How to Bridge to Hyperliquid Using deBridge (Step-by-Step Guide)

Table of Contents

- What is Hyperliquid and Why It Matters for Traders

- Bridging Challenges: Legacy Routes & Why They Fall Short

- Step-by-Step Guide: Bridging to Hyperliquid with deBridge

- Comparison Table: deBridge vs Arbitrum Bridge

- What You Need Before Bridging (Wallet Setup)

- Security and Speed: Why deBridge Is Built for High-Volume Transfers

- Developer Access: Onboarding Users Into Hyperliquid via deBridge

- Conclusion

- FAQs (Frequently Asked Questions)

Hyperliquid is a high-speed, gasless trading platform that runs its own infrastructure, designed for lightning-fast execution and a seamless user experience. Whether you're a seasoned trader or a beginner, Hyperliquid offers a high-performance platform with top-of-the-line features in a decentralized manner. But before you can dive into trading, you’ll need to get USDC onto the Hyperliquid platform.

That’s where efficient bridging becomes essential. Most users face challenges with slow, complex, or risky bridging solutions that involve multiple steps and wrapped assets. Enter deBridge, the fastest and most secure way to move any token, including native USDC, directly into the Hyperliquid ecosystem. In this guide, we’ll walk you through how to bridge to Hyperliquid using deBridge, step by step.

What is Hyperliquid and Why It Matters for Traders

Hyperliquid is a high-performance L1 with a vision of a fully onchain open financial system. It has built a crypto trading exchange with a CEX (centralized exchange) like experience, for transparent onchain orders without compromising end-user experience.

The Hyperliquid L1 uses a custom consensus algorithm called HyperBFT, which is heavily inspired by Hotstuff and its successors. Both the algorithm and networking stack are optimized from the ground up to support the L1.

Unique features of Hyperliquid

- High-Performance L1 Blockchain: Promises rapid transaction speeds, deep liquidity, and high throughput up to 100,000 orders per second.

- Gasless Trading: You can execute trades on hyperliquid without incurring gas fees.

- On-chain Order Book: Offers deep liquidity, transparency, and a better user experience.

- Advanced Features: One-click order execution, limit orders, scale, TWAP, and more.

- Staking: Stake HYPE to enhance the security of the protocol.

Bridging Challenges: Legacy Routes & Why They Fall Short

Bridging to new ecosystems like Hyperliquid often begins with the Arbitrum Bridge, but it quickly reveals its limitations. Users can only bridge native ETH from Ethereum to Arbitrum, often face slow transaction finality, and a clunky, multi-step user experience. Waiting minutes (or more) for assets to arrive can be frustrating, especially when markets move quickly.

Other bridges attempt to simplify the process of bridging but introduce new risks. Many rely on wrapped assets or liquidity pools, which opens the door to slippage, delays, and even smart contract vulnerabilities. These friction points often lead to user drop-off before bridging is complete.

That’s where deBridge stands apart. With native asset transfers, instant finality, and a seamless one-click UX, it’s the faster, safer, and better way to bridge to Hyperliquid.

Step-by-Step Guide: Bridging to Hyperliquid with deBridge

Before the integration of Hyperliquid with deBridge, users depended on services like the Arbitrum Bridge to transfer native ETH to the Arbitrum chain and then swap ETH for USDC.

Now, the best Hyperliquid bridge is the fastest. If you want to deposit USDC to start trading or increase your position size, deBridge provides an instant bridging solution to help you bridge any asset on any chain to USDC on the Arbitrum network.

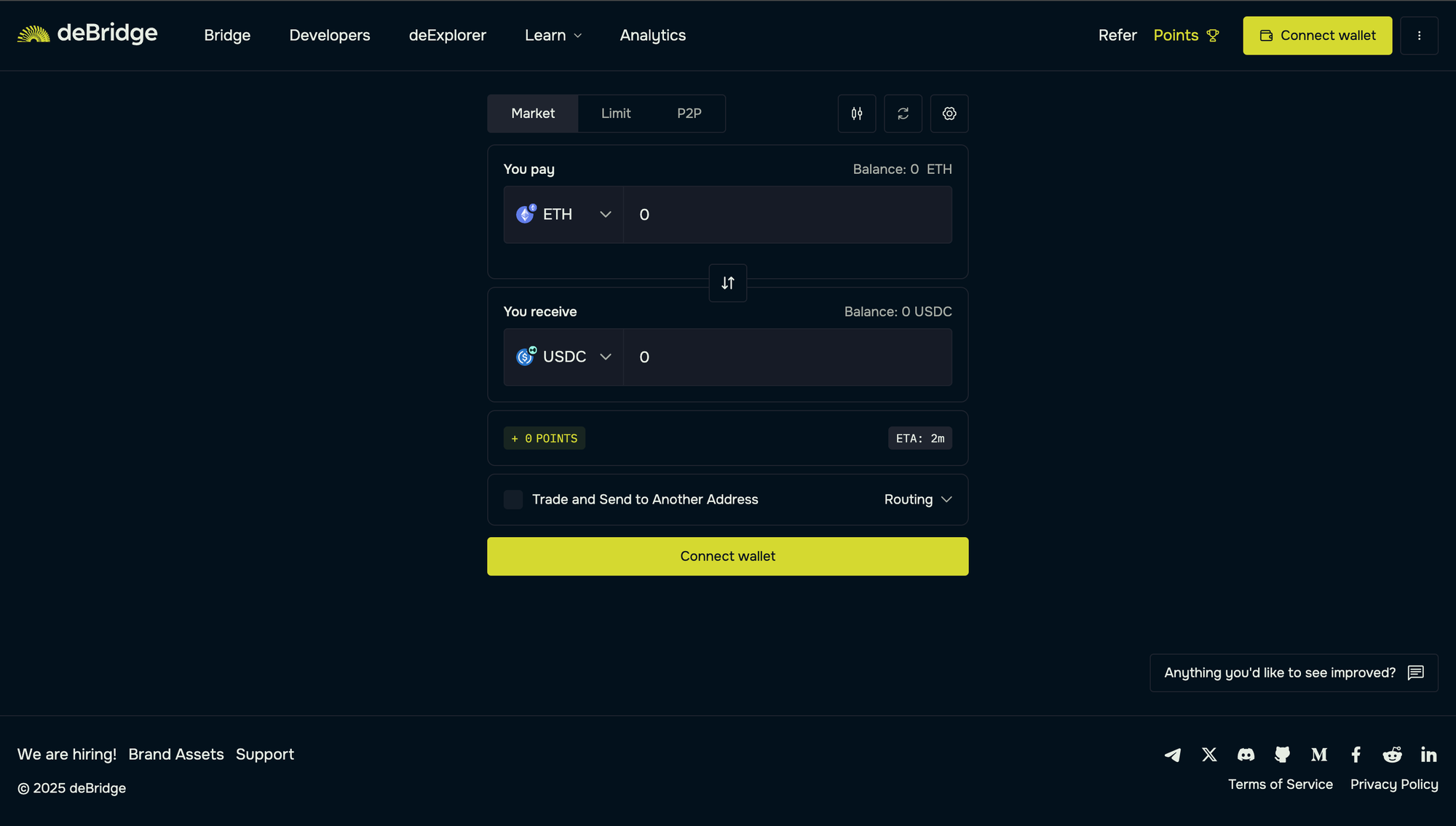

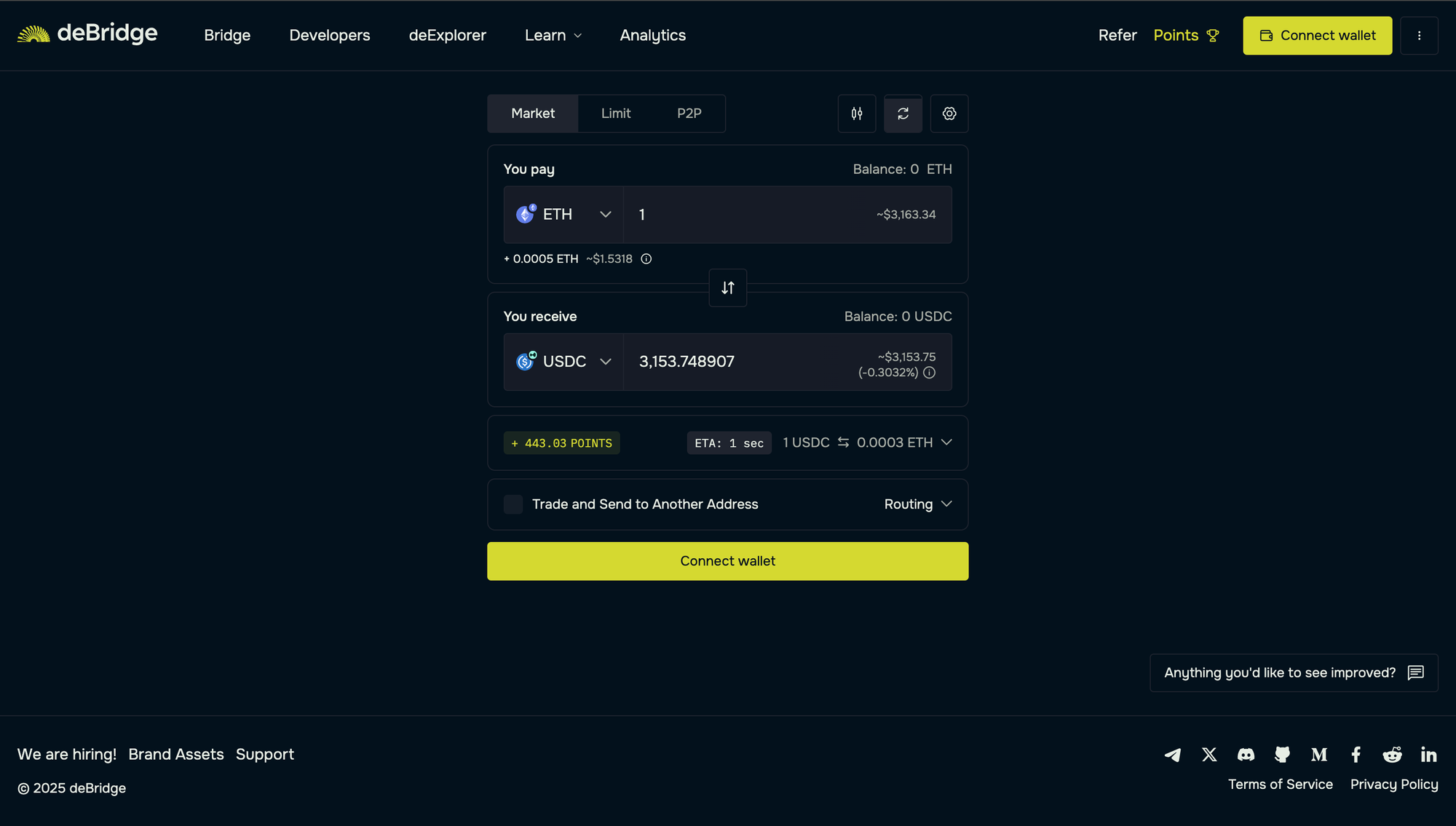

Let’s see how you can bridge USDC to your Hyperliquid account with low fees:

- Visit https://app.debridge.finance

- Select the source chain and asset you’d like to bridge. Here, we will select Ethereum as the source chain and ETH as the asset.

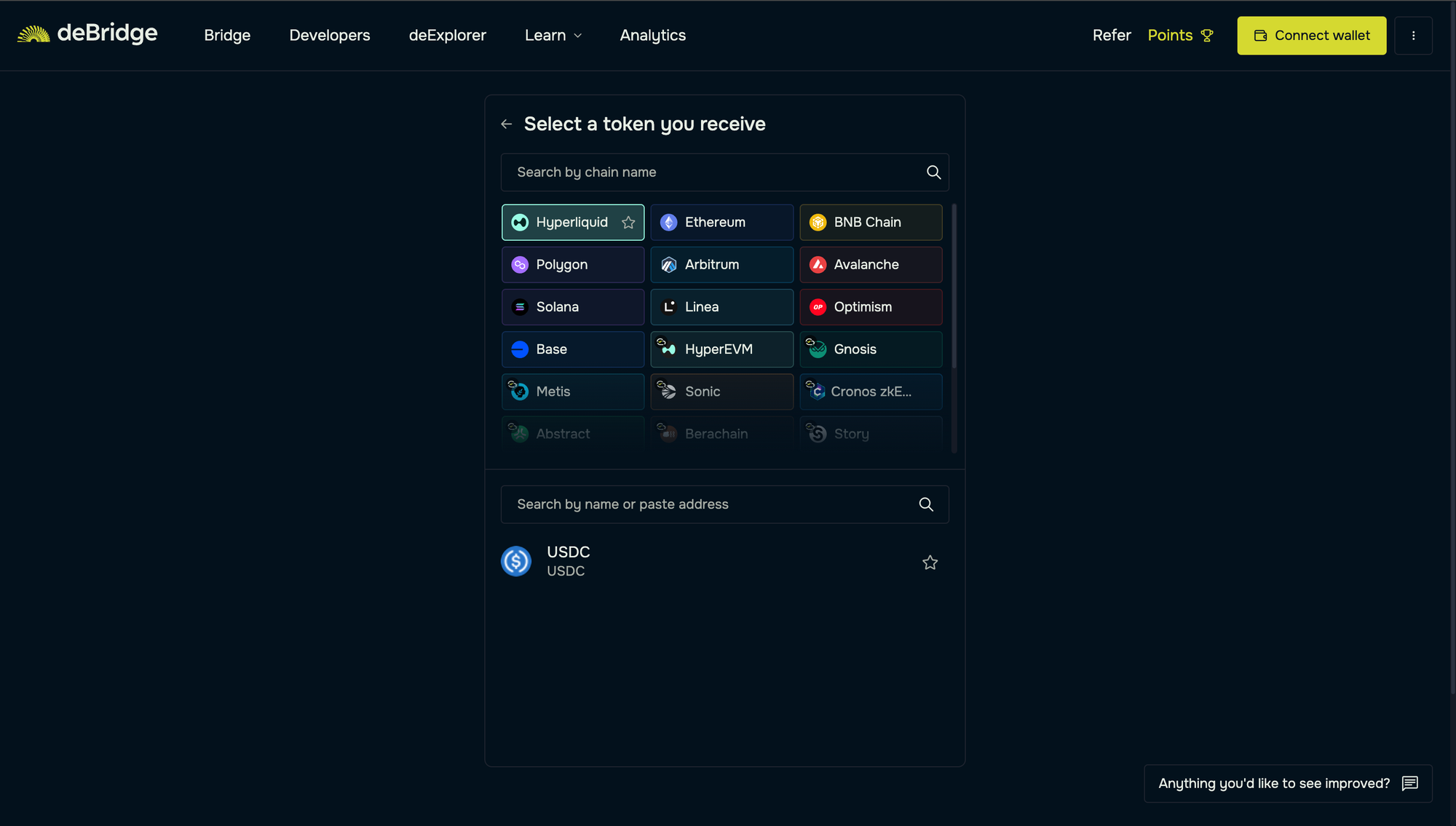

- Next, select the destination chain and asset you’d like to receive. Here, we will select Hyperliquid (Arbitrum network) and it will automatically select USDC on the target chain.

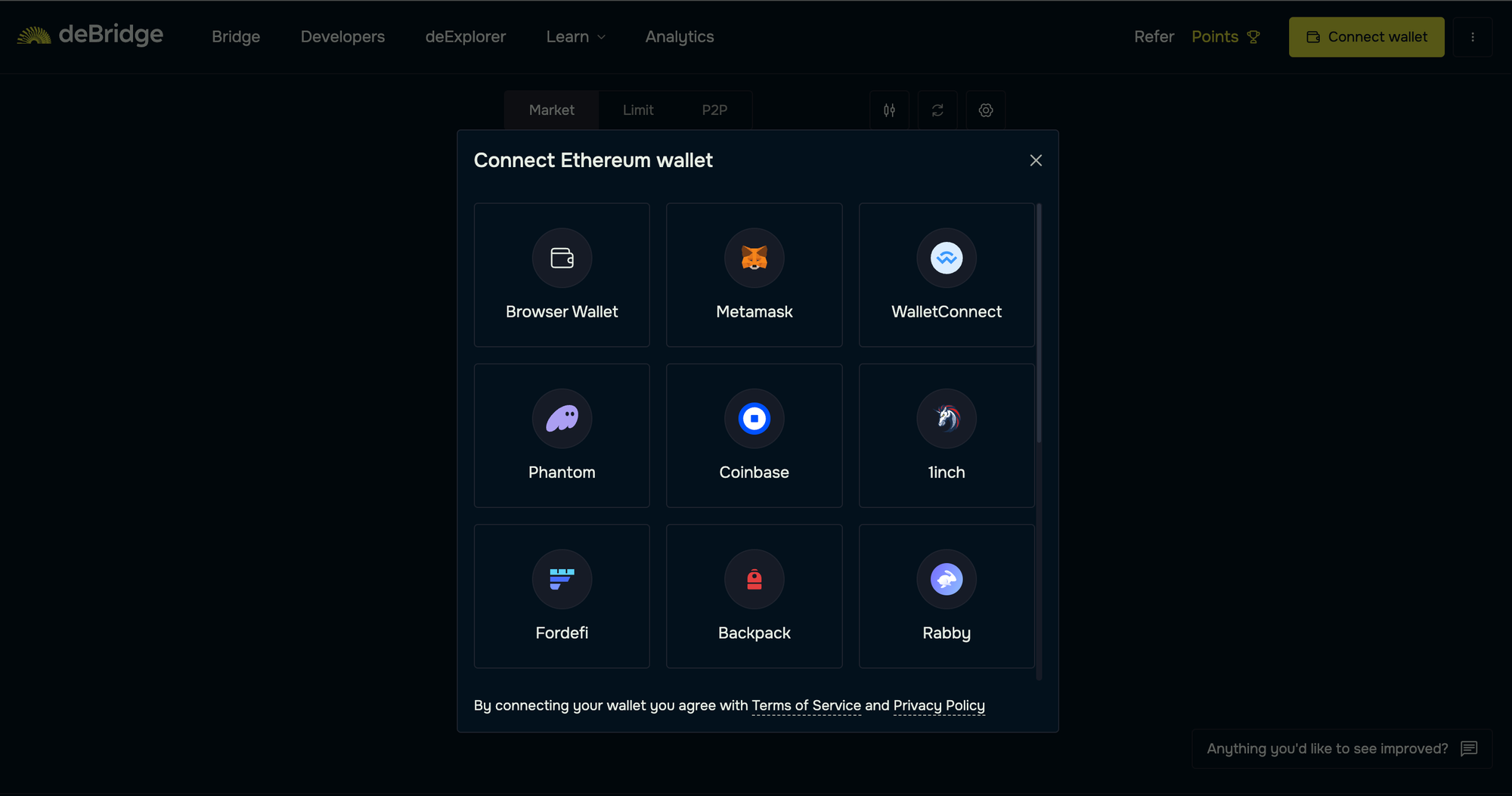

- Connect your EVM wallet as the source and destination.

- Enter the ETH quantity and review the transaction details.

- Confirm trade and sign the ensuing transactions to receive native arbitrum USDC in your Hyperliquid account.

Pro Tips

- Make sure you have sufficient ETH in your destination chain (Arbitrum) for the transaction to be completed.

- To save on ETH gas costs, avoid bridging during periods when Ethereum gas prices are high.

This process takes a few seconds to complete and reflects the bridged assets (USDC) in your Hyperliquid account. Technical users can also inspect the transaction(s) on the Arbitrum mainnet explorer.

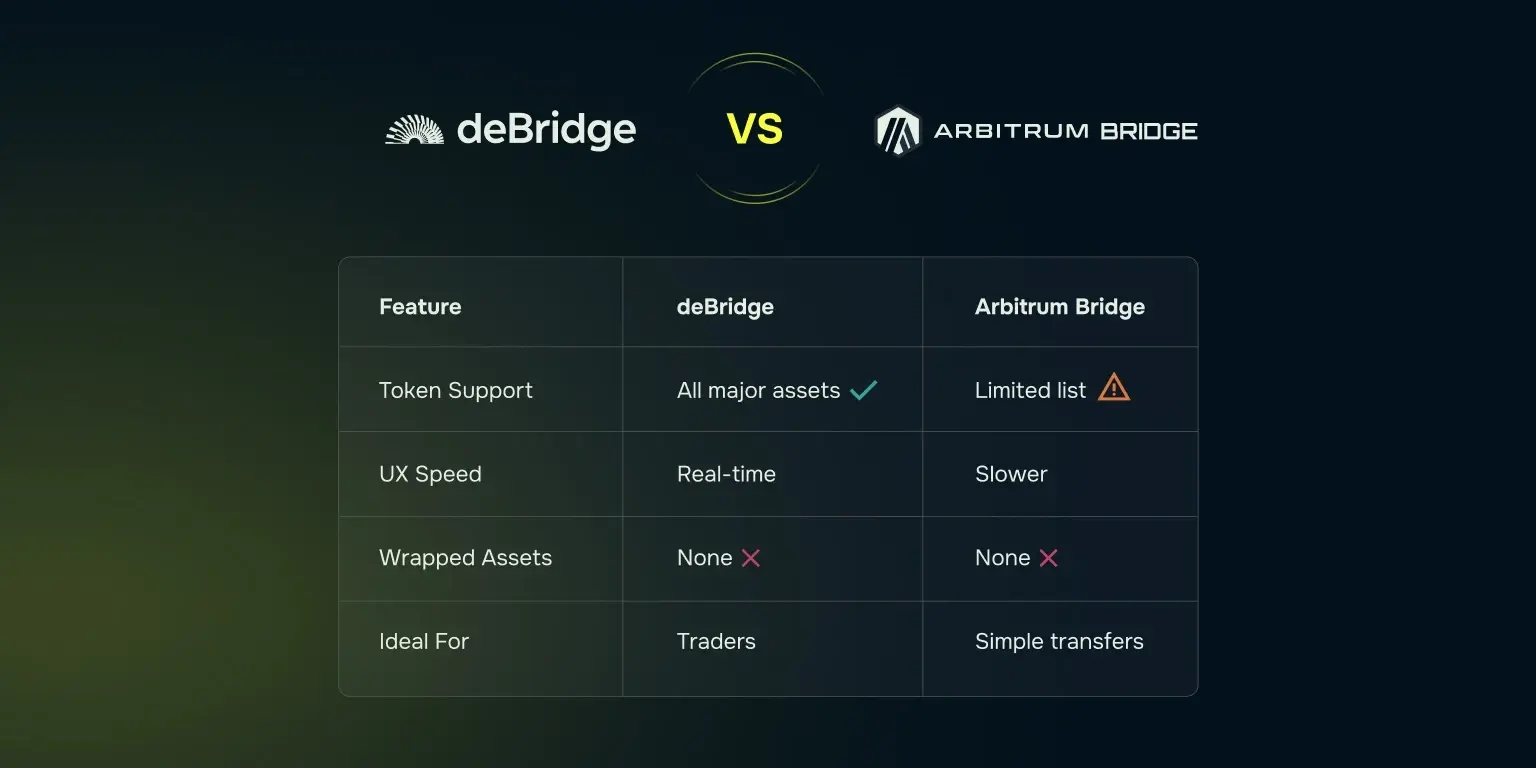

Comparison Table: deBridge vs Arbitrum Bridge

The native Arbitrum Bridge is slow, clunky, and comes with limited support for assets. Contrary, deBridge is fast, smooth, and supports all major assets. deBridge focuses on three key principles: native asset transfers, instant finality, and security-first architecture.

While most bridges use a wrapped version of assets or rely on liquidity pools, deBridge uses a 0-TVL architecture to mitigate the risk of vulnerabilities. Let’s take a look at the differences in a tabular form.

deBridge: The gateway to Hyperliquid

deBridge has processed over $12 billion in total volume and has helped nearly a million users move across 25+ chains. With real-time cross-chain routing, deBridge offers a superior alternative to native or legacy bridges, such as the Arbitrum Bridge, providing deep liquidity, guaranteed execution, and a better user experience.

- 0-TVL architecture

- Native asset bridging

- Slippage-free transfers

What You Need Before Bridging (Wallet Setup)

Before bridging to Hyperliquid with deBridge, make sure your setup is ready to prevent any delays. Here’s a quick checklist to help you get started:

- EVM-Compatible Wallet: Use MetaMask, Rabby, WalletConnect, or any wallet that supports EVM networks.

- ETH for Gas Fees: Ensure your wallet has sufficient ETH to cover transaction costs during the bridging process.

- Access to the deBridge App: Navigate to https://app.debridge.finance and connect your wallet to begin bridging.

- RPC Configuration: It is important to configure your wallet with the appropriate RPC settings. If it’s not already set up, you can easily add the correct network using Chainlist.

Once all is set, you can follow the steps above [hyperlink] and bridge to Hyperliquid in a few clicks.

Security and Speed: Why deBridge Is Built for High-Volume Transfers

deBridge prioritizes speed without compromising on security during the order lifecycle. Unlike traditional bridges relying on wrapped assets or pooled liquidity (prime targets for exploits), deBridge uses a 0-TVL architecture that avoids liquidity pools and eliminates attack surfaces.

The deBridge protocol has undergone over 30 security audits by leading firms, including Halborn and Zokyo, and has maintained a clean record of zero exploits to date. It also hosts a $200,000 bug bounty program that has yet to be claimed, a testament to the app's security.

Today, many well-known crypto projects like Phantom, Solflare, Jupiter Exchange, Infinex, and more trust deBridge. To summarize all the above points:

- 0-TVL architecture = No liquidity pools

- 30+ audits across the deBridge protocol

- $200K bug bounty (never claimed)

- Trusted by leading protocols and wallets

- Capable of 6-7 figure transfers with no slippage

Developer Access: Onboarding Users Into Hyperliquid via deBridge

deBridge is the bridge backed by DeFi that helps you trade any asset at lightspeed. It enables real-time movement of assets and information across the DeFi landscape. It is designed keeping developers in mind, making it easy to add the deBridge widget or API within the dApp.

With real-time settlement and bridging of native assets, it only makes sense for developers to use the deBridge SDK and REST API for onboarding users into Hyperliquid via deBridge. It also helps you earn fees for each transaction on your platform, along with an option for affiliate tracking.

To add advanced cross-chain functionalities to the applications, read our article on Real-time DeFi data with deBridge Hooks.

Conclusion

Are you ready to experience seamless, gasless trading on one of the fastest-growing DEXs? Bridge to Hyperliquid using deBridge at lightning-fast speed and unlock instant access to high-speed, Arbitrum-native trading with zero gas fees. Whether you’re moving ETH, USDC, or any other asset, deBridge ensures fast, secure, and safe transfers without any delays.

For developers and partners, deBridge also offers powerful tools like our integration widget and SDK, making it easy to embed cross-chain functionality directly into your app or platform. As Hyperliquid continues to lead in performance and UX, deBridge is the best choice for anyone looking to make onboarding smooth for their users.