How to trade Tokenized Stocks on Solana: A step-by-step guide

Before the rise of the crypto space, few could have imagined that being onchain would become such an integral part of our daily lives. Crypto has revolutionized the way we manage our funds by giving power into the hands of people, moving away from traditional institutions. Now, another huge step has been taken towards the end state of DeFi with the launch of tokenized stocks.

Solana, a popular blockchain in the crypto space known for its fast transaction speeds and smooth UX, achieved a major milestone by making one of the major pillars of traditional finance accessible via decentralized finance (DeFi). We're discussing the launch of tokenized stocks, i.e., blockchain-based tokens by Backed, such as AAPLx or TSLAx, each backed 1:1 by real shares of U.S. stocks. This article will cover the specifics of tokenized stocks, including those on Solana, their benefits, use cases, risks, and how to buy stocks on Solana.

What are Tokenized Stocks?

Tokenized stocks are blockchain-based representations of actual shares in publicly traded companies like Apple, Tesla, or Nvidia. In the context of Solana, tokenized stocks are known as xStocks, with each stock token backed 1:1 by the underlying stock. These xStocks are the brain of Backed, a company driving the future of finance onchain. For example, Apple's stock, represented as AAPLx, is the representation of APPL held in custody by a trusted entity.

These stock tokens mirror the real-world market price and allow you to trade stocks onchain just like crypto. Unlike traditional markets that have fixed working hours, tokenized stocks (or xStocks) on Solana can be bought or sold 24/7, making them highly accessible to a global audience. The stocks can also be purchased onchain for use in DeFi-based activities such as lending, borrowing, trading, and more.

Note: Tokenized stocks are not available in all jurisdictions. Availability may be restricted in certain regions where securities laws apply. Users should ensure compliance with local laws before interacting with such assets.

Why use Solana (SOL) for Tokenized Stock trading?

Solana is a high-performance blockchain known for its lightning-fast transactions and low fees. It can handle thousands of transactions per second and has become the backbone for a growing ecosystem of DeFi and web3 apps. Some key advantages of using Solana are:

- Ultra-fast transactions: Finality in under a second

- Low fees: Trade without worrying about gas costs

- Wallet-friendly: Phantom and Solflare for smooth UX

- DeFi integration: Tokenized stocks (xStocks) can be used as collateral, LP tokens, or within Solana's DeFi ecosystem.

With the best developer base, DeFi protocols, and institutional support, the Solana blockchain remains a strong choice for tokenized stocks for everyone.

Top platforms offering Tokenized Stocks on Solana

From Solana to Solflare, and Kamino to deBridge, major players have launched or integrated tokenized stocks on Solana. Let's take a look at some of them.

Backed Finance: One of the leading issuers, offering over 60 tokenized stocks and ETFs (like AAPLx, SPYx, NVDAx) that can be traded on Solana DEXs, including Jupiter and Raydium.

Solflare Wallet: A popular Solana wallet that enables direct purchase of stock tokens using SOL or USDC. You can easily explore and buy/trade xStocks at market price via the Market Stocks tab (mobile) or the Stocks page (web).

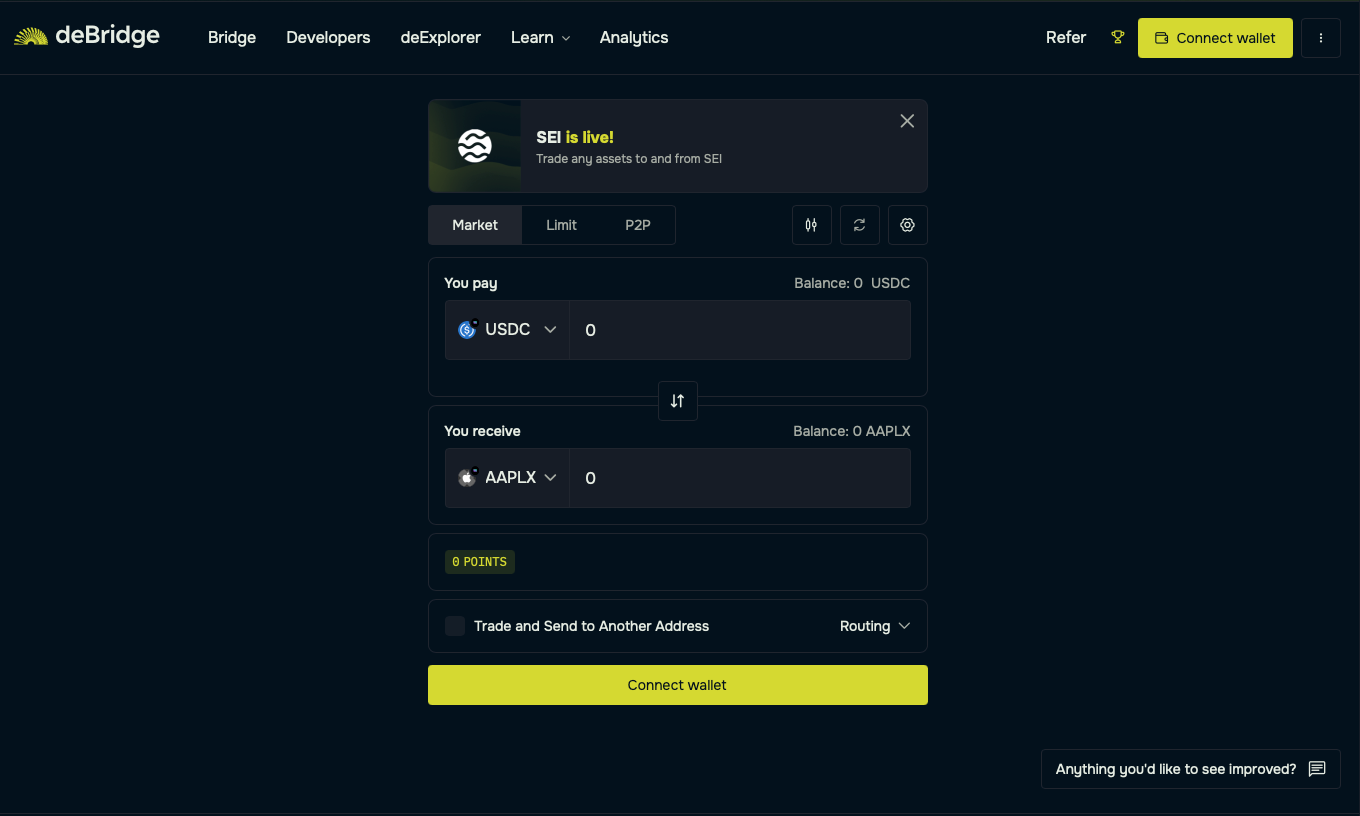

deBridge: A place to trade every token at lightspeed. deBridge enables you to move to xStocks from anywhere in DeFi in seconds.

How to buy Tokenized Solana Stocks on deBridge

deBridge is the bridge that moves at lightspeed. By removing the bottlenecks and risks of liquidity pools, deBridge enables value and information to flow instantly across the DeFiverse with deep liquidity, high security, and guaranteed rates.

Let’s see how you can select networks and buy stocks on Solana:

- Visit app.debridge.finance on your browser.

- Select the source network and asset you’d like to bridge. Here, we will select the Ethereum network as the source chain and ETH as the asset, but you are free to choose other networks.

- Next, select Solana as the destination chain and SOL as the asset on the target chain.

- Connect your EVM and SVM wallet on the deBridge app.

- Enter the quantity, review the transaction fees, and confirm the transaction details.

- Confirm the trade and sign transactions to receive SOL tokens in your Solana wallet.

- Now, you can swap your SOL tokens to any tokenized stocks (AABLx, NVDAx, etc.) easily on the deBridge app.

This process enables you to swap your tokens into tokenized stocks (xStocks) at market price.

Disclaimer: deBridge does not issue, custody, or broker tokenized stocks or other financial instruments. Any references to such assets are informational and refer to third-party platforms.

Benefits of Tokenized Stocks on Solana (SOL)

Tokenized stocks on Solana open a wide array of opportunities for anyone looking to trade onchain. You don't need to worry about weekends or holidays, as you can trade xStocks anytime with 24/7 market access. Unlike traditional stock markets, which require clearinghouses, xStocks appear instantly in your Solana wallet without any delay.

These xStocks can be used for complex DeFi interactions, like DeFi lending, smart contracts, or collateral management. Solana's low transaction fees and fast settlement make it a more lucrative option for everyone involved.

Risks and Considerations

Although the idea sounds exciting, it's important to remember that investing involves risk. Let's review the following pointers for safe investing based on your risk profile:

- Regulatory Restrictions: The United States of America has imposed certain regulations that exclude it due to securities regulations.

- Custodial Risk: Tokens depend on the issuer holding the corresponding shares.

- Liquidity Risk: Not all stock tokens have the same volume.

- Smart Contract Risk: Smart contracts remain vulnerable, as they are subject to technical risks.

- Market risk: Stock prices can fluctuate based on various factors, including global events, economic trends, and overall market sentiment.

Conclusion

The future of stocks on Solana appears bright, as they offer an alternative trading option for everyone. Thanks to platforms like Solana, deBridge, and Solflare, accessing tokenized stocks (xStocks) has become smoother than ever, making tradfi feel a bit more like DeFi.

Whether you're deeply involved in crypto or simply curious about stocks, Solana's tokenized assets provide a new way to step into the future of finance.

This content is for informational purposes only and does not constitute legal, financial, or investment advice. Access to tokenized stocks may be subject to local securities laws and regulatory restrictions.