What is HyperEVM? A Comprehensive Guide to Its Features

Table of Contents

- Key Takeaways

- What is HyperEVM

- HyperEVM Architecture

- HyperEVM Key Features

- Step-by-Step Guide: How to Bridge to HyperEVM Using deBridge

- What Makes HyperEVM a Good Option for Developers and Users

- Hyperliquid Ecosystem Projects

- Roadmap and Future Developments

- Frequently Asked Questions (FAQs)

HyperEVM is a general-purpose Ethereum Virtual Machine (EVM) built on the Hyperliquid Layer 1 blockchain. It is designed to provide a high-performance, scalable, and developer-friendly environment for decentralized applications (dApps). HyperEVM extends the success of Hyperliquid’s perps and spot trading venue into a full ecosystem for onchain finance. It supports EVM compatibility, low gas fees, and deep liquidity access, allowing developers to build advanced DeFi protocols and other applications.

Decentralized Finance (DeFi) has already reshaped how traders and builders interact with financial products like perpetual futures. For years, centralized exchanges such as Binance and Coinbase dominated perp trading, until Hyperliquid transformed the scene with its fully on-chain trading platform.

Now, the Hyper Foundation has pushed the vision further by launching HyperEVM: a general-purpose Ethereum virtual machine to open up a world of possibilities for onchain financial applications. Learn more about HyperEVM, including its architecture, main features, and main details.

Key Takeaways

- HyperEVM is an Ethereum-compatible execution layer on Hyperliquid, offering high performance, low gas fees, and deep liquidity access.

- HyperEVM features a dual-block architecture (HyperBlocks + MacroBlocks) and HyperBFT proof-of-stake consensus, ensuring fast, secure, and scalable transactions.

- Developers benefit from native components and system contracts, enabling direct interaction with tokens and Hyperliquid’s order books.

- The ecosystem is rapidly expanding with DeFi, Liquid Staking, SocialFi, and more, pushing HyperEVM’s TVL near $2B by mid-2025.

- Upcoming upgrades, such as HIP-3, margin lending, and cross-chain integrations, aim to position HyperEVM as the “AWS of liquidity” for onchain finance.

What is HyperEVM

HyperEVM is a general-purpose Ethereum Virtual Machine integrated into the Hyperliquid ecosystem. This setup offers essential functionality for application development, making HyperEVM a big player in the blockchain space. But what makes it special?

HyperEVM allows developers to build applications and issue both fungible and non-fungible tokens while being compatible with existing blockchain technologies. Developers can use their current knowledge and tools to build on HyperEVM, making the transition smoother and faster.

HyperEVM is a platform for decentralized application development to attract a wide range of developers to innovate in the blockchain space.

HyperEVM Architecture

HyperEVM is built for speed and scalability.

HyperEVM combines a novel dual-block architecture design with the Hyperliquid chain’s high-speed infrastructure. This design allows for fast execution, secure finality, and smooth interaction with onchain liquidity, making it an excellent option for building DeFi apps and trading protocols.

Dual-Block Architecture

HyperEVM’s dual-block architecture is made up of HyperBlocks and MacroBlocks.

- HyperBlocks handle rapid transaction execution with near-instant confirmation, ensuring a smooth user experience and low latency.

- MacroBlocks finalize batches of HyperBlocks, adding an extra layer of security and consistency.

This dual-layer system improves scalability by distributing execution and ensuring finality through secure batch confirmation. Developers can rely on fast confirmations without compromising security.

HyperBFT Proof of Stake Consensus

The HyperBFT consensus mechanism, which is part of the Hyperliquid Layer 1, supports HyperEVM’s functionality. This proof-of-stake model selects validators based on their stake, improving both security and transaction validation efficiency.

The security model uses a multi-layer defense with validator sets to prevent unauthorized access and asset manipulation. This robust framework ensures transactions are safe and reliable.

Native Components and System Contracts

HyperEVM also comes with native system contracts that streamline interactions for developers. These components:

- Provide direct access to tokens (minting, transferring, and managing)

- Connect with spot and perpetual order books on Hyperliquid

- Simplify core DeFi functions without requiring custom middleware

This reduces setup complexity for developers, making it easier to launch apps that directly plug into Hyperliquid’s liquidity and trading infrastructure.

HyperEVM Key Features

Let’s read about the features of HyperEVM in the section

Compatible with Existing EVM Applications

HyperEVM is compatible with the existing Ethereum infrastructure. So developers can move their applications with minimal changes, an attractive option for those familiar with Ethereum.

When HyperEVM goes live on the mainnet, developers will build the dApps of the future. Currently, the HyperEVM testnet allows developers to build Ethereum-compatible applications in the Hyperliquid ecosystem. This means you can use existing tools and frameworks, reducing the learning curve and speeding up development.

High Performance and Low Gas Fees

HyperEVM optimizes transaction processing, resulting in faster block times and lower gas fees compared to traditional EVMs. This is critical in a space where speed can make or break the user experience.

HyperEVM is faster than Ethereum, which often faces congestion and high fees. So, it’s a great option for developers to build more accessible and practical dApps for everyone.

Access to Onchain Liquidity

Smart contracts deployed on HyperEVM can interact directly with Hyperliquid’s order books. This means developers can:

- Build dApps that use deep spot and perpetual liquidity.

- Enable advanced trading mechanisms within apps.

- Offer end users tighter spreads, faster execution, and reduced slippage.

This is a unique advantage compared to other EVM chains, where liquidity usually lives outside the chain or relies on AMMs.

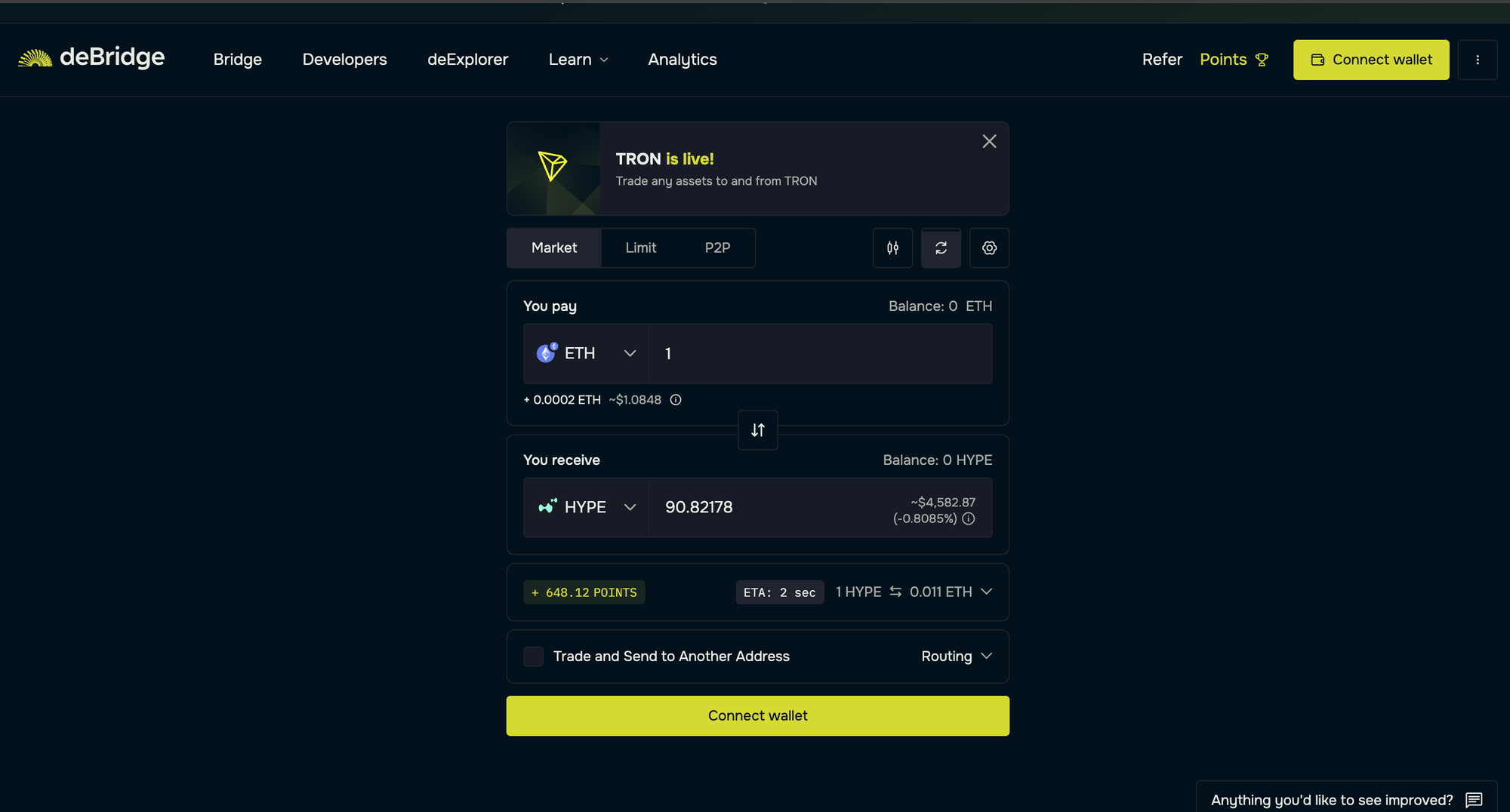

Step-by-Step Guide: How to Bridge to HyperEVM Using deBridge

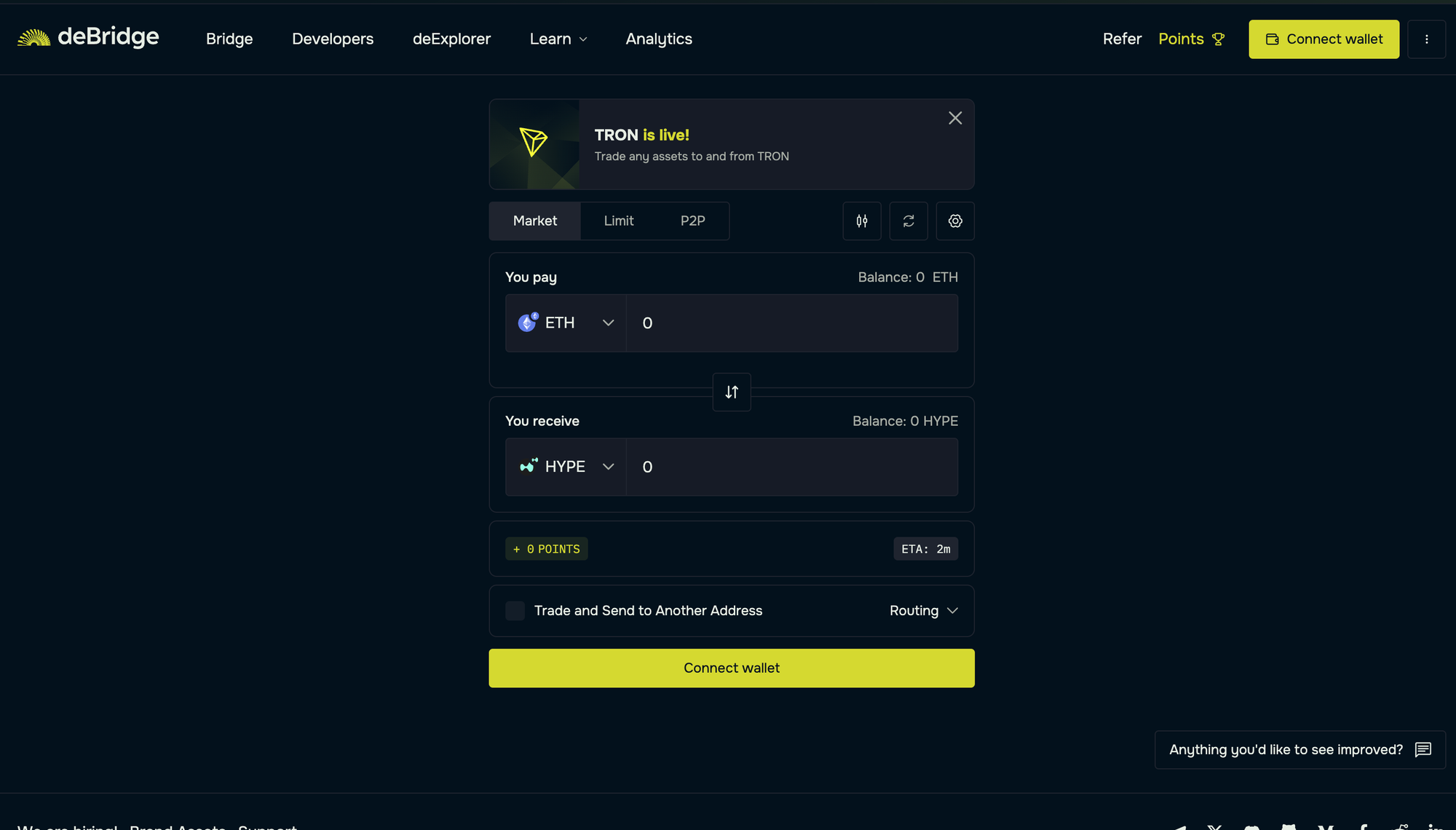

deBridge provides an instant bridging solution to help you bridge assets between HyperEVM and any asset on any chain and vice versa. Let's walk through the steps involved to perform bridging for your crypto assets in a few simple steps:

- Visit https://app.debridge.finance

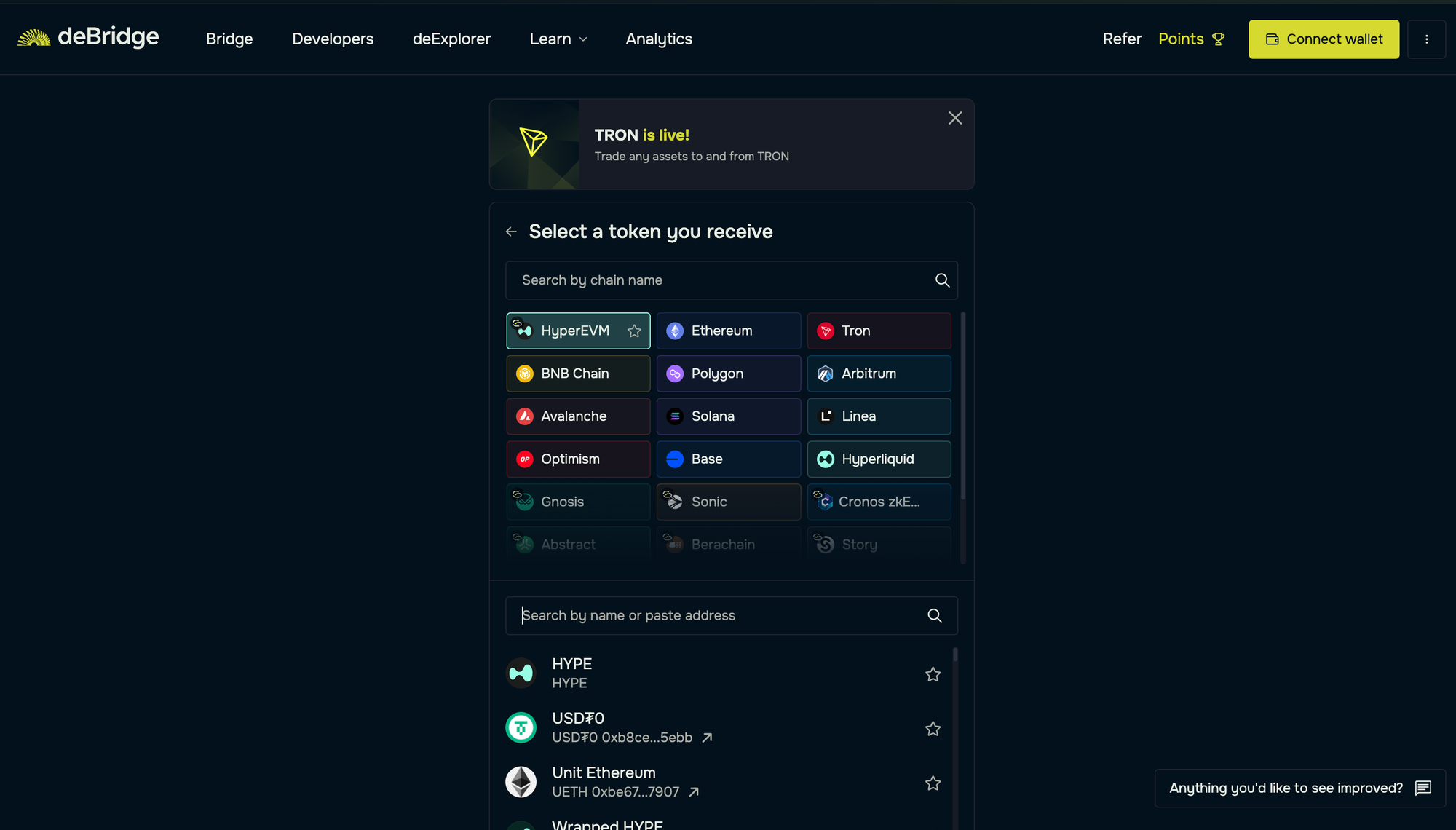

- Select the source chain and asset you’d like to bridge. Here, we will select Ethereum as the source chain and ETH as the asset.

- Next, select the destination chain and asset you’d like to receive. Here, we will choose HyperEVM and HYPE as the asset on the target chain.

- Connect your EVM wallet as the source and destination.

- Enter the ETH quantity and review the transaction details.

- Confirm trade and sign the ensuing transactions to receive native HYPE in your HyperEVM wallet.

Pro Tips

- Make sure you have sufficient HYPE in your destination chain (BNB Chain) for future transactions.

- Try to avoid bridging during peak hours to save on ETH gas costs. You can track gas prices on Etherscan.

The bridging process is quick and takes just a few seconds. You will receive the bridged assets (HYPE) in your HyperEVM wallet instantly. Technical users can also inspect the transaction(s) on the HyperEVM Chain explorer.

What Makes HyperEVM a Good Option for Developers and Users

HyperEVM has many benefits for both developers and users. Unlike RustVM, which is closed to public developers, HyperEVM is open to all developers building on it, so it’s a more inclusive and innovative environment.

Better Trading Experience

Integration with Hyperliquid’s order books allows smart contracts on HyperEVM to access deep liquidity without intermediaries, enabling robust liquidity, fast trading, and transactions.

The native components of HyperEVM include spot and perpetual order books, which enable low-fee trading. These features speed up transactions and efficiency, improving the overall trading experience.

Lower Development Cost

HyperEVM reduces the financial burden for developers compared to traditional platforms. Developers can deploy EVM contracts on HyperEVM with minimal code changes, so migration of existing applications will be smoother.

HyperEVM automates many processes so developers don’t have to worry about infrastructure. This means they can focus more on building than maintaining, lowering development costs.

More Value

Projects built on HyperEVM can leverage higher liquidity and lower fees to attract more users. Higher liquidity and visibility within the Hyperliquid ecosystem increase the commercial value of the project.

HyperEVM’s scalability allows projects to reach a bigger audience and engage more users. This cohesive trading ecosystem is beneficial, making HyperEVM a great developer platform.

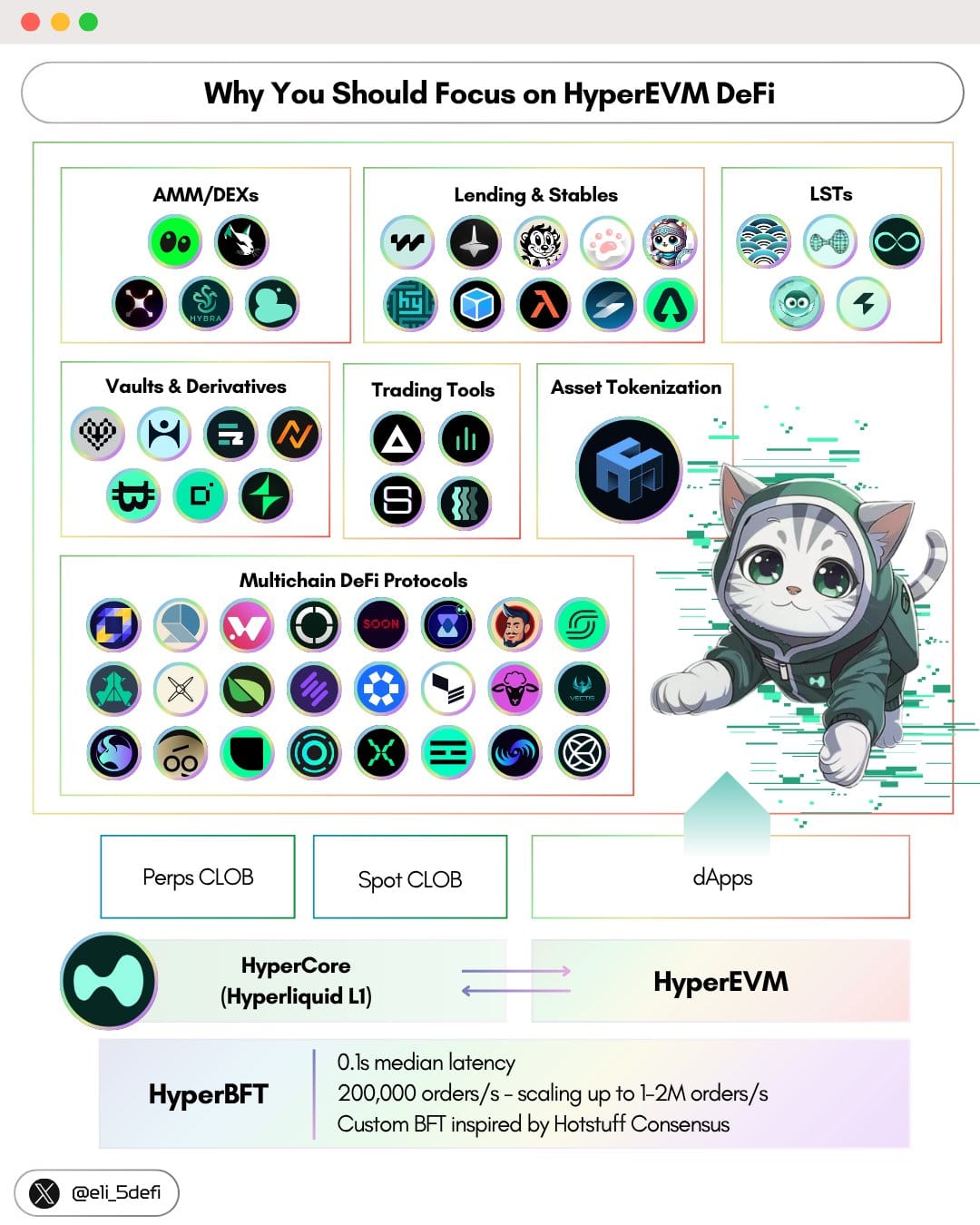

Hyperliquid Ecosystem Projects

Since the launch of HyperEVM, the Hyperliquid ecosystem has evolved into one of the fastest-growing hubs in DeFi. TVL has surged multifold, with daily activity averaging over 200,000 transactions and 40,000 active users.

HyperEVM encompasses various projects across multiple sectors, including DeFi, SocialFi, and others. Let's delve into some of the projects:

DeFi: HyperSwap, Felix Protocol, HyperLend, KittenSwap, HypurrFi

Liquid Staking & LSTs: Looped HYPE (LHYPE)

SocialFi & Analytics: HypurrFun, PvP.trade, on-chain trading bots & smart vaults

Cross-Chain / Bridge: deBridge, HyperUnit

Roadmap and Future Developments

HyperEVM launched its mainnet in February 2025, marking a major step in Hyperliquid’s evolution. Key upgrades followed quickly: HyperCore ↔ HyperEVM linkage in March enabled composability, while April introduced precompiled contracts to access core data such as order books and oracles.

By May, block times were reduced to one second, and July brought CoreWriter, allowing smart contracts to write data back to HyperCore. Adoption surged as TVL increased from less than $50 million at launch to nearly $2 billion by mid-2025, accompanied by over 300,000 daily transactions and more than 40,000 daily active users.

Looking ahead, HIP-3 will introduce permissionless perpetual (perps) listings, margin lending, and new staking models, while cross-chain bridging, institutional integrations, and advanced DeFi products, such as vaults and ETFs, are on the horizon.

Together, these advancements establish HyperEVM as a scalable, high-liquidity infrastructure layer, often referred to as the 'AWS of liquidity' for onchain finance. The team will also send Hypurr NFTs to individuals who selected this option while claiming the HYPE airdrop. The Hyper Foundation was behind the hype token launch and the genesis distribution event that occurred in November 2024.