How to Bridge ETH to Arbitrum Instantly and Securely (2025)

Table of Contents

- Why Bridge ETH to Arbitrum?

- Common Bridging Issues (and How deBridge Solves Them)

- Step-by-Step: How to Bridge ETH to Arbitrum Using deBridge

- What Makes deBridge Different from Other ETH–Arbitrum Bridges?

- ETH Gas Fee Optimization When Bridging to Arbitrum

- For Developers: Embed ETH–Arbitrum Bridging into Your App

- Security You Can Trust

- FAQ Section (Frequently Asked Questions)

- Explore More Cross-Chain Use Cases

Bridging your ETH from Ethereum to Arbitrum opens up a gateway to faster transactions, lower gas fees, and access to Arbitrum-native DeFi opportunities. Whether you're a Hyperliquid trader, DeFi guy, or NFT collector, Arbitrum offers the performance that the Ethereum network sometimes lacks.

However, finding the right bridge that works best for you can be difficult. Many bridges wrap ETH, rely on pooled liquidity, or suffer from long confirmation times, which result in slippage, prolonged wait times, and even security risks. These pain points put your assets at risk or result in unnecessary losses.

deBridge solves this by offering native ETH bridging with instant finality, no slippage, and zero pooled funds. Its 0-TVL architecture means your ETH is never locked in a vulnerable contract. Plus, with 30+ audits and deep integrations across ecosystems, it’s trusted by top DeFi teams.

In this guide, you’ll learn why bridging to Arbitrum matters, step-by-step instructions for bridging, a security summary, cross-chain use cases, and much more.

Key Takeaways

- ETH to Arbitrum = lower gas, better dApp access

- deBridge = instant, native ETH transfers, no slippage

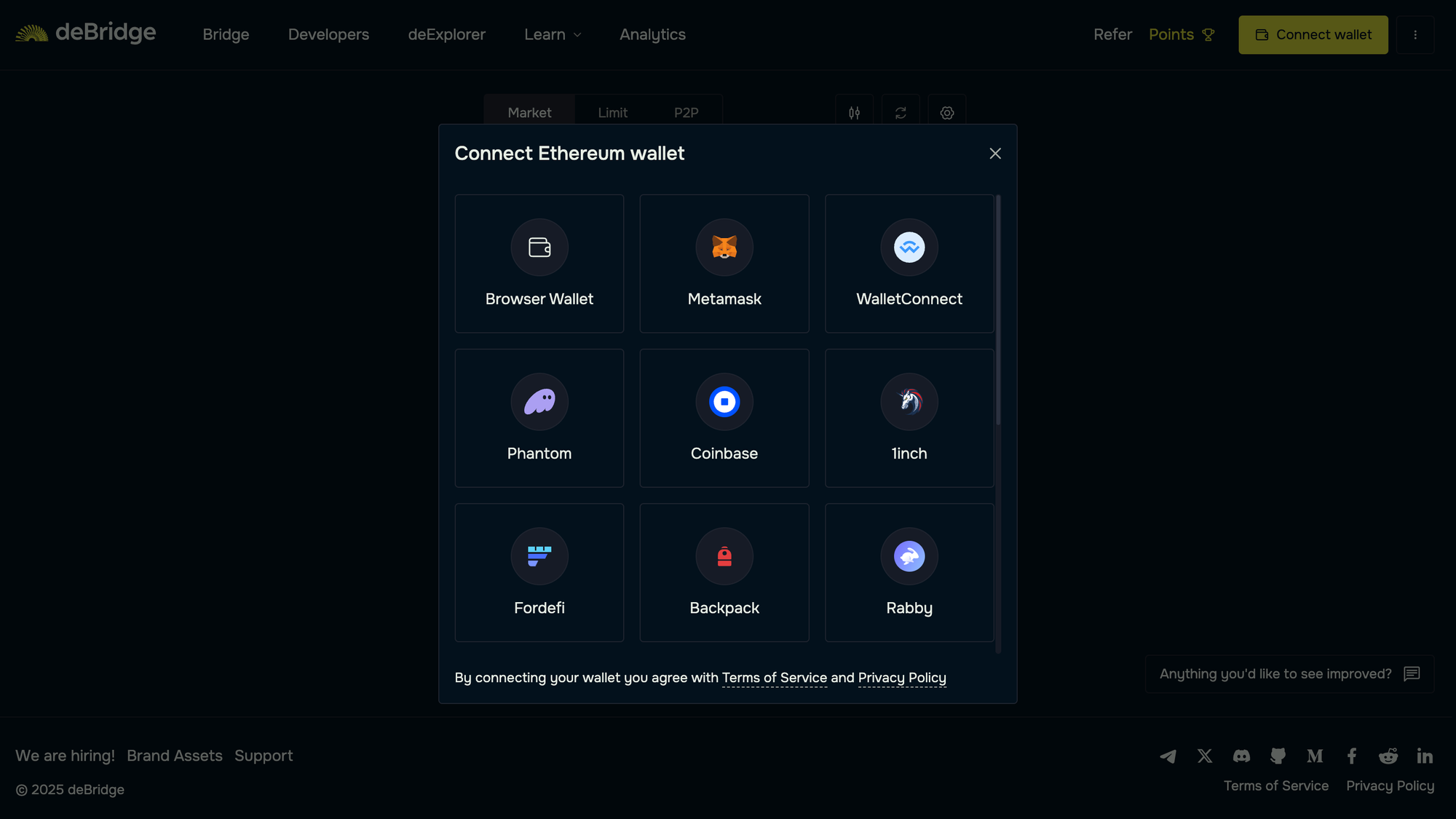

- Works with MetaMask, Phantom, Coinbase Wallet, WalletConnect

- Secure: 30+ audits, zero pooled funds, no wrap risk

Why Bridge ETH to Arbitrum?

Ethereum, the second-largest crypto token, is known for its ability to support smart contracts and dApps. However, its advantages also involve trade-offs, like high gas fees and slower finality, particularly during times of heavy network congestion.

Value Framing

Arbitrum, a Layer 2 built on top of the Ethereum mainnet, offers reduced transaction fees and faster execution times without sacrificing security. This makes it ideal for power users looking to optimize their DeFi strategies.

By bridging ETH to Arbitrum, users can access a high-performance network while retaining exposure to Ethereum-native assets. It’s a strategic move for anyone looking to scale operations or reduce friction in on-chain activity.

Common Use Cases

- Swap ETH on Arbitrum-native DEXs like GMX and Camelot

- Participate in staking, lending, or yield farming

- Interact with DAO governance or mint NFTs

- Move capital across chains for arbitrage or portfolio rebalancing

Arbitrum offers a better environment for both individual and institutional users to deploy ETH-based strategies, particularly when using solutions like deBridge for bridging.

Common Bridging Issues (and How deBridge Solves Them)

Although the idea of bridging sounds simple, the current bridging scenario has made the process complex and inefficient. Many bridges rely on wrapping mechanisms, which introduce additional trust layers and risk of asset depegging. Some bridges use the idea of pooled liquidity, storing funds in smart contracts, which makes them vulnerable to exploits.

Key Bridging Pain Points

- ETH gets wrapped or delayed: The method of wrapping and unwrapping tokens takes time, making the bridging process last minutes and even hours.

- Bridges often rely on pooled liquidity: The method of pooling user funds in smart contracts increases the risk of exploits.

- UI is clunky or lacks wallet support: The UI requires improvements, as the current bridging scenario makes it difficult for newbies to bridge funds.

- Confirmation times vary across solutions: Many bridges require multiple confirmations and oracle checks, leading to delays of over an hour for cross-chain transfers.

How deBridge Fixes These

deBridge removes the bottlenecks and risks of liquidity pools by enabling value and information to flow instantly across the DeFiverse with deep liquidity and guaranteed rates.

- Native ETH transfers: Skip the concept of wrapping and bridge real ETH.

- 0-TVL architecture: User funds are never pooled or exposed to contract risk.

- Real-time delivery: ETH is received before transaction finality.

- Universal wallet support: Works with MetaMask, Phantom, WalletConnect, Coinbase Wallet, and many more.

Explore how deBridge is improving DeFi UX through real-time bridging.

Step-by-Step: How to Bridge ETH to Arbitrum Using deBridge

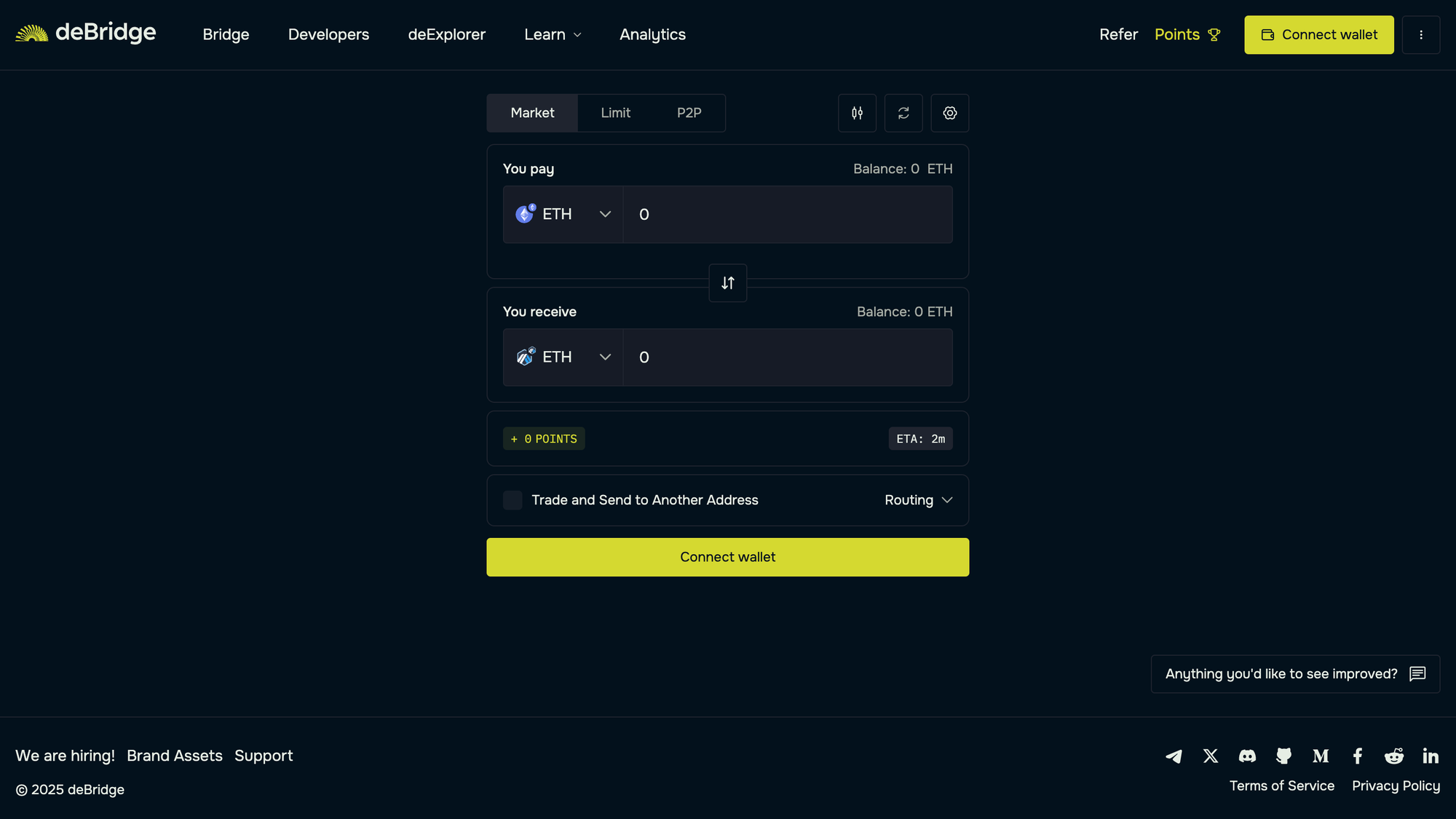

deBridge provides an instant bridging solution to help you bridge tokens between the Ethereum network and any asset on the Arbitrum network and vice versa. Let's explore how to perform cross-chain bridging for your crypto assets in a few simple steps.

Bridging Instructions

- Connect your Ethereum wallet address as the source and destination.

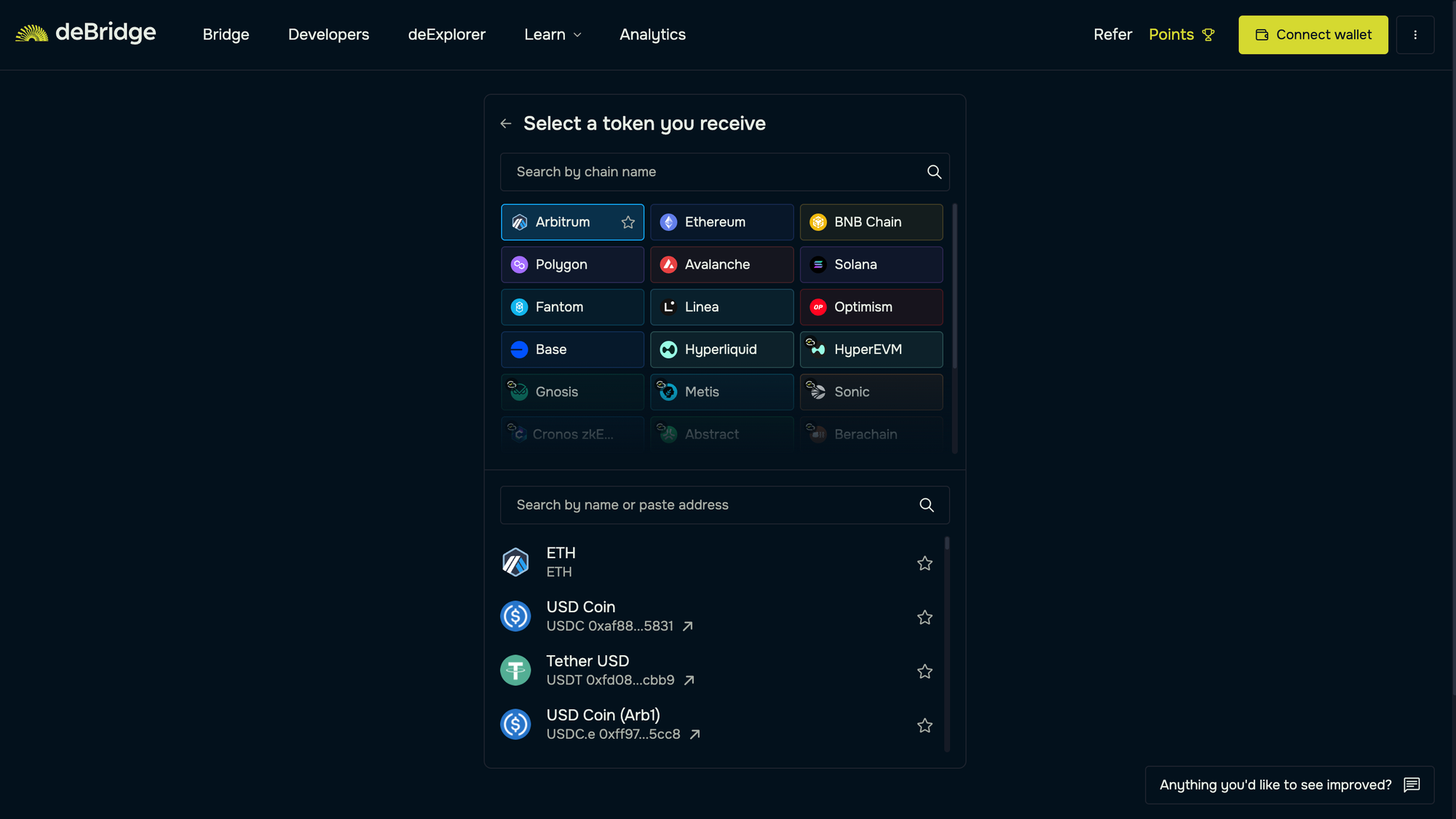

- Select the source network (Ethereum) and asset you want to bridge. Here, we will bridge ETH on Ethereum to ETH on Arbitrum.

- Next, select Arbitrum as the destination chain and the token you want to receive. Here, we will choose ETH as the asset on the target chain.

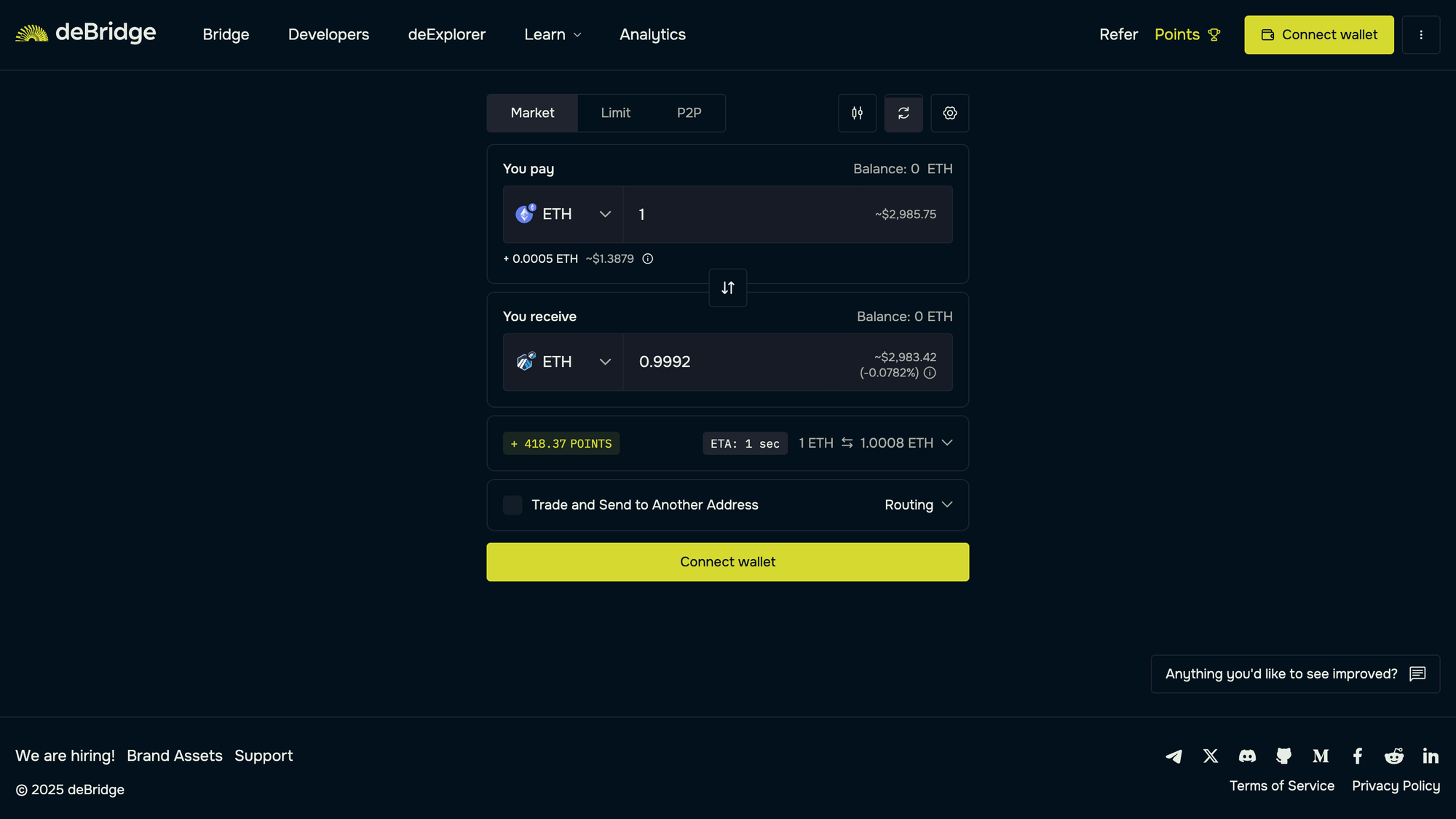

- Enter the quantity in ETH and review the transaction details.

- As the final step, confirm the trade, pay transaction fees in ETH, and sign the ensuing transactions to receive crypto in your Arbitrum wallet.

Pro Tips

- Make sure you have sufficient ETH in your destination chain (Arbitrum) for future transactions.

- For best results, avoid bridging during high Ethereum gas congestion

The "Order Fulfilled" pop-up will appear on your bridging screen in 1-2 seconds, indicating that the process is complete and bridged assets (ETH) have been received in your Arbitrum wallet. Technical users can also inspect the transaction(s) on the Arbitrum mainnet explorer.

What Makes deBridge Different from Other ETH–Arbitrum Bridges?

deBridge stands out in a crowded field of ETH–Arbitrum bridges by focusing on three key principles: native asset transfers, instant finality, and security-first architecture. While most bridges use wrapped ETH or rely on liquidity pools, deBridge uses a 0-TVL (Total Value Locked) architecture to mitigate the risk of vulnerabilities. This not only removes a key attack vector but also ensures users retain full control over their funds until the transaction is finalized.

deBridge vs Stargate vs Across vs Arbitrum Bridge

deBridge Edge

deBridge has helped nearly a million users in their DeFi journey by enabling them to bridge across 25+ chains within the app. With support for native ETH bridging, deBridge is the best place to move crypto assets from the Ethereum mainnet to the Arbitrum blockchain.

- No pooled funds = no honeypots

- Native ETH bridging

- Slippage-free transfers

- Trusted by Phantom, Solflare, Jupiter Exchange, and more

- Only major bridge offering real-time bridging + Solana support

ETH Gas Fee Optimization When Bridging to Arbitrum

Gas fees on Ethereum are relatively high compared to those on other blockchains, such as Arbitrum. Paired with peak hours or times when network congestion is high, the transaction fees can skyrocket, burning a hole in your pocket.

While deBridge is optimized for lightning-fast bridging, you can take precautionary measures to save more on gas costs. For example, you can monitor Ethereum gas prices to track gas fees and avoid bridging during periods of high congestion. Further, you can select the gas speeds to make a good balance between speed and cost.

Tips to Reduce Bridging Costs

- Head over to the ETH gas estimator for tracking gas fees

- Bridge during off-peak hours, such as 3-7 am UTC

- Use “medium” gas for cost-speed balance

Cost Comparison Table

Let’s look at the comparison between protocols that help users bridge from Ethereum to Arbitrum.

For Developers: Embed ETH–Arbitrum Bridging into Your App

deBridge is the bridge backed by DeFi that helps you trade any asset at lightspeed. It enables real-time movement of assets and information across the DeFi landscape. With a few lines of code, developers can enable native ETH transfers between Ethereum and Arbitrum within their App.

deBridge is designed with developers in mind, making it easy to add the deBridge widget or API within the dApp. The deBridge SDK and REST API are built for developers to help them implement all features with a few clicks. To add advanced cross-chain functionalities to the applications, read our article on Real-time DeFi data with deBridge Hooks.

Real-time settlement improves user experience by eliminating the wait for minutes or hours for funds to reach their wallet. This minimizes drop-off during bridging and improves conversion rates across dApps, wallets, and DeFi protocols.

Whether you’re launching a new DeFi protocol, adding a bridging functionality to your wallet, or building a Telegram bot for sniping, deBridge gives you the infrastructure for peace of mind.

SDK/API Integration Benefits

- Native ETH bridging (no need to wrap/unwarp assets)

- 0-TVL architecture for better security

- Real-time settlement reduces failed transactions

- SDK and REST API for fast implementation

- Support for ERC20s and Solana routing

- Improved user retention and dApp conversion

Explore deBridge API Docs: https://docs.debridge.finance

Security You Can Trust

"With great power comes great responsibility."

deBridge prioritizes security, keeping users safe throughout the entire order lifecycle. Unlike traditional bridges that rely on pooled liquidity (prime targets for exploits), deBridge operates on a 0-TVL architecture. This method skips the use of liquidity pools, ensuring no attack surface for exploits and vulnerabilities.

deBridge has undergone 30+ security audits, hosts a $200,000 bug bounty, and maintains a clean track record of zero exploits since its launch. Top security firms like Halborn and Zokyo have audited deBridge, ensuring it is safe for users to navigate the DeFi space.

Today, many well-known crypto projects like Phantom, Solflare, Jupiter Exchange, Infinex, and more trust deBridge. It is built for OGs who like to stay one step ahead and move assets across 25+ chains at lightning speed.

Proof Points

- 30+ audits across the deBridge protocol and smart contracts

- 0-TVL architecture ensures no liquidity honeypots

- $200K bug bounty (never claimed)

- Zero exploits since launch

- Trusted by leading protocols and wallets

Explore More Cross-Chain Use Cases

deBridge offers more than just an ETH–Arbitrum bridge, enabling any-to-any token transfers across 25+ chains like Ethereum, Arbitrum, and Solana. Native token support and real-time settlement help instill confidence among users looking to make cross-chain transfers across ecosystems.

For developers, deBridge simplifies multichain builds. It provides tools, from a wallet widget to full dApp integrations, allowing teams to launch cross-chain features easily. Real-time transfers, no wrapped tokens, and a 0-TVL design make deBridge a top choice for all protocols.

Developers can integrate deBridge’s SDK and APIs to embed bridging flows directly into their dApps on any chain. deBridge powers native, secure, and lightning-fast transfers for DeFi dApps, wallets, and more, making the cross-chain experience smoother than ever.

Read some examples of cross-chain use cases enabled by the deBridge infrastructure in our docs section.