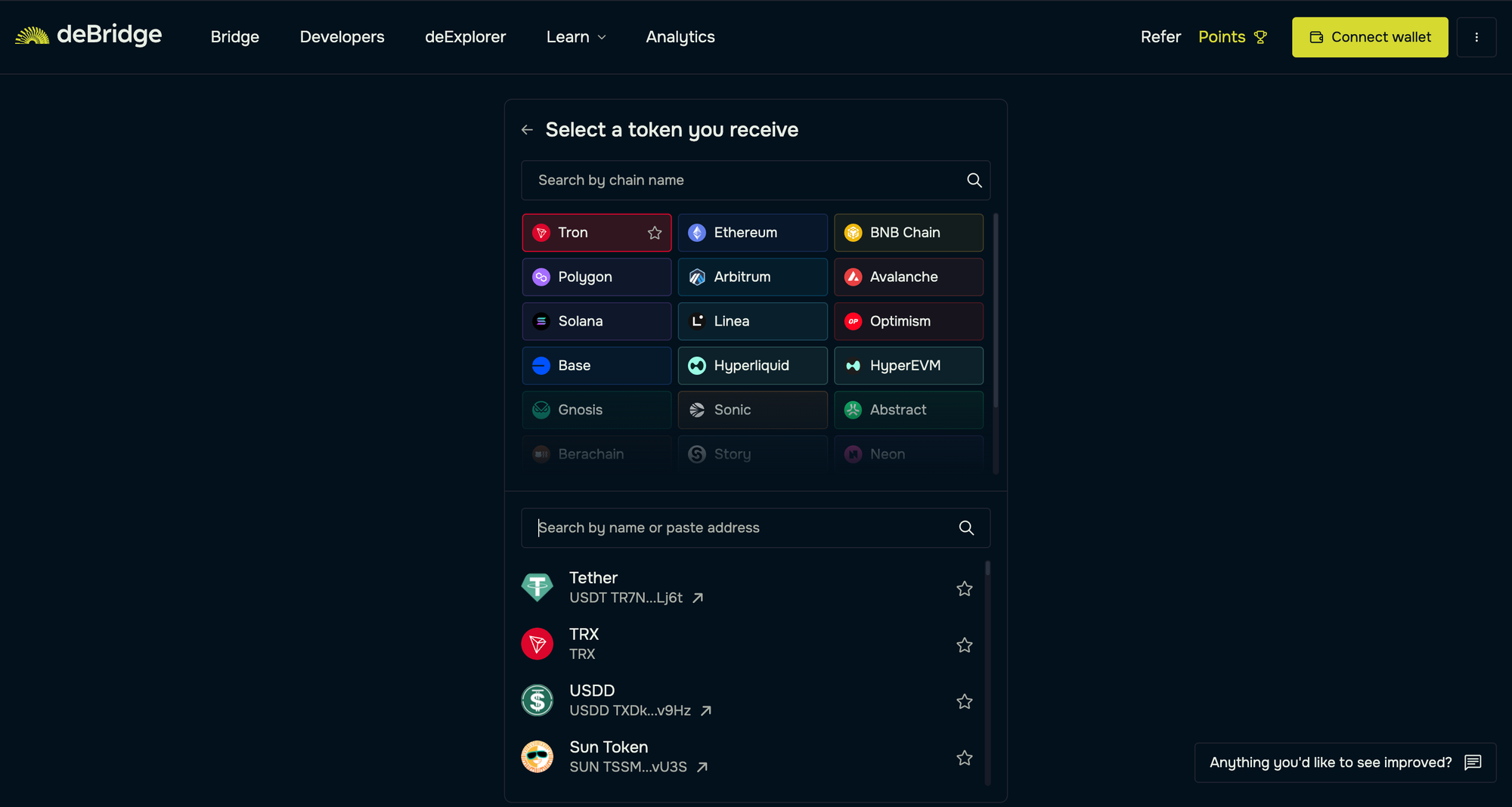

- Next, select the destination chain and asset you’d like to receive. Here, we will choose Tron as the chain and USDT as the asset.

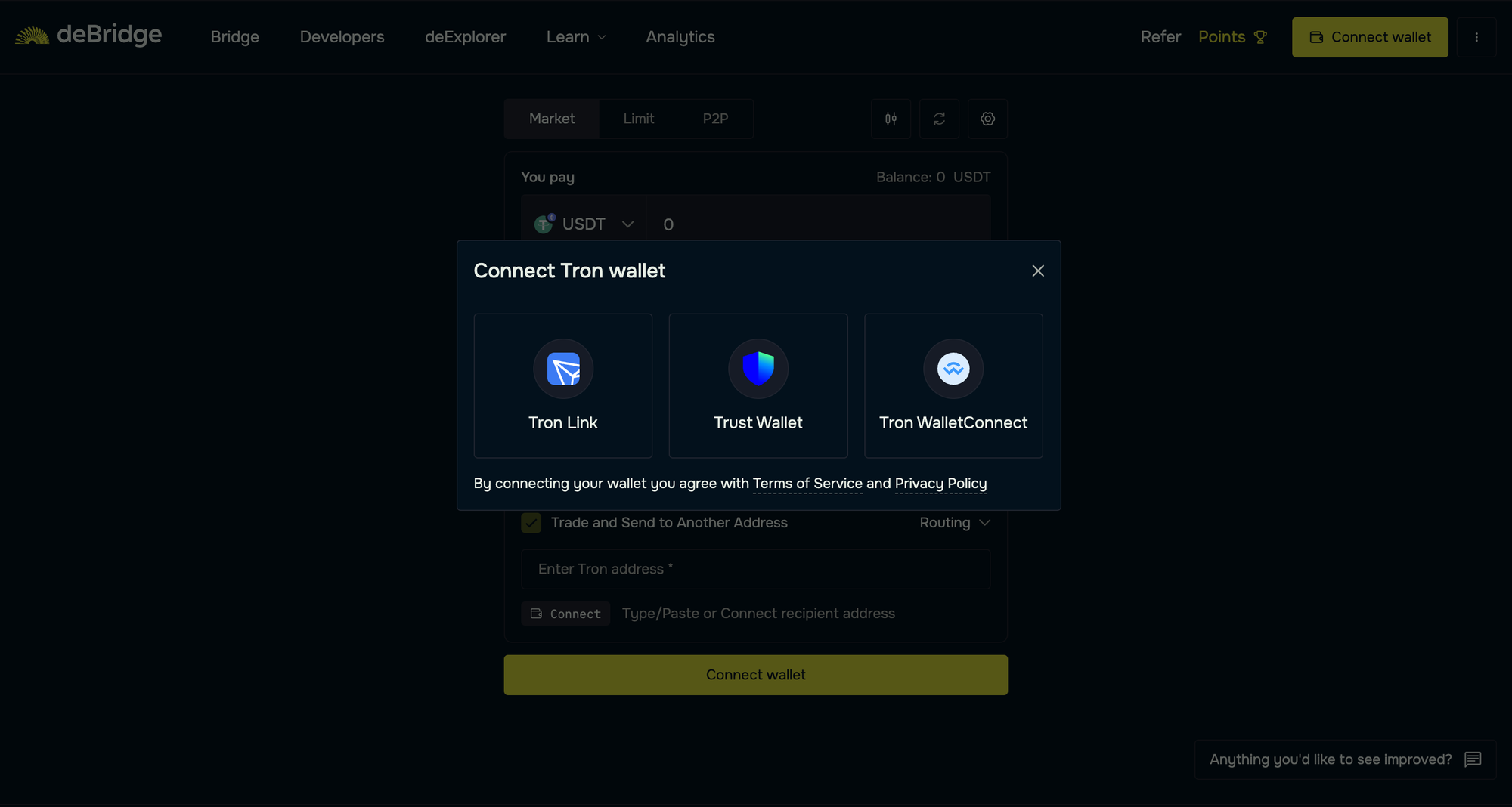

- Connect your EVM wallet as the source and Tron wallet as the destination.

- Enter the USDT quantity and review the transaction details.

- Confirm trade and sign the ensuing transactions to receive native USDT in your Tron wallet.

Pro Tips

- Make sure you have sufficient TRX in your destination chain for future transactions.

- Try to avoid bridging during peak hours to save on ETH gas costs. You can track gas prices on Etherscan.

The bridging process is simple and only takes a few seconds to complete. You will receive the bridged assets (USDT) in your Tron wallet instantly. Technical users can also inspect the transaction(s) on the Tron Chain explorer.

What Makes deBridge Different from Other Ethereum to Tron Bridges

Not all bridges are built the same. Many rely on pooled liquidity, centralized custodians, or wrapped assets, creating risks for users. This section highlights deBridge's unique features, including a 0-TVL model, native assets, and real-time execution.

Comparison Table

Key Differentiators

- 0-TVL architecture: Unlike traditional bridges that lock assets in smart contracts, deBridge works on a 0-TVL architecture that skips the use of liquidity pools.

- Native assets bridging: You receive native USDT, not wrapped tokens, on the Tron chain.

- Real-time execution: Transactions settle instantly

- Wallet support: Wide wallet support across EVM, Solana, and Tron

- Developer-ready: Easy API support for building custom cross-chain experiences.

With over $14 billion in transaction volume, deBridge is trusted by major wallets and dApps across the Web3 ecosystem.

For Developers: Add Ethereum to Tron Bridging to Your App

Adding the bridge functionality to your dApp opens access to bring users from the entire chainverse. With deBridge’s API, teams can add cross-chain functionality in minutes, opening new use cases while improving user experience.

Why Integrate deBridge

Developers can leverage deBridge to give users instant cross-chain bridging directly inside their dApps. This unlocks new use cases, improves UX, and adds revenue opportunities. Let’s look at the key reasons to integrate bridge functionality:

- Easy-to-use API – Flexible for more complex integrations.

- Real-time bridging with instant finality – Users don’t have to wait for funds.

- Revenue opportunities – Generate fees through deBridge’s affiliate model.

- Multi-chain support – Beyond Ethereum ↔ Tron, you can support Solana, BNB Chain, Arbitrum, and over 20 other chains.

Learn more about how bridging connects with broader DeFi innovation in our guide to real-time DeFi data with deBridge Hooks.

deBridge Security Summary

Security comes first.

Unlike traditional crypto bridges that pool user funds into a single location, deBridge is based on a 0-TVL architecture that skips the need for liquidity pools. This method prevents exploits like pool draining and dramatically reduces the attack surface.

By now, deBridge had already completed 30+ audits by top firms, including Zokyo, Halborn, and Ackee. It also features a $200K bug bounty that has still not been claimed since its launch.

Why Users Trust deBridge

deBridge is the top choice of users looking to bridge across 25+ chains from anywhere in DeFi. Some of the standout features include:

- 0-TVL = no pooled user funds

- Audited 30+ times, zero security incidents

- $200K bug bounty (never claimed)

- Trusted by Phantom, Jupiter, and Solflare

Frequently Asked Questions (FAQs)

What is the fastest way to bridge USDT from Ethereum to Tron?

How long does it take for USDT to arrive on Tron?

How do I bridge ERC20 to TRC20?

Explore More Bridging Use Cases

deBridge isn’t limited to Ethereum → Tron transfers. You can also move assets seamlessly across other major ecosystems. For example, bridge ETH to BNB for instant access to BNB Chain, or transfer from Ethereum to Solana to tap into Solana’s fast, low-fee environment.